by Blaine Curcio and Jean Deville

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 25 – 31 October 2021”.

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 25 – 31 October 2021”.

Hello and welcome to another episode of the Dongfang Hour China Aero/Space News Roundup! A special shout-out to our friends at GoTaikonauts!, and at SpaceWatch.Global, both excellent sources of space industry news. In particular, we suggest checking out GoTaikonauts! long-form China reporting, as well as the Space Cafe series from SpaceWatch.Global. Without further ado, the news update from the week of 25 – 31 October 2021.

1) A week of announcements in Sino-European deep space cooperation

Jean’s Take

ESA Operations Center announced on Wednesday 27/10 that the Mars Express orbiter, in orbit around the Red planet since 2003, would perform 5 data communication attempts with China’s Zhurong Mars rover. This is a new milestone in China – Europe collaboration around the Tianwen-1 mission, with ESA’s deep space ground station network having previously assisted the Tianwen-1 spacecraft after it was launched from Wenchang in the summer of 2020. There is also some irony with Mars Express performing data relay tasks for Zhurong, in the sense that it was initially meant to do exactly that for Beagle-2, the ill-fated British lander which separated from the Mars Express orbiter in 2003, successfully performed landing, but failed to deploy 2 of 4 solar panels, making its communication antenna (and consequently the entire lander) inoperative.

ESA Operations Center announced on Wednesday 27/10 that the Mars Express orbiter, in orbit around the Red planet since 2003, would perform 5 data communication attempts with China’s Zhurong Mars rover. This is a new milestone in China – Europe collaboration around the Tianwen-1 mission, with ESA’s deep space ground station network having previously assisted the Tianwen-1 spacecraft after it was launched from Wenchang in the summer of 2020. There is also some irony with Mars Express performing data relay tasks for Zhurong, in the sense that it was initially meant to do exactly that for Beagle-2, the ill-fated British lander which separated from the Mars Express orbiter in 2003, successfully performed landing, but failed to deploy 2 of 4 solar panels, making its communication antenna (and consequently the entire lander) inoperative.

The interesting point about the relay communications attempts here is that they will be so-called “blind” data transmissions. According to the ESA post, “normally, when an orbiter flies over a rover, it sends down a hello, known as a ‘hail signal’ to initiate communications. The rover then sends back a response to let the orbiter know it received the hail and that the exchange of data or commands can begin”. This normal comms process is not possible with Zhurong as it is not able to receive the frequencies used by Mars Express, although Mars Express is able to receive signals from Zhurong.

This is why the Mars Express radio system will perform a blind data transmission: it listens to any potential signal; if a signal is detected, the system then locks onto the signal, records it and transmits the data to the ESOC Darmstadt, Germany. The data is then passed on to the Zhurong team.

The data speeds will start at 8 kbps, gradually increasing to 128 kbps as the tests move forward. This speed is not bad, and can be compared to the 30-40 kbps transfer speed between Zhurong and Tianwen-1 thanks to their respective X-band and UHF band antennas. However it’s lower than the communication between the Perseverance rover and NASA’s orbiters (MRO and MAVEN), which is able to achieve 10-20x that data transfer speed.

According to the same ESA blog post mentioned earlier, this technique is not new, but had never been tested around another planetary body besides the Earth. This is also why the Zhurong team and the manufacturer of the radio system, the British company QinetiQ, performed tests, and which results are to be revealed soon according to ESA.

ESA also announced that the actual Mars Express-Zhurong radio communication attempts should take place at the following dates:

- Sunday 7 November, 12:07 – 12:17 UTC

- Tuesday 16 November, 19:34 – 19:44 UTC

- Thursday 18 November, 20:27 – 20:37 UTC

- Saturday 20 November, 21:20 – 21:27 UTC

- Monday 22 November, 22:13 – 22:22 UTC

Next, in a week fruitful in Europe-China space announcements, the head of ESA’s Moscow office, Rene Pischel, told the Russian news agency that Europe was mulling over joining the Russian-Chinese ILRS lunar station project, (aka International Lunar Research Station in full). This is not entirely news, as it was already mentioned in the past by other ESA officials, but this is (AFAIK) the first such update since China and Russia officialized their collaboration over the project in June 2021. The ILRS was otherwise previously a China-only project.

This is an interesting development where we could see Europe in the future on both fronts, as partners of both the ILRS and the US-led Artemis program. A refreshing thought, after a week of tough rhetoric between the US and China with China’s FOBS/HGV test.

2) Kuaizhou-1A Launch by Expace

Blaine’s Take

Expace successfully launched a Kuaizhou-1A rocket from Jiuquan Launch Center on Wednesday 27 Oct, carrying the Jilin-01 Gaofen-02F satellite, also known as Changshu-1. Quite a bit to unpack from this launch. First point, this is the second consecutive successful launch by Expace of the Kuaizhou-1A, this coming ~1 year after the company suffered a launch failure in the 10th launch of the small solid-fueled rocket. The company has built out a launch vehicle manufacturing facility in Wuhan at CASIC’s Wuhan National Aerospace Industrial Base, and has the capability to manufacture ~20 rockets per year. In short: watch out for a fast ramp-up if they sort out all final kinks with the KZ-1A.

