by Blaine Curcio and Jean Deville

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 29 November – 5 December 2021”.

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 29 November – 5 December 2021”.

Hello and welcome to another episode of the Dongfang Hour China Aero/Space News Roundup! A special shout-out to our friends at GoTaikonauts!, and at SpaceWatch.Global, both excellent sources of space industry news. In particular, we suggest checking out GoTaikonauts! long-form China reporting, as well as the Space Cafe series from SpaceWatch.Global. Without further ado, the news update from the week of 29 November – 5 December 2021.

1) Can commercial GEO relay satellites? CAS Hualu believes so.

Jean’s Take

One of the main problems that any EO satellite operator faces is to have a sufficiently dense network of ground stations: this is to enable the satellites to pass enough times over ground stations to perform data downlinks, and command uplinks. And on this topic, one of the main issues that China faces specifically is trying to have a global network of ground stations. While all countries face this issue, China has the disadvantage of having fewer overseas territories, with fewer opportunities to build ground stations outside of mainland China. It has nevertheless managed to build a solid network of ground stations in foreign countries (Argentina, Chile, Namibia, …), and also deploys a network of Yuanwang tracking ships for major launches of its space program. Finally, they can also use a network of GEO relay satellites called Tianlian, which get the information from a LEO satellite, and send it back to a ground station over China (which I will get back to in a bit).

China’s new wave of commercial satellite startups on the other hand don’t have the resources. I say this because all of the TT&C infrastructure mentioned earlier is basically reserved for the national space program, and is already very busy coping with the fast-paced growth of Chinese EO capabilities (Gaofen, Yaogan, …), as well as with China’s space station program (including the upcoming Xuntian telescope, which will downlink 50 To of data per day (!) according to a CCAF presentation).

China’s new wave of commercial satellite startups on the other hand don’t have the resources. I say this because all of the TT&C infrastructure mentioned earlier is basically reserved for the national space program, and is already very busy coping with the fast-paced growth of Chinese EO capabilities (Gaofen, Yaogan, …), as well as with China’s space station program (including the upcoming Xuntian telescope, which will downlink 50 To of data per day (!) according to a CCAF presentation).

To solve this problem, Chinese commercial EO companies can partner with Chinese commercial TT&C providers, which are still small but growing fast; they can also work with foreign TT&C service providers such as SSC, but which may prove to be unreliable partners if the relations between the TT&C company’s country and China get sour.

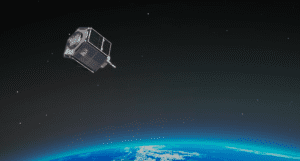

A new Chinese commercial company, Hualu Space, has proposed a 3rd solution for commercial EO companies: setting up a network of GEO relay satellites.

There are several advantages to this solution: first, the obvious one, there is no need to build ground stations outside of China, because basically 3-4 GEO relay satellites will suffice to relay information from LEO to ground stations in China.

But Hualu Space also mentions other advantages: the ability to perform laser interlinks between satellites, which enhance data transfer speeds, and also the broad coverage of GEO satellites, where 3-4 GEO satellites would be sufficient to cover the planet.

Now there’s the question of if Hualu Space will be able to pull this off, as it’s no small project. The only other commercial relay satellite project as far as I know was led by a San Francisco-based startup called Audacy, which planned to set up a constellation of MEO relay satellites. Unfortunately for them, they went bankrupt in 2019 after their satellite demonstrator failed.

Now back to Hualu Space, and a quick background on the company. Hualu Space is a commercial spin-off of the CAS founded in October 2018, with the lead investor in the company being CAS Holdings, one of the main investment arms of the CAS. It already has 6 ground stations in China, covering the entire Chinese territory.

Now back to Hualu Space, and a quick background on the company. Hualu Space is a commercial spin-off of the CAS founded in October 2018, with the lead investor in the company being CAS Holdings, one of the main investment arms of the CAS. It already has 6 ground stations in China, covering the entire Chinese territory.

Being backed by one of China’s most prestigious research entities, the CAS, will certainly be helpful. Not only does this likely mean significant financial support, but it also opens the door to many TT&C contracts as the CAS is closely involved in many other space projects which may require such services: the 60-satellite Jilin-1 EO constellation operated by CGSTL are one such company. Nevertheless, sending a couple of GEO satellites into orbit is a multi-hundred million USD project at the very least, and there is no other commercial company outside of China that has pulled this off, as far as I know.

2) Landspace interview

Blaine’s Take

Excellent interview with Roger Zhang Changwu, CEO of Landspace, as pointed out by friend of the Dongfang Hour Ace of Razgriz. Some cool nuggets: Zhang confirmed the maiden launch of the ZQ-2 in 2022, and that manufacturing capabilities for the rocket would be completed by EOY 2021. When asked about the delay in the first launch of ZQ-2 (it was originally planned for 2020), Zhang says that Landspace has been more focused on developing infrastructure, and that in the rocket industry, infrastructure is far more important than building a single rocket. The article quotes another Landspace insider as saying that once the company has succeeded in nailing liquid methalox engine technology, batch manufacturing and regular launches are soon to follow.

