By Christophe Bosquillon

The Financial Times Investing In Space Summit took place in person and online on 05-06 June 2023, under the motto “Balancing optimism with realism”. In Part 1 we covered the state of the space market and its investment value. We also looked at why the future for UK space looks bright, and how different countries can have differentiated space investment and capacity-building strategies. In Part 2, we will look at more stories behind the numbers, bold visions, disruptions, opportunities, emerging markets such as space-based solar power as potential remediation to climate issues, space resource utilization, and Moon mining, and even alternative modes of access to space. Readers who missed this event are encouraged to check out the Video-On-Demand.

Visions, disruptions, and opportunities

Dylan Taylor, Chairman and CEO of Voyager Space, presented his 10 predictions on the future of the industry between now and the end of 2030: a reminder of what enables market disruption, a review of systemic changes to be expected, and several specific and bold calls on where exactly the market will be in late 2030. Enablers for market disruption start with a reminder of the widely anticipated growth of the space market from the current 350 billion $ to over 1 trillion $ by 2040. For new business models to replace obsolete ones, a key enabler for disruption of the space domain is launcher reusability. But also, space tourism, whereas “space funding is based on public perception and national security assessments”. However, space needs to become meaningful through what it does for everyone on Earth, not for a handful of billionaire passengers.

Disruptions start with a tripling of astronauts from more nations, ethnicities, and genders. Next, a successful demonstration of point-to-point rocket capability and orbit refueling will be forced by a return of humans to the Moon with basic infrastructure. Humans will not have landed on Mars by late 2030 but Mars will at least be approached by a Starship vessel through the 2026 launch window.

The devil is in the details of building a company and surviving in the market.

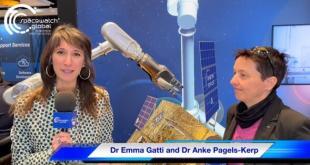

Please refer to Emma Gatti’s article specifically looking at Dylan Taylor’s 10 predictions and how he conceptualizes the systemic changes to be expected. Here, suffice to note Dylan Taylor’s 3 specific bold calls: there will be a NewSpace “Big Four” and they’ll all be “Mini-Primes”; the launch industry will collapse to just 3 or 4 industry players; and, there will be two space ecosystems: US/Western-led and China-led. And all of that happening by late 2030. We’re not going to start arguing about the pros and cons, but Dylan‘s considerations are useful blocks for scenario building to evaluate the space market and investment trends.

The keynote concluded with a question to ponder. What will happen first? The first human born in space, or the first combat casualty in space. Based on an informal poll conducted among the in-person audience, it seems there is little expectation of conflicts miraculously vanishing by 2030.

Bold visions

Steve Jurvetson, Co-Founder of Future Ventures, in a fireside chat with Sinéad O’Sullivan, Professor, Strategist, and FT Contributor, hammered the point that “We haven’t seen anything yet”. Reusable launchers and lowering the cost of access are even more consequential than we think for new business models. Same for worldwide broadband access that will enable exponential business growth. Steve Jurvetson was an early investor in SpaceX and Planet, and as partner in a Draper Fisher fund, was involved in the sale of Hotmail to Microsoft. He believes communications, geolocations, and Earth data transparency with an AI layering will be enormous for the future of the industry, as too few businesses take advantage of these yet. Same for Space Resource Utilization, where important consequences are to be expected, while acknowledging a need for investment funds lifetimes longer than 10 years. We’re entering an acceleration of the nascent space economy with new entrants, a pattern that has been verified across all of history. He dismissed though asteroid mining, due to not being able to see incremental customer base construction. In his view, the key is to be a customer and say “Here is what I want”, and the provider has to fit that customer perspective (we would nuance this with “as long as customers don’t ask for faster horses”, as once pointed out by Ford).

Chad Anderson, Founder and Managing Partner of Space Capital, in another fire chat side with FT International Business Editor Peggy Hollinger, argued that innovation doesn’t recognize market cycles. As commercial capabilities and critical infrastructure keep evolving, the disruption brought by Starship will not only outgrow the Falcon 9 launching cost paradigm but compete directly with space stations for hosting space labs and factories. Besides the fact that the US Space Force budget is now larger than NASA’s, Anderson acknowledged Artemis and the billions of dollars committed for lunar missions, human and robotic. He saw a lot of interesting opportunities in the emerging lunar economy and the Moon as a new continent and being the first to get there.

What will happen first? The first human born in space, or the first combat casualty in space?

Jim Adler, Founder and General Partner at Toyota Ventures, emphasized the need to not botch nor miss opportunities, while Julie Ying Baron, CEO of Singapore-based Via Space Holdings, justified her interest in space mining on the need on Earth for critical minerals such as copper, cobalt, silicon, lithium, and the opportunity to use new material from other planetary bodies (though it’s probably better to say “a new abundance of materials as old as the known universe itself”). She noted that, while most terrestrial exploitation relies on burning fossil fuels (coal, oil, gas), space power sources will include the sun, lunar ice, and nuclear (fission, then fusion), all renewable resources which are much needed on Earth. The lunar economy is the first good opportunity to test the production of alternative energies, and it will be followed by asteroids in a couple of decades.