Moving on to the payload, the Jilin-01 Gaofen 02F satellite will be operated by Chinese EO satellite manufacturer and operator Charming Globe Satellite Technology Limited, or CGSTL, in collaboration with Spacehawk (a subsidiary of the third Academy of CASIC), and the city of Changshu, Jiangsu Province.

The Jilin-01 Gaofen-02F satellite is the 31st Jilin-01 satellite launched by CGSTL. The optical EO satellite can capture full-color images with resolution of better than 0.75m and multispectral imaging of better than 3m at a swath of 40km. The satellite will use, among others, a ground station in Changshu City. As we have mentioned before, CGSTL is now China’s leading commercial EO satellite manufacturer and operator, and itself a fascinating example of collaboration between the CAS, the city government of Changchun, and private investors.

CGSTL has been a long time customer of Expace, with the satellite operator having famously purchased a launch from the launch service provider during a live online auction in 2020 that garnered over 500 million views. This was the 7th CGSTL launch on a Kuaizhou rocket, with 2 of the launches having failed (one KZ-1A, and one KZ-11, both in 2020).

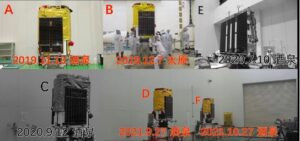

There was an interesting photo being passed around the Chinese internet of 6x Jilin-01 GF series satellites, two of which were greyed out due to KZ launch failures. That being said, the extended collaboration–and now two consecutive successful launches–is a good example of two of China’s better-funded commercial space companies having pretty large-scale collaboration.

In the case of CGSTL, the company has received support from the Jilin Province and Changchun City Governments, the Chinese Academy of Sciences, as well as RMB 2.4B of “Pre-IPO” money late last year, with which they have built what the company describes as Asia’s largest EO satellite R&D and manufacturing industrial base, capable of producing dozens of sophisticated EO satellites per year. Moving forward, we know that CGSTL has ambitions to launch ~100 more EO satellites in the next several years.

Expace, on the other hand, has received support from the Hubei Province and Wuhan City Governments, as well as RMB 1.2B of funding from Sanjiang Group, a subsidiary of CASIC, in 2017. The company has used this funding to develop the aforementioned rocket manufacturing facility in the Wuhan Aerospace Industrial Base, which is capable of producing ~20 KZ-1A rockets per year. Moving forward, Expace plans to batch manufacture KZ-11 rockets which are considerably larger (capable of launching ~6-8 CGSTL Jilin-01 satellites).

With many of CASC’s rockets spoken for by national missions, the reliability of Kuaizhou (or occasional lack thereof) will be a major factor in the speed of deployment of CGSTL’s constellation. As well, at least in the medium-term, the required deployment speed by CGSTL will be a factor in the economic viability of Expace and the Kuaizhou rockets. We know from the online auction above that the auctioned rocket sold for RMB 40M (~US$7M), and when considering that CGSTL has booked 7 launches on Expace (not all for entire rockets), we can assume that CGSTL is a VIP customer of Expace indeed!

With many of CASC’s rockets spoken for by national missions, the reliability of Kuaizhou (or occasional lack thereof) will be a major factor in the speed of deployment of CGSTL’s constellation. As well, at least in the medium-term, the required deployment speed by CGSTL will be a factor in the economic viability of Expace and the Kuaizhou rockets. We know from the online auction above that the auctioned rocket sold for RMB 40M (~US$7M), and when considering that CGSTL has booked 7 launches on Expace (not all for entire rockets), we can assume that CGSTL is a VIP customer of Expace indeed!

Separate to the satellite’s primary mission as being part of the Jilin-01 constellation, it will also play a role in CASIC’s “航天星云“ (hángtiān xīng yún),or “SatCloud” project. Not to be confused with the very similarly-named CASIC project “航天行云” (hángtiān xíng yún), the SatCloud project aims to create a “Satellite resources shared service cloud platform”. While the nature of the collaboration is not entirely clear, we do know that the project involves a Changshu City Spacehawk Satellite Application Collaborative Innovation Center (常熟市航天海鹰卫星应用协同创新中心).

At the moment, this program is a little bit scarce on details, but in general it appears that CASIC has a commercial subsidiary in Changshu that is focused on satellite applications. Changshu is a part of Suzhou City, and is also part of a fast-expanding commercial space cluster in the Yangtze River Delta. Other companies that have set up in the area include Tianbing Aerospace (Zhangjiagang area of Suzhou), Deep Blue Aerospace and Galaxy Space (Nantong), and others.

With this launch, China also passed 40 launches for the year, a new record. Moving forward, we still have a handful of launches left this year.

3) Rocket Pi signs “tens of millions” RMB purchase order for rocket engines from JZYJ

Jean’s Take

On the topic of launch, one of the newest commercial launch companies in China, Rocket Pi, inked on October 29 a purchase order for rocket engines from commercial rocket engine manufacturer JZYJ.

