As part of the partnership between SpaceWatch.Global and the European Space Policy Institute, we have been granted permission to publish selected articles and briefs. This is ESPI Briefs No. 38: ‘In-Orbit Servicing: Challenges and Implications of an Emerging Capability’, originally published in February 2020.

As part of the partnership between SpaceWatch.Global and the European Space Policy Institute, we have been granted permission to publish selected articles and briefs. This is ESPI Briefs No. 38: ‘In-Orbit Servicing: Challenges and Implications of an Emerging Capability’, originally published in February 2020.

1. In-Orbit Servicing Capabilities

In-Orbit Servicing (IOS) encompasses a broad range of new solutions for satellite operators based on Rendezvous and Proximity Operations (RPOs) techniques. IOS is a long-contemplated and potentially disruptive capability, that was envisioned in the first place for military applications. Today IOS aims to address a large portfolio of different applications – such as refuelling, life-extension, inspection, active debris removal, or even disruption for military missions.

IOS raises a variety of issues, in terms of:

- Legal and regulatory issues, related to liability and insurance issues as well as ownership of objects in orbit and intellectual property concerns;

- Technology and standardisation issues for the development of multipurpose, flexible and interoperable solutions that could support new missions in particular in the domain of space exploration;

- Safety and sustainability issues related to the safe conduct of RPOs as well as the use of IOS solutions such as debris removal to support space sustainability goals;

- Security and defence aspects, especially related to the use of IOS solutions for military applications such as system destruction/disruption and espionage;

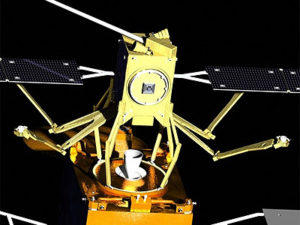

IOS developments made a big step forward recently with the launch of the Mission Extension Vehicle (MEV-1) which marked a concrete progress in both technological and business areas of servicing operations, offering new interesting prospects for the space sector at large with a potentially disruptive impact on the space industrial value chain.

2. The First Commercial IOS Mission

Developed by SpaceLogistics LLC, a subsidiary of Northrop Grumman since the acquisition of Orbital ATK in 2018, the MEV-1 is based on a servicing vehicle designed to provide life-extension for up to 15 years. In 2016, Intelsat signed a contract with Orbital ATK for the first commercial IOS mission: the MEV-1 contract provides for a 5-year life-extension service of the Intelsat 901 (I-901), in operation in GEO since 2001, for a price estimated around $70M. The MEV-1 was launched in October 2019 from Baikonur on a Proton-M rocket and started the RPO phase with I-901 in February 2020 in a graveyard orbit at 300 kilometres above GEO, in order to avoid accidents with other GEO satellites. On 25 February, the MEV-1 completed RPO phase, autonomously approaching, capturing and docking to the I-901’s liquid apogee engine, a device present on the vast majority of GEO satellites. After docking, the MEV-1 is expected to relocate the satellite to a new orbit slot, in compliance with orbital regulations, and perform as a “combined vehicle stack” the 5-year life-extension, adding 26% to the current I-901 lifetime. At the end of the mission, the MEV-1 could either extend the service or proceed with the disposal of the satellite to the graveyard orbit, consequently becoming available for new clients. Intelsat already signed a contract for MEV- 2 to provide similar servicing to its I-10-02 satcom, in operation since 2004. Northrop Grumman is reportedly developing the MEV-2 spacecraft with additional capacity to carry payloads and deploy small satellites. The company is also developing other IOS systems such as the Mission Robotic Vehicle and the Mission Extension Pods, to offer new solutions and a better life-extension service.

If successful, the demonstration of the flexible and likely replicable MEV-1 mission will illustrate some of the potential impacts of IOS at industrial and economic level.

- IOS could become a new business area for industry and provide relevant solutions to space operators to improve the capabilities of existing satellites, optimise their Return on Investment or postpone capital expenditures.

- In turn, the development of IOS solutions could impact satellite and launch service orders and, in general, the structure of the space industrial value chain,

- IOS development could also have implications in terms of system and operations standardisation and regulation, for example in the field of “IOS-proofing” of satellites or best practices for RPOs.

3. Where Europe Stands

In the United States, institutional actors, in particular NASA, DARPA and the Department of Defence, played a decisive role in fostering the development of IOS capabilities. In addition to Northrop Grumman, various other U.S. industrial companies are also actively developing IOS solutions. Although some European companies have been proactively preparing for the emergence of IOS (e.g. Effective Space, Thales Alenia Space, Airbus, D-Orbit, Avio, Surrey Space Centre), the development of industrial capabilities in this domain has not been perceived as a top priority by public actors, until recently.

Europe is therefore positioning itself in the IOS domain: at the SPACE19+ Ministerial Council the Agency took a resolute decision to identify the active debris removal (ADR) as a strategic goal, managing to gain support for it under the Clean Space initiative. ESA adopted a service-oriented approach, also to encourage the development of IOS solutions at large and demonstrate the feasibility of commercial IOS missions. The first space debris removal service contract was awarded to a consortium led by the Swiss start-up ClearSpace. The ClearSpace-1 mission will capture and deorbit the 100 kg Vega Secondary Payload Adapter (Vespa) upper stage, in LEO since 2013. Notwithstanding, in the ADR domain major hurdles emerge such as the costs and the design of the missions itself (e.g. the removal of more than one object per mission or the legal implications of selecting the object to remove). Ultimately, the attractiveness of debris removal as a service and a solid business case implies to tackle several challenges:

- The first one is probably to be able to globally recognise the economic value of a clean space environment;

- The second is to build up on these grounds a sound and sustainable ADR business case based on a long-term assessment of the commercial demand and ground-breaking technological solution;

- Last but not least, economic effectiveness of ADR will probably rely on joint operations with other kinds of In-Orbit Services. In this respect, the European approach shall be flexible enough to accommodate different applications.

Rights reserved – this publication is reproduced with permission from ESPI. “Source: ESPI “ESPI Briefs” No. 38, February 2019. All rights reserved”

For more articles please visit ESPI website (www.espi.or.at).