by Blaine Curcio and Jean Deville

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 8 – 14 March 2021”.

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 8 – 14 March 2021”.

Hello and welcome to another episode of the Dongfang Hour China Aero/Space News Roundup! A special shout-out to our friends at GoTaikonauts!, and at SpaceWatch.Global, both excellent sources of space industry news. In particular, we suggest checking out GoTaikonauts! long-form China reporting, as well as the Space Cafe series from SpaceWatch.Global. Without further ado, the news update from the week of 8 – 14 March 2021.

1) A new dedicated spaceport for commercial launch companies?

Blaine’s Take

With China’s 14th Five-Year Plan (2021-2025) being finalized in the coming days/weeks, we have begun to see concrete announcements from state media about some of the plan’s contents. This included an announcement on Saturday 13 March from the Science and Technology Daily (科技日报), the official newspaper of the Ministry of Science & Technology, on mega projects during the 14th Five-Year Plan.

Included in the list were so many buzz phrases that you could be excused for nodding off whilst reading through it. However, about ⅓ of the way through, a couple of things really stick out in the context of the space sector: 1) Build an integrated communications, EO, satnav space system with global coverage, and 2) build a commercial launch center. Big news, but with slightly different levels of expectation.

The first point–building integrated communication, EO, and satnav space system with global coverage, is not particularly new or surprising. China has been talking about the Belt and Road Spatial Information Corridor, and about the idea of “Integration of Comms, EO, and Satnav” (通导遥一体化) for several years, and over the 13th Five-Year Plan, deployed the third-generation BeiDou satnav constellation, dozens of EO satellites, and a handful of comms satellites. During the 14th Five-Year Plan, this goal will thus require significant investment into the global communications network, with this being by some margin the “least developed” of the three global networks China refers to. This will likely lend further support to “satellite internet” (which is communications, as opposed to EO or satnav), and is very likely a reference to China’s recently-confirmed Guowang (国网) constellation, to be discussed in about 5 minutes.

The second point is more surprising. China’s announcement to build a commercial launch site is not something that has been as widely discussed as the above-mentioned integrated network. To now, China’s four launch sites remain controlled by the People’s Liberation Army, and while commercial launch companies have been able to launch from Jiuquan, it is believed to involve some rather prickly regulatory hurdles. While not clear who would regulate the commercial launch site, it would likely be somewhat more independent than the existing launch infrastructure. Thanks to some follow-up posting by Twitter users Ace of Razgriz and Phil Leaf, we can also confirm that the government of Ningbo, all the way back in July 2020, published a draft of their 15-year development plan, which includes a commercial launch center in Xiangshan County, under the jurisdiction of Ningbo (it also included plans to develop a broader space ecosystem in the city). Xiangshan appears noteworthy because it is located on the sea, near Ningbo’s massive port (the world’s fourth-busiest by tonnage in 2019). This could make launches somewhat safer (launching over the ocean), and could allow for shipment by sea to/from the launch site.

Overall, an interesting announcement from the Sci & Tech Daily. A more high-level takeaway here can be that we are now at the time of the “two sessions”, a major governmental event that Jean will explain in more detail momentarily. As we have seen in years’ past, the government has used the “two sessions” as a way to formally endorse ideas at a national level that have in some cases been brewing in a less formal way for some time. That being said, what are the two sessions, and did we hear any more similar announcements this year?

2) What role will commercial companies play in China’s future satellite internet? Multiple related pieces of news this week during the annual “two sessions”

Jean’s Take

Every year in China, the National People’s Congress, China’s national legislature, holds a session, generally in early Spring (with the exception of 2020 due to covid19). At the same time, China’s People’s Political Consultation Conference is held, bringing together delegations from the CCP but also business people, the military, and academics. It acts as an important advisory platform bringing multiple facets of China’s society and economy into one place. Both sessions represent a moment where past policies are reviewed and future policies discussed. And oftentimes it’s a good place to get some info here and there about China’s plans for the future.

First event: Bao Weimin (director of the S&T Commission of CASC) Officially Acknowledged the Guowang (国网) Program on March 7, during an interview with Shanghai Securities News. Bao Weimin is a member of the PPCC, so this insight is of particular interest. The quote from Bao Weimin is actually quite short: “We are planning and developing space-based Internet satellites, and have launched test satellites. The state will also set up a dedicated “Guo Wang” (国网, meaning “national network”) company to be responsible for the overall planning and operation of the satellite internet infrastructure”.

This phrase during the “two sessions”, the fact that it’s mentioned publicly by one of the highest-ranking space officials, and also after the 10,000+ LEO satellite filing to the ITU last year (satellites also named Guo Wang), it seems that China’s broadband LEO super constellation is now more or less official.

