Firefly is well and truly ignited again. A new formation of the company with solid investors behind it is now paving the way for what has the potential to be a very successful business. International asset management firm, Noosphere Ventures, as lead investor, is set to take Firefly to the next level and beyond with an evolutionary strategy and approach that sees the development two launch vehicles to satisfy the full breadth of the dedicated small satellite launch market and for broader in-space applications as well. SpaceWatch.Global’s Editor-in-Chief, Helen Jameson, was fortunate to catch Mark Watt, Director and Acting CFO at Firefly, to talk rockets and a lot more besides.

As a company, Firefly has not had an easy time but things are now on the up and up with funding from Noosphere Ventures. What has it taken to get the new company to get back to this stage?

I’m going to start with a bit of historical context. While similar in name, Firefly Aerospace (the current company) is completely different from Firefly Space Systems (the prior company). Firefly Space Systems experienced a number of challenges in 2016, particularly relating to closing Series B financing. Noosphere Ventures was the secured lender to Firefly Space Systems, and ultimately acquired the assets of Firefly Space Systems via public auction. These assets were then used to launch an entirely new company, Firefly Aerospace.

Noosphere Ventures is an engaged and active investor in new space. We made the decision to invest heavily in Firefly Aerospace and partner with the team to deliver on its mission to design, manufacture and launch rockets that provide affordable and reliable access to space. Today Firefly Aerospace is owned by management, employees and an investment syndicate including Noosphere Ventures.

Getting to space is not easy, but we believe that Firefly Aerospace is now firmly on track to accomplish its goals of launching in late 2019. In some ways, Firefly Aerospace has benefited from its re-start. Being an early mover has its advantages, but in many instances so too does being a fast follower. For example, because of the restart we were able to step back and re-assess our addressable market. One of the conclusions that we came to was that the sweet spot for dedicated launch has shifted, requiring a larger payload capability than we had initially targeted. Concurrent with this payload re-calibration we revisited the overall launch vehicle design, seeking to remove complexity and build a vehicle that leveraged proven heritage technologies in as cost efficient and practical a manner as possible. Our goal is to create the dedicated launch industry’s most reliable work-horse, and our secret sauce is not doing anything that is overly complicated or un-necessary.

With firm financial backing and a clear strategy in place, our primary objective was to hire back and then scale the incredible Firefly team. As you know a start-up lives and dies by the quality of its team. People were understandably a little reticent at first to join Firefly given some of the past stumbles, but as we have hired, there has been an incredible compounding effect with talent recruiting, The team is now over 180 FTE on a global basis, and we have been blessed with the quality, commitment and passion of our team.

Another area of focus has been the ensuring that relationships with our stakeholders – trade partners, customers, state and federal entities etc., would not be impacted because of the issues relating to Firefly Space Systems. This has taken time, relationships can take a lifetime to build and seconds to destroy, but we have endeavoured to be open, transparent and consistently adhering to our core tenants of financial stability, realistic goals and practical approach. We believe that we have taken great strides in this area, but we realize we have to continue to deliver and execute to further rebuild trust.

As we know, the small satellite market is crying out for new launch service providers. How are you set to offer high frequency launches at the right price points that are so in demand for this starved market?

Everyone has their assessment of the market opportunity, but we believe the ultimate deliverable will be providing the right payload capability at the right price. Alpha can deliver 1 ton to LEO and 600kg to 550km sun synchronous polar orbit at an approximate price of $15,000 per kg of payload. Everyone talks about small satellites, and the significant launch demand their growth will drive, but you don’t really observe people defining where the real opportunity lies. Gywnne Shotwell said it really well: “There is demand and there is demand with money”. It’s our view that nanosatellites have a place in the market, but we believe that the market sweet spot for LEO constellations will be in 100-250kg class small satellites -this is where you are seeing the scale manufacturing of Airbus, Lockheed Martin, Boeing and others driving massive reductions in cost. If your uplift capability can only launch one of those satellites per vehicle, you have got to have an incredibly cheap vehicle otherwise your offering is too expensive compared to a ride share alternative. Firefly can provide all the advantages that operators want from a dedicated launch vehicle but at the right price too because of its payload capacity. That is one of the areas of distinction we see with Firefly.

