by Blaine Curcio and Jean Deville

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 7 – 13 February 2022.

Welcome to another episode of the Dongfang Hour China Space Updates! I’m Jean Deville, joined as always by my co-host Blaine Curcio.

In this episode, we discuss China revealing important launch projects for 2022 in its annual Blue Book, but first let’s dive into a very unusual but fascinating company: Tianbing Aerospace.

1) Looking more closely at an unusual launch company: Space Pioneer

Jean’s Take

Space Pioneer (also known as Tianbing Aerospace) is one odd and mysterious launch company in China. It has notably made some fascinating technical choices for its rockets, and this sets it apart with all other Chinese launch companies. They raised another big round of funding this week, so it’s a good opportunity for us to provide an update on the company’s current situation.

Founded in 2019, Space Pioneer is based in Beijing and Xi’an (R&D), and Zhengzhou (Test base), + a manufacturing base in Suzhou. The company is designing the Tianlong series of liquid-fueled kerolox rockets, the Tianlong 2 and 3 (there used to be a Tianlong-1 but it now seems to have been scrapped).

There isn’t any official information on the architecture of the rocket, but we are still able to figure out a few things by collating information from here and there, so let’s get into that.

Firstly, the innovation from Space Pioneer does not come from the architecture of its rockets. From various renders and models, it seems that they are going for a two-stage Falcon-9 type rocket, performing VTVL, and deriving that into a heavier version by slapping on two additional first stages as strap-on boosters, à la Falcon-Heavy. No surprises there, this is now a classic architecture with new rocket companies.

Where it gets interesting is when we start looking at propulsion. The Tianlong-2, and -3 rockets are liquid-fueled rockets, they are using the Tianhuo-11 engine, which burns kerosene and liquid oxygen inis a closed-cycle architecture with a turbopump running oxygen-rich. Without going into detail about what this is (there’s a great video by Everyday Astronaut that explains this), this is a highly efficient architecture that is very difficult to manage, and only the Russian (the legendary RD170-190) managed this kind of architecture. In a nutshell, it’s very impressive tech if Space Pioneer can actually pull it off, and it’s a first big contrast with other commercial launch companies in China like Landspace or iSpace, which use a less efficient but less complex gas generator cycle engines.

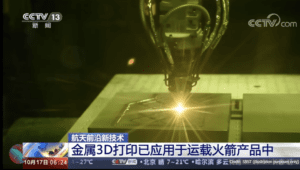

The next point of interest is that the Tianhuo-11 is >80% 3D printed, including core components like the turbopump and the combustion chamber, and while we’ve seen this level of 3D printed engines with other companies outside of China (Rocket Lab, Relativity, Orbex, …), this is definitely quite unprecedented in China. Some other New Space rocket companies (such as Aerospace Propulsion’s Canglong) use some 3D printed parts, but with Space Pioneer it’s the first time I hear figures as high as 80%. They claim that this shortens manufacturing lead time by 70-80%, and the costs by 40-50%.

Finally, the most interesting thing about Space Pioneer is some of the other engines they’re developing: the Tianhuo-1, 2 and 3. Why is that? This is because they use something called “HCP monopropellant”.

Monopropellants are fuels which don’t need a separate oxidizer to burn. They simply decompose when in presence of a catalyst element, producing a highly exothermic reaction in the process, and generating thrust. This amazing property means that monopropellant engines are much more simple, you only have one fluid to handle. Oftentimes, monoprops are in a liquid state at room temperature, unlike methane, hydrogen, and oxygen which are often used in rockets, and consequently, with monopropellants, you don’t need to deal with cryogenic plumbing systems. The disadvantages of monopropellants, on the other hand, is that they have a lower specific impulse (are less efficient per gram of propellant), and are often highly toxic, and this is the case for one of the most popular monopropellants: hydrazine. And this is why it is now seldom used as the main propulsion for new rockets.

So what’s new in what Space Pioneer is bringing to the table? Firstly, they’re not using Hydrazine, but rather a novel monopropellant that they call “HCP green monopropellant”, which is likely another name for NOFBX (or Nitrous oxide fuel blend). According to Space Pioneer, this monoprop would solve many problems: the Isp of HCP is much higher: 300+s, not too far from many kerolox engines. It is “green”, meaning that it doesn’t release highly toxic gases, a major improvement compared to hydrazine. There are rumors based on patents they registered that these engines are pressure-fed and autogenously pressurized, meaning that the engine would be using simple valves rather than pumps to feed propellant into the combustion chamber: another gain in simplicity.

