By Rami Ibrahim

As Orbofleet’s market research report on Non-Geostationary Orbit (NGSO) satellite operators will be soon available for purchase, here we present key pointers that provide a brief outlook on the current status of the major global NGSO satellite operators.

The satellite industry has been at the forefront of the race to provide internet access across the world. And the upcoming low-earth orbit (LEO) satellite constellations will ensure that this decade goal is accomplished in the coming months. Considering the recent connectivity demand driven by pandemic, the internet has become an essential and critical component of life for every individual, agencies, companies, etc. While the companies like SpaceX have publicly announced the availability of satellite internet service (operating under the brand name Starlink) in several parts of the world, there are still some challenges that the company has faced in recent times due to broadband regulations. Nevertheless, it is by far safe to say that SpaceX is one of the key players in the global market that has urged individuals and enterprises around the world to participate and innovate in the space industry. While there are several other companies planning (or have already) to launch mega-constellation in LEO, let’s take a look at what this landscape looks like and what will be the potential market opportunities generated by some of the key Non-Geostationary Orbit (NGSO) satellite operators:

Planning and Execution: The Key Elements to Success

Behind every successful mission, there are years of hard work, experience, and team integration. Especially in the space industry, a minute error can lead to massive loss both on years of hard work and finances. Therefore, critical mission planning and execution remain the key to the success of space and satellite businesses. Though several companies in the LEO segment were or have already reached the edge of bankruptcy, the key to remain an established player in the market is by creating a strong foundation for niche markets as well as creating an action plan to overcome regulatory and financial challenges.

