The so-called New Space trend is developing, creating new opportunities and new challenges for all actors of the space sector. Understanding what is happening and (potential) implications is essential for sound decision-making. Yet, European stakeholders significantly rely on foreign evaluations and data, in particular to monitor private investment and assess entrepreneurship dynamics. The European Space Policy Institute decided to address this gap with its new Space Venture Europe report series.

The so-called New Space trend is developing, creating new opportunities and new challenges for all actors of the space sector. Understanding what is happening and (potential) implications is essential for sound decision-making. Yet, European stakeholders significantly rely on foreign evaluations and data, in particular to monitor private investment and assess entrepreneurship dynamics. The European Space Policy Institute decided to address this gap with its new Space Venture Europe report series.

Tell us about your research work at ESPI?

ESPI, as an independent public think-thank specialized in international and European space affairs aims to provide decision-makers with informed views on mid-to-long-term perspectives relevant to Europe’s space-related issues. To fulfil this objective, in continuous consultation with our members, currently encompassing 17 among major European institutional and private stakeholders, we perform various analysis along a work plan defined annually with our governing bodies. Our research activities include the consultation of globally renowned experts, the organisation of workshops and round tables tailored to look into specific topics, as well conferences and events like our yearly ESPI Autumn conference.

As far as I am concerned, I am in charge of the production of the Yearbook, which aims at providing an authoritative and comprehensive outlook on the most prominent developments in the global space sector. I also elaborate more specifically on space economy, finance and innovation’s matters, aggregating in-depth literature researches with surveys and statistics to provide quantitative insights for substantiated strategic recommendations.

What is the Space Venture Europe report about?

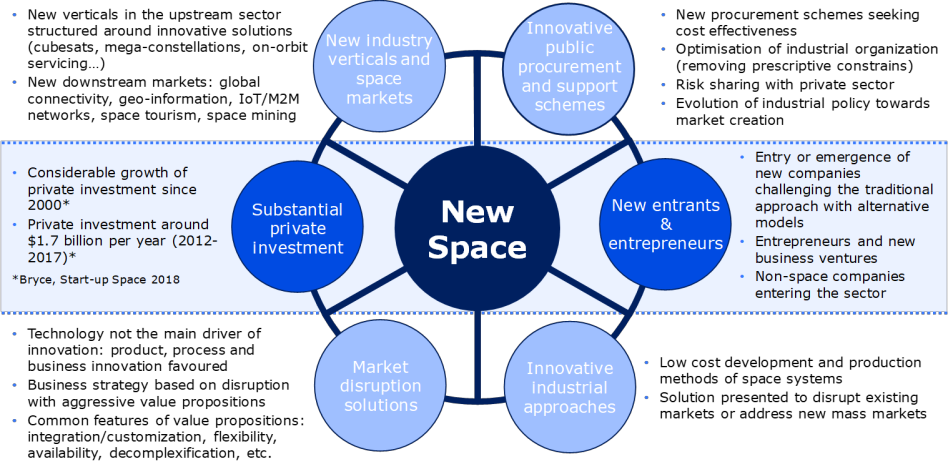

In a recent ESPI study on “The rise of private actors in the space sector”, analysing the “New Space” dynamic as a whole, we found out that information and data related to European activities in this realm were quite limited. While they have been thoroughly investigated from a U.S. perspective. For example, it was impossible to reliably assess the level of investment in European space start-ups. Yet, a more complete overview of the state of affairs in Europe is extremely valuable to appraise the impact of public policies and to understand how the entrepreneurship and private investment dynamic can be further coordinated and supported.

The new Space Venture Europe series aims at filling-in this gap by investigating key components of the changing space business environment in Europe and providing a comprehensive outlook of private investments and entrepreneurship.

How did you make the research?

For this research we developed and used two different tools: the ESPI private investment database and the ESPI space entrepreneurship survey.

Our private investment database includes all publicly available data on announced deals, much similar to other authoritative databases like the one elaborated by Bryce, who helped us with building our own. The main difference is that our database focuses on European companies along a European definition of a “start-up”. Information has been collected by screening a plentiful variety of sources including investment firms’, incubators’ and accelerators’ portfolios, articles and specialised sources.

