by Blaine Curcio and Jean Deville

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 14 – 20 February 2022.

Welcome to another episode of the Dongfang Hour China Space Updates! I’m Jean Deville, joined as always by my co-host Blaine Curcio.

In this episode, we discuss satellite connectivity for airlines in China, but first let’s talk about the many features of the upcoming Wentian module of the CSS.

1) First Shot of Wentian

Jean’s Take

Recently, we saw CMSA release publicly the first picture ever of Wentian, which is one of the two experimental modules of the Chinese Space Station, and scheduled for launch later this summer. While there is no real scoop around this picture, it’s still a very impressive one with lots of visible details, and gives us a good opportunity to deep-dive into what Wentian is all about. As a reminder, there are a lot of excellent visuals going with this analysis, which can be viewed on our YouTube channel episode for this week.

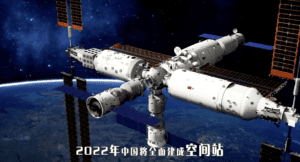

Firstly, as a brief recap, the CSS is composed of 3 modules: the Tianhe-1 core module which is already in orbit and that serves as the main headquarters for the taikonauts and the control center of the space station. Next, you have Wentian and Mengtian, which are experimental modules, meaning that they are dedicated more specifically to space sciences. But beyond space sciences, they have a couple more tricks up their sleeves.

So let’s look at Wentian visually. At a high level, it looks quite similar to Tianhe-1: you have similar lengths (17.9m for Wentian vs 16.6m for Tianhe) and diameters, and their structure looks alike: a massive cylindrical cabin, followed by two modules with a smaller diameter (for Wentian, it’s the working, airlock and control modules). Now despite the apparent similarities, there are actually quite a few differences.

Propulsion and Power: Tianhe-1 vs. Wentian

Similar to Tianhe-1, Wentian has a number of thrusters for attitude control, but rather than have them all around the propulsion unit as it’s the case on Tianhe-1, they are spread out between the large and smaller cylindrical modules. According to Dianfeng Gaodi, this is because the accuracy of attitude control is more critical with Wentian as it docks to Tianhe-1, and this is why spreading out the thrusters at both ends of Wentian is beneficial in this regard.

Now, second apparent difference: Hall Effect thrusters. Tianhe-1 is equipped with 4 Hall Effect thrusters for orbital control, but these seem to be missing on Wentian. We don’t know exactly why, but this is probably because Wentian will not be performing orbital control maneuvers once docked to Tianhe. And finally, there are 6 control-moment gyros on the Tianhe-1, but they seem absent from Wentian.

From some other Chinese sources, we know that these CMGs are actually there, but for Wentian they are internal rather than being on the outside. Putting them on the outside helps with noise (because CMGs are basically fast spinning disks), but this was probably deemed unnecessary for Wentian due to the fact that taikonauts wouldn’t be spending that much time in Wentian, Wentian would serve as temp. living quarters.

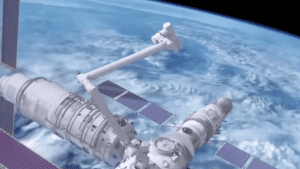

Wentian, as well as Mengtian, will have massive solar arrays, and they will become the main energy source for the CSS as they are much larger than the current ones on Tianhe-1. I wasn’t able to find the exact value of the length of the Wentian solar arrays, but knowing that the Tianhe-1 arrays are 12.6m, and using an isometric view of the CSS that I found, we can use Photoshop to measure and estimate the total length of those arrays, and after playing around with that, I believe they are around~40m (give or take). Also, another very interesting fact: once the Wentian/Mengtian solar arrays are in place, they will block some sunlight for the smaller Tianhe-1 solar arrays, meaning that the Tianhe-1 arrays will lose in terms of power output. To solve this, the arrays were made detachable, and the robotic arm of the CSS will displace and deploy them at each end of the experimental modules, where they won’t be affected.

A Companion for Tianhe’s Robotic Arm, More Sleeping Quarters, and Lots of Experiments

Speaking of robotic arms, while the Tianhe-1 core module already has one large 10m long robotic manipulator, Wentian also has the specificity of having its own smaller 5m-long robotic arm. This arm can be combined with the main robotic arm to form a massive 15m-long robotic arm which can reach anywhere of the future completed space station, thanks to its ability to crawl, using the arm attachments situated all around the station.