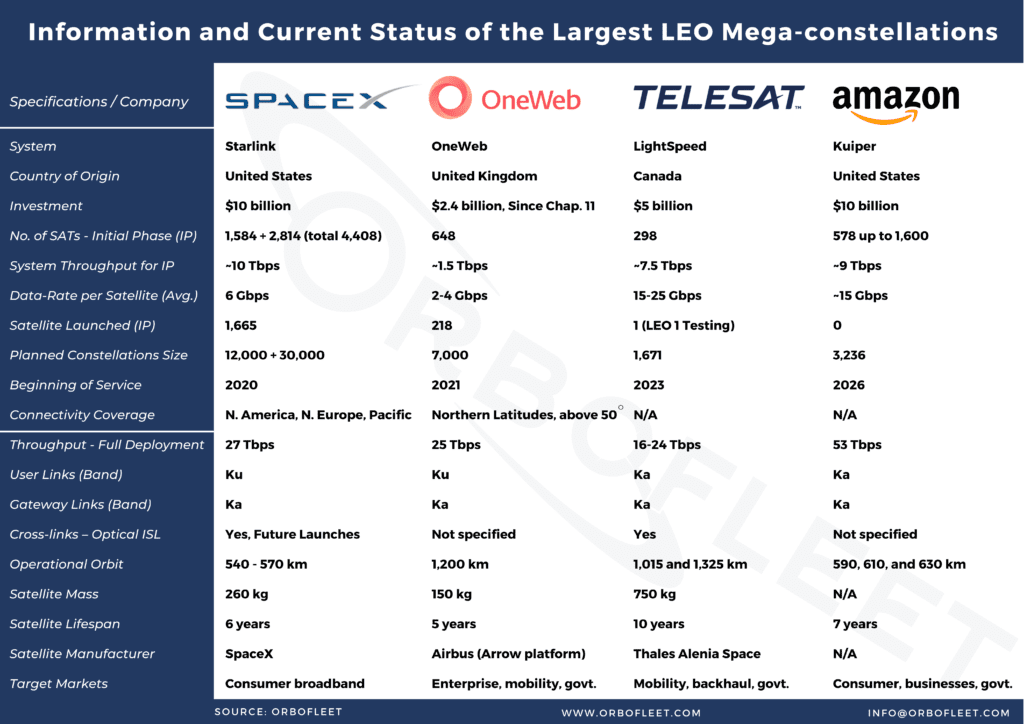

According to our latest market research and analysis of the NGSO market (as mentioned in the above table) SpaceX’s Starlink, OneWeb, Telesat’s LightSpeed, and Amazon’s Kuiper are some of the major companies in the NGSO market with strong plans to roll out services in the niche as well as in general consumer markets. SpaceX has managed to penetrate several parts of the world to sell its Starlink product but has also faced some regulatory challenges to acquire a permit in countries like India (which is one of the biggest markets alongside China). As several other LEO operators are yet to unveil their specific plans for the niche markets/regions, the regulation aspect remains a crucial challenge for new as well as existing satellite operators. Simultaneously, considering the rising demand for connectivity solutions, the next-generation transport systems like autonomous vehicles and air taxis, will also have overcome regulatory challenges while deploying onboard connectivity solutions. Though these major players have or are overcoming such challenges, their business focus on niche markets provides a broad picture of how new space solutions can accelerate the R&D process in the space industry.

On the other hand, China Aerospace Science and Industry Corporation’s (CASIC) Hongyun, China Aerospace Science and Technology Corp.’s (CASC) Hongyan, Galaxy Space’s Yinhe, Hanwha Systems, and CurvaNet have also joined the league of NGSO. While several of the companies have secured a significant amount of funding to plan and launch their respective constellations, it is by far clear that the upstream market is set to become more competitive in this decade. As the new space technology trend – low-cost and high-quality – remains the top preference of the startups, a carefully curated investment plan, a strong industrial network, government contracts, and a team of business and technical experts, will define the long-term success of the new entrants in the NGSO market.

Target Markets and Business Opportunities

Consumers, rural, enterprise, mobility, backhaul, and government are some of the key areas where NGSO’s have successfully managed to attract investment as well as urge the organizations to plan their own LEO constellation. Along with the private sector, the government and military agencies of countries like the United States are planning to launch a constellation for military communications. On the other hand, SpaceX has already rolled its Starlink consumer services in some parts of the world. While SpaceX has set a standard price (terminal kit) of USD 499, as a one-time investment for the hardware, the monthly price of the internet service is currently set at USD 100. As opposed to this, Tom Choi, Chairman, Airspace Internet Exchange, recently revealed in one of the interviews that CurvaNet’s services “will cost one-tenth of their competitors.” This landscape of price variation and flexibility will create a more competitive sphere in the consumer market segments.

Considering the business opportunities, the competition in the upstream market should be considered as a wave to trigger innovation, employment, and encourage entrepreneurs in the downstream market verticals. SpaceX remains an exception, where the company mastered the end-to-end development of satellite products and launch services. On the other hand, OneWeb has planned to begin its services in the northern latitudes; above 50 degrees (next batch of 36 satellites will be launched on July, 2021). While other key players like Telesat and Amazon are yet to roll out their business services in the market, there will be soon several opportunities in system integration, ground segment, satellite network & security, data transmission, etc.

What Does the Future Look Like?

With the current status of the key NGSO’s LEO constellation, the future looks promising as several companies have successfully demonstrated their ability to provide high-speed internet connectivity across the world. Simultaneously, as mentioned above a careful curation of business and investment plan, market opportunities and challenges will help new entrants carve a strong and sustainable business path for their respective market niche.

Orbofleet is a commercial space and satellite market research, consulting, and strategy advisory firm based in Strasbourg, France. The company is managed and operated by Rami Ibrahim and his team of global analysts and consultants, specialized in the commercial space and satellite market. With over 15 years of experience across multiple verticals of the space industry, Orbofleet’s team has successfully accomplished several consulting and research projects across Asia, Europe, Middle East, and the USA. Our decade long market leads, and research inputs have helped our clients achieve desirable results for their businesses. Orbofleet’s broad expertise in market research, business and technology consulting, custom training courses, case studies, RFP support, and management, aims to support new space initiatives; primarily for private and government agencies operating in the satellite communications, space situational awareness (SSA), deep space communications, and space tourism domain. For more information on our services and products contact us on: [email protected] , www.orbofleet.com

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space