To look into the European entrepreneurial ecosystem, we sent out a survey to 300+ companies. There are currently many entrepreneurs from various horizons seeking to start a business in a space-related domain. After the publication, we received several emails from start-ups we had not identified, who found our report useful and requested to be included in our scope of research. We keep adding new companies every month and the next issue of the survey will be distributed to a higher sample. With this survey, we propose a snapshot of start-ups’ business environment to understand their prospects for the future and expectations from governments and institutions to help them grow and innovate. With the ambition to further understand how entrepreneurship in the space sector compares with other sectors in Europe, we used the European Start-up Monitor as a reference.

What are your findings?

First of all, we found concrete evidence that New Space trends are also taking off in Europe.

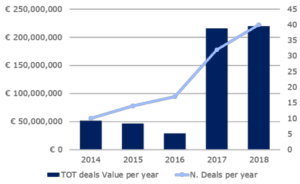

There was a massive growth in private investment in start-ups since 2014. A record high was hit in 2018 both in terms of the number of deals and of total value: 40 private transactions for a total value of €219.5 million. This is a conservative estimate since the value of transactions is not always disclosed and our definition of “start-up”, based on the European Commission’s definition, is more restrictive.

There was a massive growth in private investment in start-ups since 2014. A record high was hit in 2018 both in terms of the number of deals and of total value: 40 private transactions for a total value of €219.5 million. This is a conservative estimate since the value of transactions is not always disclosed and our definition of “start-up”, based on the European Commission’s definition, is more restrictive.

Regarding funding sources, Venture Capital proved to be the main form of private funding for space start-ups (65% of the total). Another interesting finding reveals that investment value is mostly concentrated in a few large transactions: in 2018, five deals exceeded €20 million reaching together €141.3 million.

For what concerns the entrepreneurship trend we found out that Space start-ups are radically more innovation- and global-oriented than other European start-ups in each component of their value proposition: product, technology, processes, and business model. For example, 71% of space start-ups offer a product that is a global innovation while it is the case for only 52% of “non-space” start-ups. In addition, 63% of space start-ups address international markets while only 24% of “non-space” start-ups do.

In comparison with other industrial sectors, it also appears that European space entrepreneurs are more concerned by their business environment but also more confident in the future. They perceive their business environment as rather hostile with potential threats from new entrants or substitute products, higher bargaining power of customers and suppliers as well as fiercer intensity of competition. This contrasts with the positive evaluation of their business situation (83% consider to be in a satisfactory or good situation) and their optimistic outlook on the future (73% foresee an even better situation in the future), suggesting that European space start-ups consider to be well equipped (or properly backed) to succeed.

Finally, it emerged from the survey that gaining customers and securing sales is an even greater challenge for space start-ups than raising capital. Nonetheless, they actively seek (and need) financial and non-financial support, in particular from public sources on which they tend to rely prominently.

Are there differences in the European Countries?

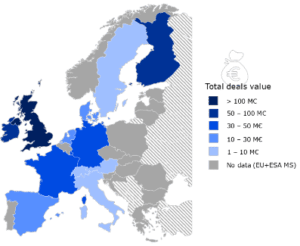

We observed that private investment and entrepreneurship dynamics are widespread across Europe with a few top countries. Space investment deals worth more than €1 million were recorded in 13 European countries. Owing to the multiple forces at play including national policies and approaches to entrepreneurship, industry market and macroeconomics forces, we found out that there is a limited correlation between national public space budgets and the intensity of domestic space entrepreneurship. Moreover, investment in the space sector is fuelled by synergies with other sectors. In this respect, distinction between space and non-space investment is poised to become increasingly blurred. This is particularly true in the downstream segment of the space value chain. For many start-ups, space is only one constituent of their value proposition / business model.

We observed that private investment and entrepreneurship dynamics are widespread across Europe with a few top countries. Space investment deals worth more than €1 million were recorded in 13 European countries. Owing to the multiple forces at play including national policies and approaches to entrepreneurship, industry market and macroeconomics forces, we found out that there is a limited correlation between national public space budgets and the intensity of domestic space entrepreneurship. Moreover, investment in the space sector is fuelled by synergies with other sectors. In this respect, distinction between space and non-space investment is poised to become increasingly blurred. This is particularly true in the downstream segment of the space value chain. For many start-ups, space is only one constituent of their value proposition / business model.

What areas of space are the most interesting/attractive in Europe?

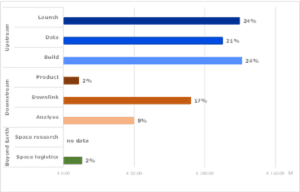

It is very challenging to identify specific areas that would be more attractive, however the study provides a snapshot of the distribution of investment along the space value chain.