The purchase was said to be in the range of “tens of millions of RMB” (or a couple million US dollars), and will probably cover the first batch of engines that will be used by Rocket Pi to perform tests on its rocket prototypes.

Rocket Pi was founded in December 2020, and is definitely a latecomer when you consider that there are at least a dozen other commercial launch startups that were founded before them, with many that are well advanced such as Landspace, iSpace, Galactic Energy, and more recently DBA, CAS Space, and Space Pioneer.

Rocket Pi is in the R&D phase for the Darwin-1 rocket, a 2.25m diameter 2-stage launch vehicle that will be able to put 270 kg into LEO and 150 kg into SSO.

Almost unsurprisingly, the solution that Rocket Pi has gone for to make up for its late start is to purchase off-the-shelf rocket engines, as this saves up a lot of development time; and something that definitely isn’t easy to pull off, all the aforementioned more advanced companies have been developing their own engines for quite a long time (Zhuque, Jiaodian, Cangqiong, Tianhuo, …). Of course, the advantage of developing your own engine is that you have an engine that’s really tailored to your needs, which enables more flexibility when designing your rocket.

According to a WeChat post by JZYJ, the first stage of Rocket Pi Darwin-1 rocket will use JZYJ’s heavier thrust Longyun engine (70 tons at sea level), while the second stage will use the vacuum optimized Lingyun engine (12.5 tons).

I think buying rocket engines off-the-shelf could be a growing trend for these later generation companies. In terms of choice these companies would have, today we have at least 5 commercial companies which are focusing on rocket engine manufacturing exclusively, such as the aforementioned JZYJ, Aerospace Propulsion, Tianqing Space, AA Engine, and to some extent XAPT. Put together this gives a great variety of choice to the Chinese rocket manufacturer: low or medium thrust, kerolox or methalox, various attitude control technologies.

So let’s recap a little bit who’s buying from who: Rocket Pi is buying engines from JZYJ, CAS Space is sourcing engines from fellow CAS company XAPT, Linkspace had previously announced a collaboration with JZYJ for engines. Who’s next?

We could see other new-gen companies follow suit such as Enter Space, Space Tai, or Ospace. We can also imagine that 1st generation launch companies that had initially focused on solid-fueled rockets but are planning to diversify into liquid-fueled rockets (such as OneSpace, or even Expace), will be looking closely at the engines offered by these rocket engine companies.

So some cool stuff happening in launch, with a lot of newer gen launch companies in China. We also asked Tianyi what he thought on the emergence of these rocket companies that are barely 1-2 years old. His feedback was that this showed that there is a remaining strong belief in China that the upcoming domestic satellite launch demand is sufficient to sustain these additional rocket companies.

Blaine’s Take

Just a very small point to add about Rocket Pi and JZYJ–yet another collaboration between two companies that have strong presence in the Yangtze River Delta region. JZYJ has significant operations upriver in Bengbu, Anhui Province, while Rocket Pi is HQed in Huzhou, on the southern side of Lake Tai.

4) China Satellite Conference Debrief

Blaine’s Take

This week in Beijing saw the 2021 China Satellite Conference (卫星大会), a major commercial satellite conference held every October at the New Century Nikko Hotel in Beijing. The conference is one of the oldest space conferences in China, having been held since 1999, with foreign commercial companies having been in attendance for most if not all years of the conference. Having attended for a few years, we’ve also seen the Ambassador of Sierra Leone to China as a conference attendee.

This week in Beijing saw the 2021 China Satellite Conference (卫星大会), a major commercial satellite conference held every October at the New Century Nikko Hotel in Beijing. The conference is one of the oldest space conferences in China, having been held since 1999, with foreign commercial companies having been in attendance for most if not all years of the conference. Having attended for a few years, we’ve also seen the Ambassador of Sierra Leone to China as a conference attendee.

This year’s edition saw speeches from most of the usual suspects, including China Satcom, China SpaceSat, CAST Xi’an INstitute of Space Radio Technology, Beihang, CETC 54th, etc. For more information on China Satellite 2021, be sure to check out our debrief episode, coming up in a few weeks!

This has been another episode of the Dongfang Hour China Space News Roundup. If you’ve made it this far, we thank you for your kind attention, and look forward to seeing you next time! Until then, don’t forget to follow us on YouTube, Twitter, or LinkedIn, or your local podcast source.

Blaine Curcio has spent the past 10 years at the intersection of China and the space sector. Blaine has spent most of the past decade in China, including Hong Kong, Shenzhen, and Beijing, working as a consultant and analyst covering the space/satcom sector for companies including Euroconsult and Orbital Gateway Consulting. When not talking about China space, Blaine can be found reading about economics/finance, exploring cities, and taking photos.

Jean Deville is a graduate from ISAE, where he studied aerospace engineering and specialized in fluid dynamics. A long-time aerospace enthusiast and China watcher, Jean was previously based in Toulouse and Shenzhen, and is currently working in the aviation industry between Paris and Shanghai. He also writes on a regular basis in the China Aerospace Blog. Hobbies include hiking, astrophotography, plane spotting, as well as a soft spot for Hakka food and (some) Ningxia wines.

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space