Finally, the HCP monopropellant is non-cryogenic, and stable at room temperature, meaning that rockets wouldn’t need complex cryogenic launch infrastructure to be fueled before launch. According to Space Pioneer, any flat concrete surface is workable: the rocket would be deployed by a dedicated erector vehicle, and would be fueled by ordinary tank trucks. This would massively cut down launch costs (SP mentioned 30 000 RMB/kg to LEO in late 2019), and enable launch from almost anywhere.

So on paper: these engines are pretty incredible, and would enable Space Pioneer to provide simple, low-cost rockets compared to its competitors.

Now again, how real is any of this? Let’s look at the facts.

Kang Yonglai, the CEO, is no newcomer to rocket development. He occupied positions like the director of the general research office at CALT, as well as deputy chief engineer for projects including the DF-17 missile and the Long March 11 rocket. There have also been multiple videos of tests of their Tianhuo-11 kerolox engine and their Tianhuo-1, 2, 3 HCP engines, as well as images of the preparation of the VTVL prototype Tiansuo-1, which Space Pioneer should use to learn about reusability. And again, we’ve also seen them file several patents on HCP monoprop technology.

However it seems odd for a rocket company to pursue two different families of liquid-fueled rockets, using engines that deliver the same amount of thrust individually although using different technologies. These could be in competition with each other.

Another point: we also know nothing about the rockets that will be using the HCP monoprop engines. We only know about the kerolox-fueled rockets: the Tianlong-2 medium-lift rocket which should be launched for the first time later this year, and the Tianlong-3 heavy lift rocket at an unknown date. It is possible that HCP monoprop engines were pushed further down the roadmap as recent WeChat posts make less mention of them.

Whatever the reasons, it seems that investors remain very keen on continuing to invest in Space Pioneer. The company raised multiple rounds amounting to “several hundreds of millions of RMB” each time in 09/2020 and 07/2021, and last week raised an undisclosed amount in a B-round of funding, bringing its total valuation to ~2B RMB according to the company. They’ve also been hiring massively in recent months.

Space Pioneer, a real pioneer in launch technology, or just another Chinese launch company planning kerolox-fueled VTVL medium-lift rocket? Blaine, what do you think?

Blaine’s Take

Definitely some interesting stuff coming from Space Pioneer. Just a couple of last points to add–first, a note that Kang Yonglai, in addition to having formerly worked for CALT, is of course the former CTO of Landspace, and we have seen some similarities in technological approach between the two companies.

Also noteworthy is that Space Pioneer is a member of the launch sector cluster developing around the Yangtze River Delta, with the company having set up an intelligent rocket manufacturing base in Suzhou around 1 year ago. The cluster also includes, among others, Landspace, Rocket Pi, Jiuzhou Yunjian, and Deep Blue Aerospace.

Moving forward, be on the lookout for more collaboration between the various launch companies in the cluster, especially if a couple of them start to jump out to a big lead in terms of successful launches.

2) CASC releases its annual Blue Book

Blaine’s Take

This week saw the publication of CASC’s annual Blue Book. The Blue Book is published by one of CASC’s think-tanks, namely the 512th Institute of CAST, and lays out the year’s plans and goals for China’s largest space company. Given the large overlap between CASC’s major projects and China’s space program, a lot of the year’s plans will involve major space projects.

Among the noteworthy highlights from this year: CASC plans to launch more than 140 spacecraft in 50+ launches in 2022, with this compared to 48 launch missions completed by CASC in 2021. Among the 50+ launches will be the maiden launches of the Long March-6A and the Jielong-3 rockets, with the former being a considerably scaled up version of the Long March-6 (with four side boosters, and a height of 50m compared to 30m for the LM-6), and with the latter being a commercialized rocket being marketed by CALT subsidiary China Rocket.