One of its main roles of the Wentian small robotic arm will be to handle experiments in the external experimental bay. Experiments can be brought there either by the taikonauts as they perform EVAs, or by the robotic arm which can take payloads up to 3 tons.

There are 3 sleeping areas in the Tianhe-1 core module, but Wentian will extend that capability to 6 by providing 3 additional sleeping spaces, and this will enable a team of 3 taikonauts to be continuously on the CSS (a relieving team would be able to arrive at the CSS while the previous team of 3 taikonauts are still there).

As you’d expect from an experimental module, Wentian will be chock-full of experiments: there will be the external bay, as mentioned (with 24 external payload adapters), and this is helpful for experiments which are aiming at being exposed to the space environment, vacuum & solar radiation (for example for breeding new species of crops). These payload adapters come in different shapes and sizes, and not only do they enable experiments to be firmly fixed to the station, but they also have the role of providing thermal control, power, and data transmissions. Multiple racks are also available inside Wentian, taking place in normal pressurized conditions.

To wrap up this Wentian deep dive, there are some additional nuggets worth mentioning: there’s a comms antenna to communicate with the Tianlian relay satellites, to complement the antenna on Tianhe-1 which is occulted by the Tianhe-1 itself every once in a while: and this would enable the CSS to have near 100% continuous communication with the ground.

There is also an additional airlock which will enable taikonauts to perform EVAs from Wentian, instead of from the current airlock of the multidocking node. This will become the main airlock of the CSS, replacing the one in the multidocking node which will act as a back-up. One of the main advantages of the Wentian airlock is that during an EVA, only the Wentian module would be sealed, enabling taikonauts not involved in the EVA to circulate between the other modules (Mengtian, Shenzhou, Tianzhou, Tianhe). When using the multidocking node’s airlock, this is naturally not possible because you’re sealing up the main node of the space station.

For further information on the Chinese Space Station and how it moves around, check out our dedicated videos on the subject, or our Dongfang Hour article about China’s upcoming Space Station missions in 2022. So that’s for Wentian. Blaine, let’s move to a totally different topic: satellite connectivity in commercial airliners in China, aka IFC.

2) Chinese Women’s Football Team Interviewed Mid-Flight, IFC in China

Blaine’s Take

Moving on to our second piece of news, a couple of interesting updates from the in-flight connectivity, or IFC space, in China.

First, the Chinese National Women’s Football Team won the 2022 AFC Women’s Asian Cup, held in Mumbai over the past handful of weeks. A big congratulations to the Steel Roses, or Kēngqiāng Méiguī /铿锵玫瑰. Now, what does this have to do with IFC, you may ask?

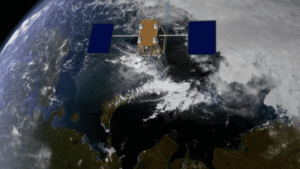

The team was interviewed mid-flight on their return from Mumbai to Shanghai last week, with the interview broadcast live on CCTV. The interview took place on a China Eastern Airlines Boeing 777, which was connected to the Apstar-6D satellite using Ku-band HTS satellite capacity. The article noted that the satellite allows for up to 220 Mbps of bandwidth to the airplane, an improvement of 8x since China Eastern first started connecting their international long-haul flights in 2014 (i.e. 8x increase in 8 years).

The article mentions that in the future, China Eastern plans to have its entire fleet, including all narrow-body planes, outfitted with IFC by 2030. This would be pretty unprecedented for a Chinese airline, with most airlines in China very slow to roll out IFC services. Now, why have most airlines been slow to roll out IFC in China?

A Brief History of Chinese IFC

Initially, this was due to a slow approval process by the government (you couldn’t even turn on your cell phone on Chinese flights until a handful of years ago), combined with highly conservative airlines. For example, during an interview in 2019, an Air China executive note that they would have IFC on their North American long-haul routes (the most profitable and appropriate for IFC), within 5 years. In short, IFC solutions are expensive, and Chinese airlines have been conservative.

