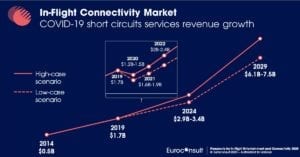

Paris, 15 September 2020. – Revenues in the $1.4 billion In-Flight Connectivity industry are expected to drop by 20 to 30 percent this year, the consulting and research firm Euroconsult said in its recent research report “Prospects for In-Flight Entertainment and Connectivity”.

In-Flight Connectivity (IFC) has been a key driver for the entire ecosystem and constituted a $1.4 billion market in 2019, Euroconsult said. “Current restrictions on travel and health concerns, however, are expected to decrease service revenues by 20-30 percent in 2020.”

The research found that roughly 9,200 aircraft were equipped to provide in-flight connectivity worldwide at the end of 2019. “Despite the COVID-19 crisis, that number is projected to increase to between 15,000 and 18,000 aircraft by 2029. Almost 110 airlines provide connectivity with the largest market in North America where only a few remaining aircraft are yet to be connected.”

“The European market is gaining maturity in terms of penetration with the biggest airlines currently committed to an IFC solution. India could be a growth market for IFC as its regulatory environment changes following the recent grant of licenses authorizing IFC,” the report concluded.

“Intelsat’s recently announced acquisition of Gogo’s commercial business is an example of the reorganization of the In-Flight Connectivity industry following the COVID-19 crisis,” said Xavier Lansel, Senior Consultant at Euroconsult. “While Gogo needed to take action, with its business in North America dropping by about 90 percent, Intelsat justified its acquisition on the basis that the commercial aviation business will rebound and ultimately grow. It also benefits from the ownership economics resulting from having its own satellite capacity.”

Euroconsult sees the market for satellite operators “becoming more competitive with evolving technologies and a massive increase and change of nature of the capacity supply in the next five years”. As a result, Euroconsult predicts that the average cost of satellite capacity will decrease dramatically, and the IFC consumer experience will improve in the coming years. “These dynamics will benefit service providers.”

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space