What are you looking at in terms of launch frequency?

As we’ve talked about before, we are communicating to the market that we are pragmatists, with the right vehicle architecture at the right price. If we were to then turn around and promise a bold and aggressive launch plan, our credibility would be instantly damaged. If we were to come out and say that in the first year we are aiming to do twelve launches, we just wouldn’t appear credible. If you look at every predecessor that has come along, it’s taken them much longer and it’s been much harder to scale than they could have ever envisaged. We are still on track for our first launch in late 2019 but we articulate to our customers a prudent scale of launch cadence in 2020. We plan to control as many variables as possible and therefore only plan to fly from Vandenberg Air Force base in 2019 and 2020. We are talking single digit launches in 2020.

You have to plan for the worst case and you hope for the best. You build your business case in a conservative fashion but what happens if the market scales more rapidly, what happens if everything is going great with Alpha? I think we all understand that if, in the perfect case scenario, there were absolutely no technology challenges with Alpha and it flew perfectly, that market demand would support a much higher launch cadence than single digits in 2020. We see huge pent up demand from our commercial, government and other customers and once we have demonstrated mission success for our first several launches, there will be huge interest for us to fly as frequently as we can. Our business model is based on a conservative launch plan, but we also have plans to scale rapidly once ready. So we are thinking about how and when to increase our manufacturing capabilities – facilities, equipment, infrastructure etc. Firefly’s current manufacturing capability supports the build and launch of eight Alphas a year. Bringing a new manufacturing plant online, requires a lead time of about 18 months so you have to develop a three-plus year forward plan. This is not easy when you have not yet flown your first vehicle. Fortunately we have a superb team that has significant experience helping scale new space companies and we have solid plans in place already. We are in detailed negotiations with two U.S. states regarding the location and construction of our scale manufacturing facility with the goal to be breaking ground in early to mid-2019. We want to be ready to meet the demand whenever we have proven our ability to fly it.

In terms of the Alpha roadmap, where are you in terms of integrating the vehicle and in terms of testing?

On a component level, the majority of the vehicle is designed and built. We are now in the midst of system integration, and stage testing. We expect to complete fully integrated upper stage testing in Q4 2018. Single engine testing for our first stage will also be completed in Q4 2018, with quad engine qualification testing extending into Q1 2019. Our first and upper stage engines are very similar in design, essentially being scaled versions of each other. We expect to complete integrated first stage testing in early Q2 next year and thus remain on track for launch in late 2019.

What level of interest are you receiving in Alpha from small sat operators? The SSTL agreement was significant. Are you expecting this to snowball now over the coming months?

There’s a huge amount of interest in Alpha. We feel that we’ve got almost perfect line of sight into our launches for 2019 and 2020. For 2021 and beyond, there’s a lot of interest. I think that, long-term, we see the blend of customers being about 80% commercial and 20% government. I think in the near-term, the commercial constellation development has not evolved as rapidly as people thought and so we are mindful that we need to re-balance demand until that comes online.

I also think that, when you look at the national level, there is a space race, and the U.S. government has a significant number of payloads that require TRL validation in space. Because of Alpha’s payload capacity, we believe we will be able to offer the U.S. government an attractive launch solution – but we first need to fly to crystallize this opportunity.

Can you tell me about the reason for Firefly’s decision to open its R&D centre in the Ukraine?

Firefly is a U.S. company. Alpha and Beta are entirely designed, manufactured, tested and flown from the U.S. I think it’s really important that this is understood. Firefly is a U.S. company and is managed and controlled from the U.S. We’re all aware what is going on from a geopolitical perspective in Ukraine. If Firefly’s Ukraine team for whatever reason, could not support Firefly, we would not miss a single beat. Firefly Ukraine is entirely additive to Firefly. Firefly is in no way dependent upon Firefly Ukraine.