And with the mention of having an SoE (Guowang Company) being in charge of the operation and infrastructure, these shows also “国家队”/state-owned companies will have the lead for the operations of China’s satellite internet projects.

But at the same time…

Second event: Lei Jun, the CEO of Xiaomi, submits 4 proposals during the two sessions

Lei Jun is the CEO of Xiaomi and also the founder of Shunwei Capital, one of the larger VC funds backing Chinese space startups. During the same period, as a member of the NPC, he submitted four proposals to the 2021 “two sessions” to promote Chinese private commercial space. This call for stronger support for the sector included:

- Including satellite Internet as a strategic emerging industry for key development in China’s “14th Five-Year Plan”, and clarifying that satellite Internet-related commercial space companies are part and parcel of the national aerospace industry.

- Deepen reform of the domestic satellite frequency application mechanism, simplify the management process of China’s satellite network data application

- Increased liberalization of the space industry, reducing restrictions on private enterprises using commercial satellites to develop commercial services.

- Encouraging funding of private commercial space companies, at a national level (national funds) and local level (local govs, financial institutions). Facilitate access to the Starboard for private commercial space companies.

They are remarkable because Lei Jun is probably the most high profile Chinese billionaire supporting the development of China’s private space industry, both from an end-user standpoint (Xiaomi’s IoT ecosystem) but also as an investor (Shunwei being a big investor in Chinese New Space).

Noteworthily, this is the second time Lei Jun has been vocal about these four points, having proposed them almost one year prior during the previous Lianghui in 2020. His strong support for the role of private companies in China’s satellite internet is also to be expected, considering the significant investment Shunwei Capital has put into Galaxy Space, one of the most advanced private company involved in building (and operating?) broadband satellite constellations.

Now linking this to the previous news on Guo Wang, it will be interesting to see what role private companies will be allowed to take regarding such large broadband constellations.

And wrap this up, just throwing another opinion in the discussion: Commsat CEO Xie Tao was interviewed on March 11, during which he acknowledged that the operations of satellite internet constellations will probably remain a state-owned business, but all the businesses around that would likely be open to commercial companies (upstream with manufacturing the infrastructure; or downstream with services)

Blaine’s Take

Holy smokes, a lot to unpack here, and a very helpful and comprehensive summary by Jean. First, I would point out that these are, as Jean alluded to, basically the exact same four points that Lei Jun suggested last year. A little bit more context on Lei, and why we should take him seriously in the Beijing political context–Lei Jun was a sort of “wunderkind”, having joined Chinese software giant Kingsoft as an engineer at age 23/24, and becoming CEO of the company before his 30th birthday. Lei struggled, but eventually succeeded in guiding the company through an IPO, and made a lot of powerful people very rich. In a Forbes piece on Lei’s time at Kingsoft, they recall a speech by Lei in 2012, when he pointed out that he was “when he was CEO of Kingsoft in the 1990s, Tencent Chairman Ma Huateng and NetEase Chairman William Ding were only webmasters”. That is to say, in a certain sense, despite being only 51 years old, Lei is one of the founding fathers of China’s internet industry.

In the years since Kingsoft, Lei has built Xiaomi into one of the world’s largest consumer electronics companies, while also seemingly cultivating relationships in Beijing and his hometown, Wuhan. This included what seemed, at least 1 year ago, to be a very unfortunately-time opening of a second Xiaomi HQ in Wuhan, which occurred in late 2019. Lei’s political and economic heft, combined with his investment into satellite internet, make him one of the better-positioned private sector investors to push for industry liberalization. That being said, given that his 4 recommendations have not changed at all in 1 year…he may have an uphill battle.

Getting back to Guowang, the formal acknowledgement by Bao Weimin represents the opening up of the worst-kept secret around. For at least a year, it’s been openly discussed in private circles that there is a “Guowang” under consideration, and ITU filings were evident for some time. Nonetheless, an important statement by a high-level person in China’s space industry hierarchy. Will be exciting to see how this goes!

3) China successfully launches Long March 7A Y2 one year after the rocket’s maiden launch (and failure)

Jean’s Take

China successfully launched for the first time the Long March 7A rocket on Thursday, March 11th, putting a satellite named Shiyan-9 into GTO. This is a significant event for several reasons. First of all, this is a nice addition to the Chinese Long March rocket family. The current workhorse for China’s GEO launches is the old LM-3 rockets, in service since the 1990s. This rocket uses extremely toxic hypergolic fuels (UDMH/Nitrogen Tetroxide), an issue for operations on the ground but also post-flight as the boosters come crashing back down on Chinese territory. LM7A, like a rocket of the new generation Long March family, uses cleaner and more efficient kerolox engines.