We observed that investments have been primarily directed towards the upstream segment, which accounts for twice as much as the downstream segment. However, it is important to note that a strong bias exists due to the difficulty to track investments in the downstream sector, which involves companies whose service and product portfolio is not entirely embedded in the space value chain. For example, companies providing storage or processing capabilities rarely address the space sector as a core customer. Comparably, space data is often one input among others for companies delivering solutions to end-users.

We observed that investments have been primarily directed towards the upstream segment, which accounts for twice as much as the downstream segment. However, it is important to note that a strong bias exists due to the difficulty to track investments in the downstream sector, which involves companies whose service and product portfolio is not entirely embedded in the space value chain. For example, companies providing storage or processing capabilities rarely address the space sector as a core customer. Comparably, space data is often one input among others for companies delivering solutions to end-users.

What do they mean for the New Space Market in Europe?

It is clear today that public investment has enabled the emergence of a sizeable and dynamic market for space-based services and products. Space capabilities are also a key lever for multiple economic, societal and environmental challenges and this will become increasingly true with the cross-fertilisation of space and terrestrial technologies: autonomous cars, smart cities, 5G networks. This creates promising opportunities, in particular in Europe where entrepreneurs can rely on a skilled workforce and advanced industrial base.

Today, European institutions actively support entrepreneurship in the space sector and, although there is still room for improvement, their effort is now yielding concrete results. Notwithstanding, existing instruments are particularly effective in early stages of product and business developments, well supporting the emergence of an “offer”. They show some limits when getting closer to the market. Taking into account the challenges faced by start-ups to gain customers and secure sales, supporting the emergence of a “demand” would be helpful.

What are your recommendations for the European public actors?

The objective of the report is first and foremost to provide useful data and information but we also identified three potential areas of action that could support the continuous growth of these trends.

First, stimulate the demand. Public actors already actively promote the market uptake of space-based solutions but much could still be done to leverage institutional demand like in the United States (e.g. anchor tenancy approach) where public markets are a pillar for the business development of new space ventures.

Second, promote a European single market. Large markets are essential for new space ventures to transform commercial opportunities into profitable and sustainable businesses. In Europe, national demand rarely offers the required critical mass.

Last, drive the demand to support innovation and growth. Following the two first recommendations, the benefits from a stimulated and aggregated European demand would be maximised by a policy promoting a European offer whenever suitable.

The full report Space Venture Europe 2018 can be find here.

Annalisa Donati is currently holding a position as Research Fellow at the European Space Policy Institute (ESPI). In this capacity she is responsible, among other activities, for the studies on space economy, finance and innovation’s domains. As part of her duties she is also managing the production of the ESPInsights, a synthetic overview of major developments in the global space sector. Before joining ESPI she was a Young Graduate Trainee within the Industrial Policy and SMEs Division of the European Space Agency (ESA), where she was in charge of the design and implementation of new platforms for cooperation among a diverse range of stakeholders in the field of business development and industrial innovation. Before joining ESA, Annalisa won a national public competition held by the Italian Space Agency (ASI) aiming at providing a fellowship programme supporting the works of the United Nations Office for Outer Space Affairs (UNOOSA). There she contributed to devise communication and partnership strategies along with content production and analytics for reporting purposes. Prior to that she was a Trainee in the strategy department dealing with institutional and industrial relations.

Annalisa Donati is currently holding a position as Research Fellow at the European Space Policy Institute (ESPI). In this capacity she is responsible, among other activities, for the studies on space economy, finance and innovation’s domains. As part of her duties she is also managing the production of the ESPInsights, a synthetic overview of major developments in the global space sector. Before joining ESPI she was a Young Graduate Trainee within the Industrial Policy and SMEs Division of the European Space Agency (ESA), where she was in charge of the design and implementation of new platforms for cooperation among a diverse range of stakeholders in the field of business development and industrial innovation. Before joining ESA, Annalisa won a national public competition held by the Italian Space Agency (ASI) aiming at providing a fellowship programme supporting the works of the United Nations Office for Outer Space Affairs (UNOOSA). There she contributed to devise communication and partnership strategies along with content production and analytics for reporting purposes. Prior to that she was a Trainee in the strategy department dealing with institutional and industrial relations.

SpaceWatch.Global thanks Annalisa Donati of ESPI for the interview.