In the case of the Jielong-3, we heard from Long Wei, Deputy Project Manager for the rocket, that CASC plans 2-3 JL-3 launches in 2022, including a “first mission that will be based on a platform at sea”, and a further 5 launches of the Jielong-3 in 2023. As a reminder, with a liftoff weight of 140 metric tons, the rocket will become China’s largest and most powerful solid-propellant rocket when it enters service.

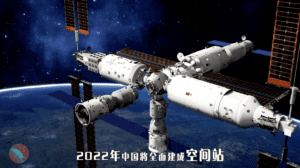

In addition, the two other main focuses of China’s largest space conglomerate during 2022 will be the completion of the CSS, and deepening R&D related to space exploration missions, notably the 4th Phase of the Lunar Exploration program and various asteroid missions.

Notably, the year will include 6x CSS missions (2x lab modules, 2x crewed, 2x cargo), with the Shenzhou-14 and -15 crews expected to be sent to the CSS before the end of the year, and with the station having, at one point during 2022, 6 taikonauts on board.

Additional announcements through interviews:

- 4-5 launches of the LM11 in 2022, plans for 10+/year afterwards

- 2 launches each of the LM-7 and LM-7A in 2022. The first LM-7 expected to leave the factory in April 2022, having seen more than 10 improvements compared to the most recent iteration of the LM-7.

- 2 launches of the LM-5B rocket (Mengtian and Wentian), with CALT having completed final AIT work on the first LM-5B, with preparations underway to depart from the factory in Tianjin to Wenchang. The other LM-5B is currently undergoing final AIT work.

- The Long March-8 will have its second flight in February/March 2022, with the launch expected to carry 22x satellites into orbit, a new high for a Chinese rocket and setting a new precedent in China for rideshare.

And so, if we think about China’s launch cadence in, say, 2023, it’s already looking impressive. For example, if we assume basically constant launches for most rockets, but then an increase from 2-3 JL-3 to 5x JL-3, and then from 4-5 LM-11 to 10+ LM-11, we are already looking at easily >60 launches in 2023, and presumably several hundred satellites. And, this is not even counting all the commercial launch companies that are coming out with new rockets over the next 1-2 years. In short, it’s been a hectic few years in the Chinese space sector, but it’s possible that we ain’t seen nothing yet.

A couple of final points to note: first, huge amount of emphasis on launch vehicles, lot of emphasis on the space station, and very limited emphasis on satellite/constellation projects. This is perhaps not surprising given that, as it turns out, CASC is not the main contractor for most of China’s biggest constellation plans, but nonetheless, it’s definitely a little bit surprising to see such tremendous emphasis on launch, and such relatively limited emphasis/specifics on satellites.

So Jean, we have >140 spacecraft to be launched on >50 rockets. Any specific highlights for you from the Blue Book?

Jean’s Take

Not much from my side, I just want to add that 50 launches from CASC, that’s up from the 40 that they had announced in early January 2022, so if we combine that with the launches from commercial launch companies, I’m almost certain that China’s going to pass the 60 annual launches mark in 2022, a first for the country.

And with that, that’s a wrap-up for this episode, before signing off a special shout-out to SpaceWatch.Global and Go-Taikonauts, two great sources of space industry news. A special thanks to @thetimechamp and 2 other anonymous patrons who bought us some coffee over the past week at buymeacoffee.com/dongfanghour.

This has been another episode of the Dongfang Hour China Space News Roundup. If you’ve made it this far, we thank you for your kind attention, and look forward to seeing you next time! Until then, don’t forget to follow us on YouTube, Twitter, or LinkedIn, or your local podcast source.

Blaine Curcio has spent the past 10 years at the intersection of China and the space sector. Blaine has spent most of the past decade in China, including Hong Kong, Shenzhen, and Beijing, working as a consultant and analyst covering the space/satcom sector for companies including Euroconsult and Orbital Gateway Consulting. When not talking about China space, Blaine can be found reading about economics/finance, exploring cities, and taking photos.

Jean Deville is a graduate from ISAE, where he studied aerospace engineering and specialized in fluid dynamics. A long-time aerospace enthusiast and China watcher, Jean was previously based in Toulouse and Shenzhen, and is currently working in the aviation industry between Paris and Shanghai. He also writes on a regular basis in the China Aerospace Blog. Hobbies include hiking, astrophotography, plane spotting, as well as a soft spot for Hakka food and (some) Ningxia wines.