Perhaps more importantly, LM7A fills in a gap within China’s GEO launch capabilities. LM3 in its heaviest version (LM3B/E with enhanced boosters and core stage) is only able to put 5.5 tons into GEO, while LM7A is able to put 7t. LM 7A fills a gap between LM3 and the much larger (although same height) LM5, which puts 14t in GTO. So LM7A will be launching China’s larger GEO satellites, although the largest ones with still are launched by LM5 (such as the DFH5 satellites. Shijian 20 launched in Dec 2019 was for example over 8t)

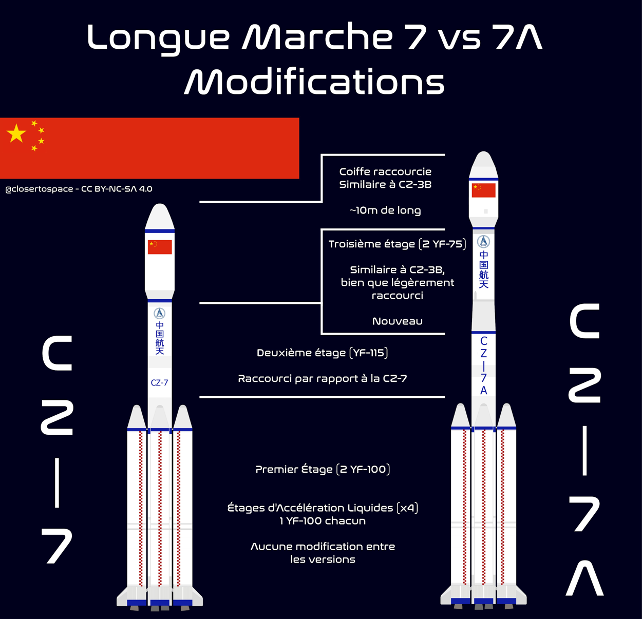

As you have probably guessed, LM-7A is a variant of the LM-7. As a good visual is always better than a long explanation, here is a fantastic sketch done by @Closertospace and posted on Twitter, which shows the differences between the two versions.

LM-7A is a 3-stage version, as opposed to the 2-stage CZ-7. While the first stage remains unchanged, the second stage of the LM-7A was slightly shorted to accommodate the 3rd stage (and probably to limit the height of the rocket, which is likely close to the limit form factor IMO).

Worth mentioning also, this was actually the second launch attempt of LM 7A, the first attempt having failed in March 2020. There has been a lot of mystery on the actual reasons behind the failure, with CALT staying rather silent for months. Some China space enthusiasts such as @CosmicPenguin on Twitter related this to a loss in pressure in the second stage.

Worth mentioning also, this was actually the second launch attempt of LM 7A, the first attempt having failed in March 2020. There has been a lot of mystery on the actual reasons behind the failure, with CALT staying rather silent for months. Some China space enthusiasts such as @CosmicPenguin on Twitter related this to a loss in pressure in the second stage.

Fortunately, the official reasons were announced shortly after the success of the 2nd LM7A during the past week: investigations showed that it was due to a cavitation phenomenon occurring in the booster’s oxygen outlet. After a redesign of the outlet and multiple simulations and tests, the cavitation issue was solved (a relief, knowing that LM-7A shares parts with many other LM rockets, including the crewed LM-7). Mystery solved!

Speaking of mysteries, I think for last week’s launch, the payload itself Shiyan-9 was also somewhat of a secret payload? → transition to Blaine (below)

Blaine’s Take

Limited information is known about Shiyan-9, but we do know that it took around 8 months to assemble. The satellite will be used for spatial environmental monitoring, though we do not have a lot of additional information.

Of note in the above launch is that this was the first time that China used a wholly domestically-developed Ka-band TT&C system on the rocket, according to the official WeChat account of the Beijing Radio Institute of Telemetry/Long March Rocket Company.

4) Galactic Energy Appears at Jianyang Investment Conference

Blaine’s Take

Chinese commercial launch company Galactic Energy appeared at an investment conference held in Jianyang, near Chengdu, on 10 March. The article, posted on Galactic Energy’s official WeChat account, notes that the company’s Ceres-1 intelligent manufacturing base in Jianyang is nearing completion, with the base expected to come online in May of this year.

The article also mentioned that when the base is “fully completed in the future”, it will have an annual capacity of 24x rockets, presumably mostly/entirely Ceres-1 (as opposed to the company’s larger Pallas-1, expected for launch in the coming years). The company also plans to complete the assembly of their Ceres-1 prototype 2 and 3 rockets at the Jianyang base, with the rockets slated to launch in September and November of 2021.

