By Ronald van der Breggen

When talking about GEO versus NGSO systems – predominantly LEO and MEO – one typically ends up in a discussion about latency and how MEO and LEO are capable of offering much lower latencies relative to the traditional GEO satellites. Alternatively one may also end up in an endless debate about satellite pricing and how it will come down by virtue of so much (NGSO) capacity flooding the market, causing many challenges for many satellite operators.

These discussions have been going on for the past decade and for some reason or another, we seem to have lost track of the more interesting discussion and ultimately bigger issue that provides a better context, and allows for a much better analysis of the challenges that we face in the satellite industry. So, let’s try to get beyond latency and price and discuss the real topic at hand and the opportunities it will bring to our industry.

The Move from Video to Data

If we look at the last 20 to 25 years, it becomes very clear very quickly that the satellite industry is moving from an industry that is dominated by video – video broadcasting in particular – to ultimately becoming an industry that will be dominated by pure data. While trying to adapt to this changing world, we need to make sure we keep the bigger picture in focus: If we take the transition from streaming video towards data as our point of reference, many of the current developments, and particularly opportunities we are currently seeing in our industry become more clear.

We all know that GEO satellites are traditionally designed and operated as video birds and they’re built to carry lots of high quality video content for which its customers are (or certainly were) prepared to pay very high prices in order to have their content carried to millions of households. With the advent of the Internet and the desire to reach more places than cables would go, these video birds are now also being used as a last mile solution for data networks that lacked the necessary terrestrial infrastructure to close circuits in far and away countries. Often being at the bottom of the priority list and with nothing else to offer other than low bandwidth and high latency, the telecommunication companies (Telcos) pushing for these circuits were demanding low prices. With capacity to spare and a desire to enter into this new world of data and Internet, the satellite operators have been playing along to the best of their ability. The result? Rock-bottom and falling prices, resulting in continued sub-optimal satellite designs for data. We’re still, to a large degree, facing these problems in our industry today.

Latency Does Matter

In addition, there has been another important trend that has dominated our industry in its pursuit to make the transition from video to data: connecting the unconnected. When, with O3b, the first MEO satellite system was presented to the world, it came with the promise of connecting to the Internet all those that were still unconnected. While very noble in its cause, it further triggered the discussion on price, as after all, when trying to make a business out of connecting people that have hardly any money to spend, one cannot help but wonder how the business plans will close. It also triggered a more or less renewed discussion on how GEO satellites could be better designed to carry more data to help the same cause at an equal or lower cost point. It is clear that, for example, ViaSat has taken that ambition seriously and is currently very successful.

While the cost discussion continued to go on, another discussion came to the forefront: latency. GEO satellites are characterized by very high latencies. The standard RTT (round-trip time) up and down to the satellite is 500 milliseconds and for data communication that simply is too high. Much has been done to mitigate the negative effects of high latency by introducing new hardware and new software as part of the ground infrastructure, the smoothing effects are predominantly seen in one-way traffic such as video streaming, up/downloading, and web-browsing. For transactional services and collaboration applications such as video conferencing, the high-latency continues to be a source of frustration and often disqualifies the (GEO) satellite solutions altogether. With NGSOs being able to offer lower latencies than its GEO counterparts, here was a true Unique Selling Point (USP) that the industry hadn’t seen in a long time. The industry was used (and largely still is) to price being the only USP, predicated on the assumption that satellite capacity is largely commoditized and one vendor can be easily switched out for another.

So while making the move from video towards data, and despite the introduction of NGSOs at the beginning of this decade causing some excitement over latency, the industry is still very much caught up in a discussion about (dropping) prices and oversupply in a commoditized market. For that reason it is no wonder that many people are skeptical and oftentimes concerned about the development of new NGSO systems. After all, if all the capacity is ‘the same’ and if we’re heading towards oversupply, why bother rolling out NGSOs further?

New Opportunities

It is exactly at this point where the better context of an industry moving from predominantly video to predominantly data will provide interesting clues and better indications for direction and success. After all: if the future is about data, one has to give it to the terrestrial infrastructure guys that these are the people that own that domain. As much as in our industry we have some of the smartest people in the world on our payrolls, when it comes to data we collectively have to take the backseat to the terrestrial guys. If the future is about data, we would be doing ourselves a huge favour to bring these people on board our companies to help us design the satellites of the future. With a flair for the dramatic, I would even go so far as saying that after our industry’s successes with video and DTH, taking this approach will allow our industry to enter into a new era of great success by designing satellite systems that combine the benefits of terrestrial infrastructure with the benefits of satellite.

