By Christophe Bosquillon

The 2023 edition of Space Resources Week (SRW) took place on 19-21 April in Luxembourg and online. The conference demonstrated a focused European scientific capacity building, with partnerships from North America to Japan.

In Part 1, we covered topics relevant to the extraction and use of space resources, such as mining, the intersection of in-situ resource utilization (ISRU) with digitalization, and terrestrial and lunar infrastructures. Here we review the commercialization and regulatory sessions, together with aspects relevant to the prospects of Europe in the space resource utilization (SRU) emerging market.

Commercialization: use cases and business models

The two sessions on commercialization showed that selling solutions through quantified value chains as part of a market economy, as opposed to government procurement and VC-sponsored R&D, remains a struggle. Even with a clear use case, a paying customer model isn’t warranted.

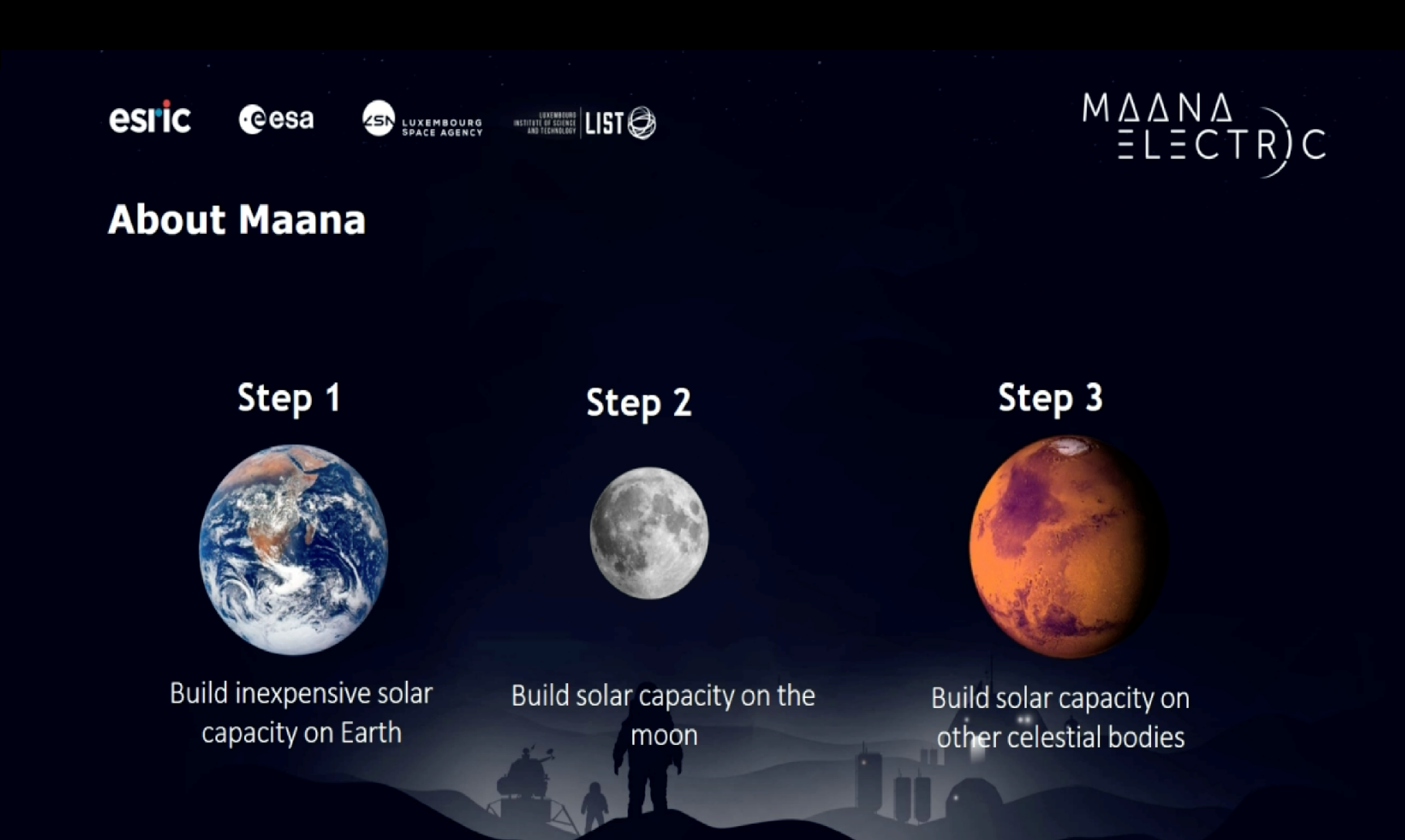

However, hybrid business models could work: terrestrial markets constitute a commercial and financial foundation, providing credibility and cash flow for tackling lunar markets. A good case study is OffWorld, which offers robots for terrestrial mining that can be adapted to do the same thing on the Moon and beyond. Another example is Helios (Israel), a company making revenues from Green Steel production out of terrestrial iron ore, aiming at extracting oxygen from lunar regolith. Another case is Maana Electric, which just completed an assembly line for photovoltaic panels made from terrestrial desert sand. Maana focuses on terrestrial oxygen and silica ISRU, but it plans to do the same with Moon regolith.