Firefly is a U.S. company. Alpha and Beta are entirely designed, manufactured, tested and flown from the U.S. I think it’s really important that this is understood. Firefly is a U.S. company and is managed and controlled from the U.S. We’re all aware what is going on from a geopolitical perspective in Ukraine. If Firefly’s Ukraine team for whatever reason, could not support Firefly, we would not miss a single beat. Firefly Ukraine is entirely additive to Firefly. Firefly is in no way dependent upon Firefly Ukraine.

I think the second message relates to hiring and personnel costs. Start-ups are almost always being asked what their hiring plans are outside of the major technology hubs of Silicon Valley, New York and even Austin. The war for talent is incredibly costly. We see Ukraine as providing a compelling, low-cost, offshore capability that Firefly can leverage. Firefly Ukraine is based in Dnipro, a former Soviet space city. The depth of space engineering talent in Dnipro is impressive. We can recruit engineers with ten-plus years of highly relevant aerospace engineering experience for a fraction of the equivalent cost in Silicon Valley. Being able to quickly scale a low-cost, skilled team is thus an attractive feature.

The challenges of developing a rocket can almost equally be split between design and manufacturing. Not only was the Soviet Union very advanced in certain design fields such as turbopumps, but they had deep manufacturing expertise also. Their processes and skills in areas such as fabrication, metallurgy even brazing is incredible. We see Firefly Ukraine as a way to harness this expertise and bring it to bear at Firefly.

Separately, we have been developing a couple of in-space propulsion systems. Firefly Ukraine has been working on both plasma and Lox-Methane propulsion systems that can be used for orbital transfer vehicles, spent stage de-orbiting and even lunar cargo delivery. There is some incredible in-space propulsion experience in Ukraine that we would love to leverage once we have all the documentation in place.

Firefly’s Beta vehicle is on the drawing board and understandably, you are focusing on Alpha first. However, can you tell us a little about Beta and when things will accelerate on that project?

There’s huge interest in Beta. We have hundreds of millions of dollars of LOIs in place for Beta already.

Beta has a very interesting uplift capability – four tons to LEO, three tons to Polar/ SSO. It is a U.S. vehicle that competes with PSLV (India) and almost with Soyuz (Russia) and yet its price point is significantly lower than its competitors and it’s also built and flown from the U.S. which makes it a much more attractive offering to U.S. customers. Much of the roadmap for Beta is tied to Alpha anyway so it’s not that we’re doing nothing on Beta. Interestingly, one of the things we are doing as a company today is raising some external capital for the first time to allow us to accelerate Beta’s roadmap.

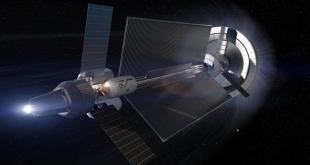

Beta’s basic architecture is a three-core vehicle, incorporating three Alpha first stages and a new upper stage. If Beta is three Alpha’s and we have the current manufacturing capability for eight Alpha’s per annum, every Beta we build is going to materially impact our Alpha plans. Thus we need to start thinking about Beta manufacturing infrastructure. Additionally, we will have to modify our launch plans. When you look at the use cases for Beta, it can do small constellation deployment, carrying four tons to LEO. However, Beta has significantly greater mission capabilities including offering GEO and lunar launch solutions. This capability necessitates an east coast launch facility. If it was just a question of designing Beta, it would be easy to accelerate. However, it’s much more than that. It involves manufacturing, launch pads, additional companywide infrastructure etc. We believe there is so much opportunity for Beta that this is worth doing, so that’s why we are beginning to have targeted fundraising conversations.

There’s increasing competition out there, some viable, and some perhaps not so. What are the factors that mean that Firefly will succeed as a leading provider for smallsat launches?

We believe we have the right payload capacity at the right price. I think customers like our pragmatic philosophy: make Alpha a workhorse; make it reliable and don’t do anything overly complex. We hope that this philosophy translates into a rocket that is going to be successful, that only has minor hiccups along its roadmap of evolution, and that can support the huge demand from the market place. If we keep it simple and deliver a rocket that can fly safely and regularly, then I think we will be in a good place.

SpaceWatch.Global thanks Mark Watt of Firefly for the interview.