So what are some of these benefits then? We’ve already touched upon latency. For MEO that is much better than GEO, and LEO will again improve on that. From ~500ms to ~150ms to ultimately ~20ms (RTT at bore sight). By further interconnecting the satellites, onboard-processing and taking into account the rules of physics – bits travel faster in free space than in glass fiber cable – this latency advantage results in satellite infrastructure now being able to compete with the latency of terrestrial infrastructure over longer distances. Satellites beating fiber – wow, that is new!

However, as relevant as latency is, it is not the only thing. If satellites and constellations are designed with data in mind, then other key features of satellites help improve the service relative to its terrestrial alternatives. Global coverage is one of them. Most of the NGSO constellations are covering the entire world. Per definition a cable system can only connect two points, the two end points of the cable; satellites do not have that limitation and that comes with great advantages for any terrestrial operator. And there are more: think about scalability, meaning that given the global footprint of most NGSO constellations, the solutions created in one part of the world are guaranteed to also work in any other part of the world. This comes with the great advantage of having to design a network solution only once for a specific area and see it operates successfully on a global scale after a global rollout.

Rapid deployment is another: it’s well known that in the terrestrial world the enterprise customers have to wait a long time for their remote offices to be connected. This can sometimes take up to three or four months. With the advent of FPA (flat panel antenna), the sheer ability to install two antennas on either side and get a connection up and running in a matter of days is a very interesting value proposition to any Telco installing network services for global customers. With these and many more advantages characterizing ‘the new satellites’, they are now able to compete with fiber and, in doing so, there is an opportunity for our industry to grow beyond the traditional satellite communication (SatCom) market into the much larger datacom market. This market is said to be 200 to 250 times bigger than the SatCom industry.

Subject to the architectural design of the constellation, the new NGSO satellite infrastructure is going to be able to offer competing services for the last mile, as an extension of terrestrial networks. Alternatively, it might want to focus more on trunking applications for the Telcos’ and/or mobile operators’ backhaul requirements. It might however also want to focus on more enterprise type services, by combining both the last mile and the trunking capabilities into one E2E (End-to-End) service.

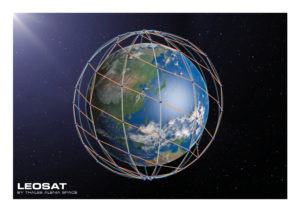

LeoSat is a company that has clearly chosen to do the latter and in doing so it has had the opportunity to add a few more advantages on top of the ones already mentioned. Security is one of the more important ones: if satellites and constellations are designed with data mind, facilitating a link from one rooftop somewhere in London to another rooftop in Sydney is very well possible outside of any terrestrial infrastructure. Not having to tunnel through, or interconnect with, any third party network, the security profile enhances significantly, not only from a data protection perspective, but also from a resiliency perspective as there are simply no interconnects where someone can pull (or tap) a cable – great for governments, and Ministries of Foreign Affairs in particular!

A New Compelling Architecture for the Future

So in conclusion, while the interest in LEO and MEO satellite systems is currently largely framed by discussions on latency and price, the real interest of (future) investors is driven by successful business plans for satellite data-communication. For these LEO and MEO business plans to be successful NGSO systems need to add relevant features and functions beyond those of what terrestrial datacom industry can offer or, better yet, be able to compete and beat terrestrial infrastructure altogether.

LeoSat has taken the latter view, and as part of its design philosophy has effectively chosen to launch MPLS (Multi-Protocol Label Switching) routers in space. In doing so it is completely mimicking the capabilities of our terrestrial counterparts, while adding a few extra capabilities of its own in terms of latency and security. We’ve designed a compelling alternative for mission critical data-communication requirements where data needs to arrive faster and more secure than any alternative option, be it terrestrial or satellite. It is this opportunity, to tap into the broader data-communication market outside and beyond the traditional SatCom market, that explains in large part the interest in MEO and LEO, ie. NGSO.

Ronald van der Breggen is Chief Commercial Officer of LeoSat. He has more than 20 years of experience in the telecom, fiber and satellite sectors working for Dutch Telecom company KPN and leading satellite company SES. He holds a Bachelor’s degree in Business Administration & a Masters in Business Telecommunications.