There are other interesting case studies. Along the line that those who made real money in the Klondike gold rush were the sellers of shovels and jeans, other service companies are emerging. TerraLuna Resources is building a device for melting lunar ice into water, while Aurora Connect is developing specific connectors that can survive in lunar environments. These sound like straightforward use cases with a procurement model for both the public and private sectors.

Opening to terrestrial actors beyond the space domain

For commercialization to happen, the space domain needs to open to terrestrial industries acting as both suppliers and customers. This was reflected at SRW with AirLiquide, a leader in industrial gases, developing a collaborative solution for space life support systems markets: a special absorbent for air recycling and rejuvenating for CO2 and air pollutants. Gradel, a Luxembourg engineering company producing structural parts for industrial markets, has a redesign solution to decrease the weight of parts by 70% to accommodate lunar payload constraints. In Part 1 we mentioned Epiroc, a mature Swedish company with 70,000 employees, active in the drilling and excavation segment of the mining value chain, that partnered with iSpace.

Sometimes the “why” is still missing as we witness a fourth wave of interest in space resource utilization.

And then there is Japan, where consortia of industries, services, banks, and insurance companies have formed, to address space and lunar value chains. The crash-landing of Hakuto-R mission 1 on the Moon doesn’t change the fact that the commercial ecosystem surrounding iSpace will continue to include a Takasago Thermal Engineering payload. Chiyoda Corporation presented a water analysis device they’re developing together with Yokogawa Electric, and they’ve figured the Technology Readiness Levels (TRLs) and business plan all the way to lunar pilot plant and industrial production. Although not present at SRW 2023, Toyota and Shimizu Corporation are well-known for their past and current development plans for Lunar Cruiser and lunar base infrastructures respectively.

In search of the killer app

Space refueler OrbitFab has a straightforward, credible case for commercialization while building a sustainable lunar propellant supply chain: the company has a business relationship with Lockheed Martin and Northrop Grumman, a space propellant contract with Astroscale, and a US Department of Defense refuelling deal for 2025, while also looking at the UK space debris removal market.

Space-Based Solar Power (SBSP), on which SWGL reported here, here and here is a candidate for a killer app: Advenit Makaya, referring to ESA SBSP studies, developed the argument that SBSP infrastructure building and operations can act as a market demand driver for propellants and Moon ISRU, a point reinforced by Arthur Woods of Astrostrom.

Julian Schroth & Christian Walter of ESA reminded us of the commercial objectives of the Moonlight mission for lunar comms services. Benjamin Bussey of Intuitive Machine indicated a cadence increase in the demand for lunar access services. There are more candidates for lunar value chains, such as Lightigo Space, Lunar Outpost, Orbital Assembly now renamed “Above: Space Development Corporation”, and Heliox Space.

Dorian Leger and Fardin Ghaffari of SpaceshipEAC, ESA & Connectomix are mapping energy requirements for O2 production using distinct methods that includes taking into account the lunar locations (such as the equator vs the poles). While Michele Hollist of OxEon Energy, brought the attention back on MOXIE, NASA’s ISRU experiment for Mars, declaring that the agency is aiming at a 30 tons production of oxygen propellant.

Even with a clear use case, a paying customer model isn’t warranted.

In addition to all this, there are digitalization commercial opportunities. The Norwegian Geotechnical Institute develops digital avatars to do geotechnics with lunar surface regolith. ESA / EAC built PANGAEA, a mineralogical database for the Moon, Mars, and asteroids. The European Space Foundation created a device to detect materials on the Moon (ilmenites concentration and sulfide deposits) and commercialize the data. While Astroport Space Technologies are building a robotic platform called Four Point Space, which is a robust case of AI-driven environmental assessment of mining-sites vicinities. Furthermore, ESRIC created a multi-criteria decision-making (MCDM) algorithm to support inter-disciplinary decision-making when evaluating the performance of a given technology. Dennis Williams of Lunar Station has developed MoonHacker, a data and communication exchange platform, while Matt Cross of Mission Control (Canada) presented Spacefarer, an operations software platform for missions, that is being used by iSpace for their Moon mission.