The other factor in the slow adoption of IFC by Chinese airlines has been a general lack of satellite capacity, with primarily traditional widebeam satellites in-service over China. This is starting to change, with larger satellites such as the above-mentioned Apstar-6D having been launched, and moving forward, we expect to see more satellites with higher throughput (i.e. Apstar-6E, several future ChinaSat satellites, etc.).

Reform On the Horizon?

The timing of the in-flight interviews was interesting, with this week also seeing a paper written by CCID, a think tank under the Ministry of Industry and Information Technology’s Electronic Information Research Institute (国家工业和信息化部中国电子信息产业发展研究院), with the paper calling for reform in China’s in-flight connectivity market.

Several key pain points were outlined in the paper, with this including:

- Cost. Currently, satellite capacity (or air-to-ground connectivity), related equipment, and everything else involved in the IFC ecosystem are relatively costly in China. This is due to the aforementioned relative lack of satellite capacity, a relatively unsophisticated supply chain, and various costs associated with licenses and regulations. The paper recommends adding more satellite and ATG capacity, aligning standards, and creating a more well-integrated industrial base.

- Industry dynamics and players involved. The paper notes that there needs to be more integration between the IFC value chain and broader tech ecosystems, particularly calling for platform internet companies to enter the market. It’s not explicitly spelled out, but from my perspective, this seems to mean companies like Tencent or Alibaba who could conceivably enter the space and subsidize connectivity.

- Business model. The paper notes that China’s IFC sector needs a wider variety of ways of monetization, taking as an example the idea of providing free connectivity to first and business class passengers, then options for economy class including free + adverts, paid + no adverts, paid + extra high speed, and so on.

So overall, what to take away from this? First, it’s important to note that the IFC penetration rate in China remains very low, at well under 10% of airplanes offering in-flight connectivity (compared to >50% in North America). Second, China has been pushing to digitize a lot of different things in recent years, including its aviation and maritime sectors, both of which have significant potential for expansion of satcom connectivity. Finally, Chinese consumers, like those in the west (possibly even more so) are increasingly expecting to be connected all the time.

Moving forward, there’s enormous potential in the IFC sector in China, but ultimately, they’re going to need more capacity. If we look at North America only really started to see IFC take off after we got a lot of Ka-band capacity over the continent, with this allowing for better user experience. For example, American Airlines began offering free trials for Apple Music on their flights in 2019, only because the connectivity got to be good enough that Apple was willing to subsidize free Apple Music trials for users. With less capacity available, Apple would not subsidize it, because the user experience would have been poor.

That being the case, China might be pretty close to a virtuous cycle. China Satcom and APT Satellite are launching more HTS capacity in the coming years, including ChinaSat-19 and ChinaSat-26 (both were expected to launch in 2022, as of mid-2021). With this new capacity, it’s entirely possible that China’s big tech firms will start to subsidize the services, hoping that they can upsell customers that are by definition 1) captive, and 2) at least middle-class, probably more like upper-middle/upper-class (Tencent Music trials, anyone?).

To see this, we would also need to see further development of a domestic supply chain and service provider ecosystem, as well as faster regulatory approvals for what has been a regulatorily tricky business model. That said, if North America is anything to go by, we may see a fast rampup of airplanes outfitted with IFC in China in the years ahead.

This has been another episode of the Dongfang Hour China Space News Roundup. If you’ve made it this far, we thank you for your kind attention, and look forward to seeing you next time! Until then, don’t forget to follow us on YouTube, Twitter, or LinkedIn, or your local podcast source.

Blaine Curcio has spent the past 10 years at the intersection of China and the space sector. Blaine has spent most of the past decade in China, including Hong Kong, Shenzhen, and Beijing, working as a consultant and analyst covering the space/satcom sector for companies including Euroconsult and Orbital Gateway Consulting. When not talking about China space, Blaine can be found reading about economics/finance, exploring cities, and taking photos.

Jean Deville is a graduate from ISAE, where he studied aerospace engineering and specialized in fluid dynamics. A long-time aerospace enthusiast and China watcher, Jean was previously based in Toulouse and Shenzhen, and is currently working in the aviation industry between Paris and Shanghai. He also writes on a regular basis in the China Aerospace Blog. Hobbies include hiking, astrophotography, plane spotting, as well as a soft spot for Hakka food and (some) Ningxia wines.