by Connor Sattely

SpaceWatch.Global is on a mission: to share with you every single space-tech deal globally, every month. We transparently show who’s included, and who’s not included in our list and explain why.

After a behemoth month of space-tech investment in February ($1.7b), global venture investment in space-tech fell back to earth in March with only $93.96m invested. Europe held three of the four largest investments this month: Multiverse Computing in Spain (€25m), Mbryonics in Ireland (€17.5m), and Blackwave in Germany ($6.6m), with South Africa’s Simera Sense (€13.5m) rounding out the top-four.

Deal highlight

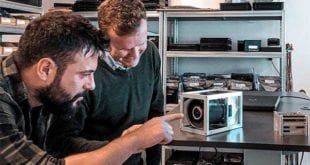

Our Deal of the Month is an exciting “enabler” of the future space economy, as Italy’s Kurs Orbital raised €3.7m from OTB Ventures, joined by Credo Ventures, Galaxia, Obloo Ventures, Piemonte Next, and others.

The historical aspect of Kurs Orbital’s technology shows a fascinating journey through geopolitics.

“If you’re talking about space-to-space docking, you’re talking about the US and Russia only” said founder Volodomyr Usov. “The Americans made this docking to be manual, while Soyuz developed the autonomous one. But this technology was developed not in Russia, but Ukraine.” Usov, the former head of the Ukrainian Space Agency, says that it was a ripe technology to explore for commercialization. “What do you need for servicing in space? You need to connect stuff” Usov said. “If you have that, you can repurpose things, refuel things, enhance payloads. Autonomous docking will be critical for all of that.”

Wojtek Walniczek, Partner at OTB Ventures, said the heritage of the technology played a major role in the investment decision. “This type of experience is unprecedented in the market. Perfecting docking technology requires hundreds of docking attempts, and having worked for a space agency in the past provides that experience.” Both Walniczek and Usov chuckled when asked about the international media’s focus on Usov’s CV over the technology of the company. “I get how the media works” Usov said. “My story and the role that Ukraine plays in this technology is part of why they run the story. But they covered it in Forbes, in Fortune – it’s rare to get this wide of coverage outside of the specialist space press, and we welcome that.”

The investment capped a busy month for OTB Ventures, which also announced it closed a “significantly oversubscribed” $185m Fund 2, less than a year and a half after announcing the fund’s first close. This fund will focus on space-tech as one of its four verticals, and in particular technologies such as Kurs Orbital that have the potential to act as disruptive enablers of a growing industry.

“Kurs Orbital is a enabling technology that will support the wave of assets going into space in the next few years” said Walniczek. “It’s going to be a huge market in 10 years to make it easier, faster, and more efficient to do things in space.”

All deals in March 2024, by $ (descending)

- Multiverse Computing (Spain) – accelerating computing through quantum – raised €25m.

- Mbryonics (Ireland) – optical systems for satellite comms – raised €17.5m.

- Simera Sense (South Africa) – optical payload, Cubesat imager – raised €13.5m.

- Blackwave (Germany) – carbon fiber high-pressure tanks for launch vehicles and satellites – raised $6.6m.

- Phase Four (USA) – advanced propulsion systems for space vehicles – raised $6.25m.

- Aliena (Singapore) – low-power propulsion systems suitable for LEO/VLEO small satellites – raised $5.6m.

- Phelas (Germany) – resilient energy storage from renewable sources – raised €4.1m.

- Orbio Earth (USA) – monitor/reduce methane emissions via satellite – raised $4m.

- Kurs Orbital (Italy) – in-orbit satellite servicing – raised €3.7m.

- Lumen Orbit (USA) – data centres in orbit. – raised $2.4m.

- SpinLaunch (USA) – satellite launches via high speed spinning – unknown amount.

- Phantom Space (USA) – satellite construction and launching – unknown amount.

Estimating the size of the Spacetech industry

SpaceWatch.Global estimates that so far in 2024, 74 space-tech companies have raised a total of approx. $2.4b.

The fine print

We’ve dug into each of these deals. What will they use the funding for? Who are the funders? If you’re an investment wonk and want this information, get in touch: [email protected]. Did we miss your investment? If so, compose an angry e-mail to [email protected]l and we’ll fix the mistake.

SpaceWatch.Global includes deals that:

- Are space-tech investments made in this month only;

- involve equity-based venture funding.

One great source of space-tech funding information is the Dealroom/ESA Space Tech Dashboard. As a way of triangulating whether SpaceWatch.Global is accurate relative to industry estimates, each month we compare our list to theirs.

This month, Dealroom claims there were 23 space-tech deals raising a total of $257m. This significant disparity between SpaceWatch and Dealroom’s dashboard can be explained by five key differences.

- Different definitions of SpaceTech. The definition of what is SpaceTech will widely vary person to person. Some which are clearly not spacetech are still listed on Dealroom (a clothing company, a company creating affordable housing in Florida). 7 deals, $658m.

- Incorrect information. One deal is listed without source or validation (Astron Systems, 100k GBP), one deal is Kickstarter (AR Market, $13k), and two deals worth $80m were February investments – they’ve been added to our February article.

Dealroom estimates that as of the end of March 2024, 95 space-tech companies have raised $951.77m.

Spacewatch.Global estimates that 74 space-tech companies have raised a total of approx. $2.4b.

Connor Sattely is an entrepreneur and startup advisor working in startup ecosystems all over the world since 2012. His monthly column for SpaceWatch.Global covers the world of venture capital in spacetech. Based in Amsterdam, he’s passionate about supporting startup founders as they grow and build their dream companies. He has launched startups in Switzerland, Uganda, and the Netherlands, and has advised founders in more than 50 countries. You can sometimes find him around Amsterdam playing the tenor saxophone with one of his bands.

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space