During the interview, Zhang also spoke about the early days of Landspace in 2015, when he and two co-founders pooled RMB 5M (~US$800K) of their own money, plus RMB 8M of angel investment, to start Landspace. What a long way Chinese commercial space has come since that time. From 2015 to 2020, investment in Chinese commercial space increased from RMB 700 million to RMB 10 billion. Financially, the industry has come a long way, which is impressive when considering how early-stage it remains even today.

During the interview, Zhang also spoke about the early days of Landspace in 2015, when he and two co-founders pooled RMB 5M (~US$800K) of their own money, plus RMB 8M of angel investment, to start Landspace. What a long way Chinese commercial space has come since that time. From 2015 to 2020, investment in Chinese commercial space increased from RMB 700 million to RMB 10 billion. Financially, the industry has come a long way, which is impressive when considering how early-stage it remains even today.

An interesting dynamic during the interview is the comparison of Landspace to SpaceX. The interviewer makes it very clear that they view Landspace as the closest thing to a “Chinese SpaceX”, which seems to make Zhang slightly uncomfortable (the interviewer says that he seems a bit anxious about the issue). Implicitly, this is because a “Chinese version of SpaceX” might indicate that Landspace is simply copying SpaceX, which Zhang does not really feel to be the case, noting that “whether it’s SpaceX or Blue Origin, everyone knows that the technical route is feasible. With enough money we can definitely make it, but how much money is enough and how long does it take us?”

Which is to say, yes, Landspace is doing the same thing as SpaceX and Blue Origin–building liquid-powered rockets–but they’re doing it their own way using their own technology, and they recognize that anyone could do it given enough time and money. We often see (mostly western) commentators saying that “China is copying SpaceX”, and to the extent that Chinese commercial companies are building rockets, that’s true. But in the end, just building a rocket, even one using a specific type of fuel, is not copying, just as Tesla making a car powered by electricity is not necessarily copying the General Motors EV1, which was the first modern electric car.

Zhang also points out that Landspace was founded 13-14 years after SpaceX, and that the company remains in its early stages. Indeed, Zhang notes that most of Chinese commercial space companies (including Landspace) are currently in what he calls “Development Stage 1.0” (1.0发展阶段), and that the successful launch of the ZQ-2 would propel the company to Development Stage 2.0. Eventually, Zhang says that Landspace will go to stage 3.0, and 4.0, and intriguingly, he hopes he can one day “proudly say that (Landspace) is a software-driven company” (有一天我能骄傲地说,我是一家软件驱动的公司).

Other highlights of the article include some discussion about Landspace’s designation as a “new “small giant” enterprise” (新“小巨人”企业) by China’s Ministry of Industry and Information Technology (MIIT) in August 2021. The company achieved this designation due to its progress in liquid methalox engines. At the time, the MIIT named a total of 2,930 enterprises as “small giants”, of which >70% have been around for 10 years or more (making Landspace on the younger side).

Overall, nice interview with Roger Zhang, and great insights into the mind of the leader of one of China’s leading launch firms. The one thing I’d like to draw some attention to before moving onto our next piece of news is Roger’s low-key nature. The author noted that the comparisons to SpaceX make Zhang a bit uncomfortable, which is not surprising. Whenever I’ve met Roger, he has always been pretty quiet and low-key, preferring to work silently and let the results do the talking. It’s a very different style from SpaceX (or indeed, some Chinese commercial launch firms), and may suit the company well in China.

That being said, we saw this week a new prospective customer for China’s commercial launch companies, that being yet another small-medium-sized constellation being announced. Jean, what’s going on over in Harbin?

3) A new constellation (Tiangang)

Jean’s Take

This week saw the announcement of a new Earth Observation constellation, namely the Tiangang Constellation of 36 satellites. The announcement took place at a signing ceremony in the Northeastern city of Harbin, and saw commercial satellite manufacturer Zhuhai Satellite and Tianjin Xingtong Jiuheng S&T corporation sign an agreement for the constellation.

The constellation will be used for natural resource monitoring, disaster prevention, and other fairly standard EO applications. The first satellite, currently under development, will be sent to 500km SSO, and will carry a hyperspectral imaging payload with a resolution of 10m. It will launch next year, followed by 5 other satellites also next year, and together they will be referred to as the Yunnan No. 1 01-06 satellites, which are the first segment of the 36-satellite constellation, as mentioned earlier.

This constellation is an interesting example of how government or SOE-led space infrastructure projects are increasingly involving commercial players. The so-called Tianjin Xingtong Jiuheng corporation is actually the company managing the S&T platform of the Geological Survey department of the Ministry of Natural Resources.

In the past, we were used to seeing government projects reach out to government providers (typically: Chinese space program satellites like Beidou, Gaofen, or Haiyang are built by state-owned satellite manufacturers and launched by state-owned rockets). But there are signs that this may be shifting a bit. China is definitely not at NASA-level, where space stations, lunar landers, cargo delivery, and crewed spaceflight are handled to a large extent by commercial companies. But as mentioned in previous episodes, the CMSA published a request for proposal for a small cargo spacecraft in January this year, seemingly open to commercial companies. CETC Institute 38 and BUPT have both reached out to Spacety for the manufacturing of satellites for the Tianxian and Tiansuan constellations a couple of weeks ago; And recently, the government technology verification satellite Shiyan-11 was launched on an Expace Kuaizhou-1A.