A few takeaways to unpack: first, impressive progress by Galactic Energy. As we have noted in our long-form episode covering the Chinese commercial launch, Galactic Energy is one of the fastest-moving commercial launch companies in China, having been founded in only 2018, and having successfully launched their first Ceres-1 rocket last year.

Second takeaway: Jianyang is an interesting place to build an intelligent manufacturing base for rockets. The city is around 1 hour away from Chengdu and is very near the massive new airport being built there. Importantly, the city is also the original home of hotpot powerhouse Haidilao, the world’s most valuable hotpot company with a market capitalization of three hundred billion Hong Kong dollars (yes, billion with a B). Apart from airports and amazing hotpot, Jianyang has indeed developed a space industrial base of sorts over the past few years, including being home to aspiring BRI-region satellite operator Star Time.

Jean’s Take

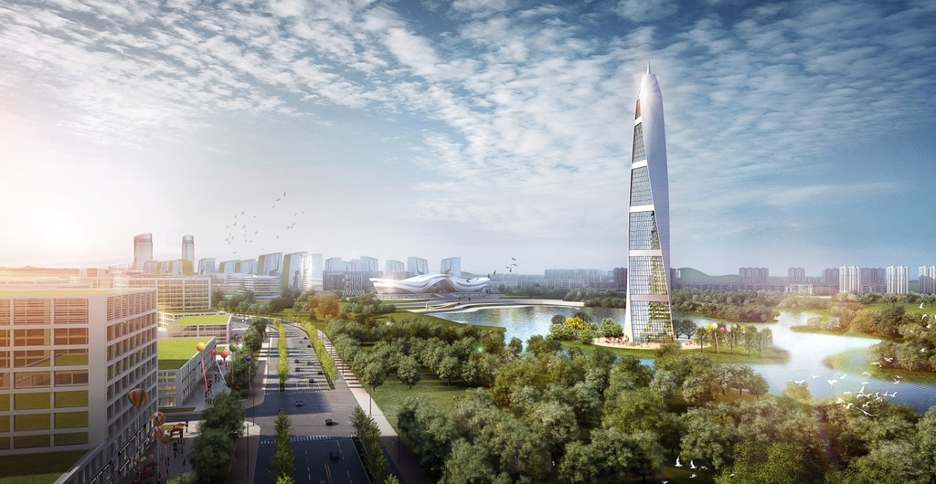

Definitely agree with you that Jianyang is an interesting place to build a manufacturing base for rockets. And broadening the scope of the discussion a bit, I think this also illustrates how Chengdu/Sichuan province has done a great job of attracting aerospace talent after starting from scratch a couple of years ago. Take Galactic Energy’s base in Jianyang for example GE is not building it just in the middle of nowhere in Jianyang, it is situated in the Chengdu Aerospace Industry Functional Zone (简阳市的成都空天产业功能区). It has an approved area of 168 square km, and is designed to be the space industry cluster of Chengdu. When you look at pictures of this base under construction, you realize the scale of what Chengdu is trying to do in Jianyang:

Several Chinese articles also show how the management from the Jianyang industrial base has been actively trying to attract space companies, travelling multiple times to Beijing to meet with startups such as Galactic Energy. They offer (in what is now a classic for local authorities) office space, land, but also funding; A opportunity too good to miss, according to Galactic Energy’s CEO Liu Baiqi in an interview in Nov. 2020: “This is a fertile soil for our start-up commercial aerospace companies. The functional zone has made a lot of preparations in terms of policies, physical space, and funding, so we made the move”.

This has been another episode of the Dongfang Hour China Aero/Space News Roundup. If you’ve made it this far, we thank you for your kind attention, and look forward to seeing you next time! Until then, don’t forget to follow us on YouTube, Twitter, or LinkedIn, or your local podcast source.

Blaine Curcio has spent the past 10 years at the intersection of China and the space sector. Blaine has spent most of the past decade in China, including Hong Kong, Shenzhen, and Beijing, working as a consultant and analyst covering the space/satcom sector for companies including Euroconsult and Orbital Gateway Consulting. When not talking about China space, Blaine can be found reading about economics/finance, exploring cities, and taking photos.

Jean Deville is a graduate from ISAE, where he studied aerospace engineering and specialized in fluid dynamics. A long-time aerospace enthusiast and China watcher, Jean was previously based in Toulouse and Shenzhen, and is currently working in the aviation industry between Paris and Shanghai. He also writes on a regular basis in the China Aerospace Blog. Hobbies include hiking, astrophotography, plane spotting, as well as a soft spot for Hakka food and (some) Ningxia wines.

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space