As a result, we expect killer apps – or apps declared as killers in their initial phase – to pop up in several segments of SRU value chains.

Building blocks of SRU commercialization

Then come the difficult questions: what building blocks shall we use for space and lunar resource commercialization? How to stay relevant to VCs challenged by the complexities and timelines of space development?

John Vrublevskis of Thales Alenia Space suggested making tech constraints clearer, especially when discussing complex issues like producing oxygen and metals. Technology Readiness Levels (TRLs) definitions have evolved: when confronted with the so-called “TRL 4-5-6 Valley of Death”, businesses need to identify major gaps and recognize they will meet obstacles that aren’t technological in nature. Vrublevskis noted there can’t be viable business models without first solving the in-situ architecture power supply equation: a proper way to address this challenge is to intensify R&D on isotope transfer and nuclear fission, in addition to Space-Based Solar Power.

Regulatory affairs

The regulatory affairs session was presented by Giuseppe Reibaldi of the Moon Village Association (MVA), Masashi Sato of iSpace (Japan/Luxembourg), and Steven Freeland for the Working Group on Legal Aspect of Space Resource Activities at the UNCOPUOS Legal Sub-Committee. Giuseppe mentioned the Lunar Commerce Portfolio developed by MVA, and went on to present the Recommended Framework and Key Elements for Peaceful and Sustainable Lunar Activities developed by GEGSLA the Global Expert Group for Sustainable Lunar Activities. Sato-san described the iSpace Moon business and legal models, which take advantage of the Japanese space legal framework. Steven introduced the UN COPUOS Space Resources Working Group (WG) mission, and the purpose of getting to an international consensus on a common set of rules: it remains to be seen to which extent the WG will propose a new framework, or a model for a new international organization to implement such a framework. Presentations resonated with an audience eager for regulatory clarity, which is another condition to unlock SRU investment. This was emphasized by Gary Cywie, a commercial space lawyer at Elvinger Hoss Prussen, during a short follow-up discussion.

Space Resources Week 2023 takeaways

SRW 2023 discussions highlighted the need for more relevant data as a requirement for credible SRU business cases starting with mining. While it is difficult to make headways without an anchor customer and proper funding, international and national legal and regulatory environments should provide the kind of clarity on rules without which investments can hardly be made and trades are stifled.

In his concluding remarks, James Carpenter of ESA emphasized that sometimes the “why” is still missing as we witness a fourth wave of interest in space resource utilization. It is an achievement to have that much science, technical foundation, and hardware flying to the Moon. But what is the future scenario, who are the customers, which are the technological foundations of this enterprise? Is space exploration sufficient to support this, or had it better start by addressing terrestrial needs? There is a need for more ideas on the use of SRU for Earth ecosystems and societies, to build a space development foundation legitimized by its civilizational significance, something to which Europe could significantly contribute.

Focused on fundamental sciences, Europe needs to relentlessly hold and build up its own positions within SRU value chains, in that emerging ecosystem from Earth to orbit, to the Moon, and beyond.

Christophe Bosquillon has a diverse professional background, having operated globally with a focus on the Indo-Pacific region. His experiences in Japan, the Koreas, Taiwan, China, ASEAN, India, Russia, and Australia have given him a deep understanding of the multipolar realpolitik of our world under the Pax Americana. With a background in engineering, trade, and foreign direct investment in industries relevant to Space Resource Utilization (SRU), such as mining, transportation, energy, manufacturing, agrifood, environment, and digitalization, Chris is committed to developing SRU value chains that benefit the Earth. As an executive, owner, writer, and founder of Autonomous Space Futures Ltd, Chris has extensive experience in collaborative policy crafting and works to develop space business and governance models relevant to society. He is a member of NGOs that provide input to the United Nations Committee on the Peaceful Uses of Outer Space (UNCOPUOS) legal subcommittee Working Group on Space Resources. Chris contributes to regulatory clarity on appropriation, priority, sustainability, and sharing in a way that balances national interests with civil society inclusion, provided a transparent due process is followed. When advocating for access to technology and space for the Global South, Chris believes that emerging space powers’ participation in space markets must be commensurate with their interest and involvement in international space politics. He believes that their ability to develop sovereign domestic capabilities with spillover potential is also essential. Chris is keen on ‘Peace Through Strength’ diplomacy and deterrence-based security as enablers of secure space access. He supports sovereign cislunar space situational awareness as mandatory for freedom of circulation in the space domain and deconflicted cooperation on the Moon.