4) A Very Busy Couple of Weeks for Zhang Kejian

Blaine’s Take

The CNSA, and notably its Director Zhang Kejian, have seen a very busy few weeks in the field of international cooperation. This week Wednesday, China and Argentina met and discussed plans to strengthen bilateral ties, with specific focus on science & technology development. The meeting took place between Argentina’s newish ambassador to China, Sabino Vaca Narvaja, and Zhang Kejian, who during this meeting appeared to be wearing his title of Vice Minister of Industry and Information Technology, one he wears in addition to the Director of CNSA.

The two countries agreed to promote negotiations of a “2021-2025 Space Cooperation Plan”, encompassing a variety of areas, including space science, deep space exploration, and earth observation. Argentina has become an important partner for China’s space ambitions in recent years across these different areas. In space science and deep space exploration, China recently built the Espacio Lejano Estacion in Neuquén Province of Argentina as part of its Deep Space Exploration Network. On the commercial side of things, Satellite Herd, a Chinese commercial TT&C company, recently opened a ground station in Argentina.

Zhang also offered during the meeting the prospect of scholarships for Argentinian students in areas of space, nuclear energy, and defense industry areas, which will be important for Argentina given that the country has been trying to develop and maintain domestic space capabilities. This has included the Gsatcom satellite manufacturing JV between Argentinian company INVAP and Turkish Aerospace Industries, which has aimed to allow Argentina to domestically produce satellites for its Arsat program. While not explicitly stated during the meeting, China’s offer of scholarships in the space sector are likely to appeal to the Argentinians given their emphasis on developing domestic space capabilities. Argentinian space initiatives (in this case commercial ones) that have benefited from Chinese collaboration up to this point include the Satellogic EO constellation, which has received funding from none other than Tencent, and which agreed to a series of launches onboard Long March rockets.

In what was indeed a very busy week for Zhang Kejian, the very next day, CNSA and the State Space Agency of Ukraine (SSAU) held virtual talks. The talks appeared to center on the 2021-2025 “Program of Ukraine – China Cooperation in Space”, with officials on both sides noting that the prerequisites exist for deepening cooperation across the space domain. This comes about 1 year after China and Ukraine signed a long-term cooperation agreement in space encompassing 69 projects worth >US$70M over the period of 2021-2025. While the brief Ukrainian press release of this week’s meeting does not explicitly mention these projects, we can assume that a high-level discussion of 2021-2025 matters would have included them.

The two sides have historically cooperated in areas related to propulsion (among other things), with Ukraine home to a lot of rocket science brain power coming from the days of the Soviet Union. Indeed, we have heard from sources inside of China that at least one Chinese commercial launch company has been in talks with the Ukrainians about collaboration and technology transfer. Early last year saw the Ukrainian Vice Prime Minister for EU and Euro-Atlantic Integration, Dmytro Kuleba, state that Ukraine needs to decrease trade barriers with China and enhance cooperation in the field of space.

These two meetings come about 3 weeks after a meeting between Zhang Kejian and Italian Ambassador to China, Luca Ferrari, which took place on 12 November in Beijing. During that meeting, Zhang and Ferrari discussed cooperation in the space and nuclear fields, similar to the discussion with Argentina.

Overall, these three meetings taking place in such a short period of time, with three pretty developed countries, is noteworthy. China is clearly seeing specific technologies–namely space, nuclear, and defense–as critically important, not just for China but for other countries. As other countries try to develop stronger domestic technological capabilities, China seems ready to cooperate with them, albeit in a way where China appears to be the senior partner, and in some cases on Chinese timelines of 2021-2025. Moving forward, keep an eye on these collaborations, and expect to see more Argentinian, Italian, and Ukrainian students in Beijing once the borders start to re-open.

This has been another episode of the Dongfang Hour China Space News Roundup. If you’ve made it this far, we thank you for your kind attention, and look forward to seeing you next time! Until then, don’t forget to follow us on YouTube, Twitter, or LinkedIn, or your local podcast source.

Blaine Curcio has spent the past 10 years at the intersection of China and the space sector. Blaine has spent most of the past decade in China, including Hong Kong, Shenzhen, and Beijing, working as a consultant and analyst covering the space/satcom sector for companies including Euroconsult and Orbital Gateway Consulting. When not talking about China space, Blaine can be found reading about economics/finance, exploring cities, and taking photos.

Jean Deville is a graduate from ISAE, where he studied aerospace engineering and specialized in fluid dynamics. A long-time aerospace enthusiast and China watcher, Jean was previously based in Toulouse and Shenzhen, and is currently working in the aviation industry between Paris and Shanghai. He also writes on a regular basis in the China Aerospace Blog. Hobbies include hiking, astrophotography, plane spotting, as well as a soft spot for Hakka food and (some) Ningxia wines.

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space