Paul Reichert, Associate Principal Scientist at Merck Research Labs, leader in the pharmaceutical industry’s use of space, made the case for the synthesis of new “crystal suspension” (derived from previous studies by astronauts which demonstrated the ability to operate and experiment with liquids in micro-gravity) that would make the best drug delivery system at the doctor’s office, in replacement of IVs. Comparable terrestrial experiments produced heterogeneous repartition whereas micro-gravity preparation was better. There is a need to do more to take advantage of micro-gravity, controlling sedimentation, temperature, and diffusion of particles. Micro-gravity would also be critical for the manufacturing of vaccines (see Space Economy Insights with Matt Gillihall on this topic). It would require a clear-cut advantage though to move from R&D to manufacturing in space, because that will require moving materials back and forth from Earth, which means scaling up the weight from grams to kilograms to tons. There are applications where nanograms are required and would be more adapted to manufacturing in space and returning to Earth on a routine basis. An example is an artificial retina made with protein in space, which would also be an application usable for millions of people. ISS is the place where it is happening at the moment, but Merck is involved with Orbital Reef and Axiom, and they are both considering doing experiments and looking at applications.

Space in relation with Climate Action

The first panel “Can the space industry help tackle the climate crisis” featured Dr. Florence Rabier, Director-General of the ECMWF and Claire Jolly, Head of Unit in the Directorate for Science, Technology, and Innovation (STI), at the Organisation for Economic Co-operation and Development (OECD). The conversation was strong on Earth Observation, the importance of oceans, and the need to cooperate internationally (with China) in e. g. positioning respective assets and satellites to optimize measurements of greenhouse gas emissions. For more context on Climate and Earth Observation, please refer to the SWGL GLOC 2023 Special.

The second panel “Can space-based energy generation fast track net-zero?” covered Space-Based Solar Power (SBSP), on which SWGL has reported here, here, and here. This panel featured Martin Soltau, Co-CEO of Space Solar. Space Solar aims at commercializing the CASSIOPeiA concept, whose designer is Ian Cash, who holds CASSIOPeiA patents for its 360o steerable phased array architecture.

The CEO estimates that placing 2,000 tons of material in orbit will require nearly 70 Starships for launch and refueling, to ultimately deliver 2 GigaWatt of power daily to the grid (equal more or less to the daily needs of a 2 million people city in the industrialized world). With a six billion investment for the first twelve years to put SBSP in the UK energy plan, a fully operational power generation in space should be achieved at Year 12, with production ramping up over a year. Energy companies indicated they might get involved with a project financing approach, once a demonstrator has been successfully deployed, since oil & gas companies see SBSP as a transition from fossil to renewable. This approach echoes the way ESA federates the energy industry around the SBSP Solaris project, with participants such as Engie and Enel.

Alternative access to space

What about non-rocket launches? Spain is up to the challenge. In a session moderated by Sinéad O’Sullivan, Jose Mariano Lopez-Urdiales, CEO of Zero2Infinity, made the case for high-altitudes balloons and launching platforms (20-25 km) to provide services in some part of the world. A spaceport can be a very expensive item on a customer balance sheet, while a balloon is easier and can be launched from a boat or barge. The business model is not so capital intensive, turbo-pump assembly isn’t necessary, and it is cheaper to light your rocket once you’re outside the atmosphere. The company has garnered interest from Algeria and Singapore, from the government and private sector. Launch options such as Near-Space balloon platforms, electromagnetic propulsion, and others, are worth evaluating, if they demonstrate some market fit over time, as alternatives to rockets chemically propelled from the ground.

Overall, the FT Investing in Space Summit was successful in its balanced assessment of opportunities without undue hype nor self-defeating skepticism. Yet, in the end, the devil is in the details of building a company and surviving in the market. Massive cost reduction of access to space is transformational, but it is far from being the whole story, and is only one of the factors behind an investment decision. For a use case to reach critical mass within a specific space market, execution isn’t about mere vision, but customer-centric adoption, as part of an economically viable value chain.

Christophe Bosquillon has a diverse professional background, having operated globally with a focus on the Indo-Pacific region. His experiences in Japan, the Koreas, Taiwan, China, ASEAN, India, Russia, and Australia have given him a deep understanding of the multipolar realpolitik of our world under the Pax Americana. With a background in engineering, trade, and foreign direct investment in industries relevant to Space Resource Utilization (SRU), such as mining, transportation, energy, manufacturing, agrifood, environment, and digitalization, Chris is committed to developing SRU value chains that benefit the Earth. As an executive, owner, writer, and founder of Autonomous Space Futures Ltd, Chris has extensive experience in collaborative policy crafting and works to develop space business and governance models relevant to society. He is a member of NGOs that provide input to the United Nations Committee on the Peaceful Uses of Outer Space (UNCOPUOS) legal subcommittee Working Group on Space Resources. Chris contributes to regulatory clarity on appropriation, priority, sustainability, and sharing in a way that balances national interests with civil society inclusion, provided a transparent due process is followed. When advocating for access to technology and space for the Global South, Chris believes that emerging space powers’ participation in space markets must be commensurate with their interest and involvement in international space politics. He believes that their ability to develop sovereign domestic capabilities with spillover potential is also essential. Chris is keen on ‘Peace Through Strength’ diplomacy and deterrence-based security as enablers of secure space access. He supports sovereign cislunar space situational awareness as mandatory for freedom of circulation in the space domain and deconflicted cooperation on the Moon.