by Blaine Curcio and Jean Deville

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 24 – 30 January 2022 ”.

Welcome to another episode of the Dongfang Hour China Space Updates! I’m Jean Deville, joined as always by my co-host Blaine Curcio. In this episode, we dive deep into the many recent announcements coming from Chinese NewSpace launch startups, which suggest that 2022 is going to be a pretty crazy year.

1) Record Rounds of Funding in Launch

Jean’s Take

The past couple of weeks have been unprecedented for Chinese NewSpace. After an impressive number of announcements in smallsat manufacturing (that we discussed in Ep 68), it seems that it is now the turn of Chinese commercial launch companies.

The star of the show was Galactic Energy, a launch company who raised 1.27 billion RMB or 200 million USD in a new B/B+ round of funding. Let’s put 200 million USD into perspective: this is the second largest funding round in the history of Chinese NewSpace after CGSTL in 2020, and the highest funding round ever for a Chinese commercial launch startup. It slightly exceeds the previous records of 170-180-ish million dollars raised separately by competing launch companies iSpace and Landspace.

To put this round of funding into some context: the focus of the Chinese commercial launch sector today is a race to launch a liquid-fueled reusable medium-lift rocket, which should be the type of rocket to capture most of China’s constellation deployment launches in the future. There are many contenders: at least 20-ish commercial launch companies, but only a handful are close to the finish line, notably iSpace, Landspace, Galactic Energy, and perhaps a few others (DBA, Space Pioneer).

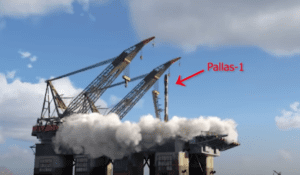

As Galactic Energy is the star of the week, let’s quickly recap what Galactic they are planning. They have a solid-fueled small-lift rocket called the Ceres-1, which was launched twice in the past and plans to launch 5 times in the coming 12 months. The liquid-fueled rockets by Galactic Energy are the Pallas-1 kerelox-fueled rocket (which puts 5 tons into orbit and is reusable), as well as a heavier version called the Pallas-1A (which adopts a sort of Falcon Heavy architecture, and puts 14t into orbit). The maiden launch of the Pallas-1 is expected in 2023.

Their fellow competing Chinese launch companies (iSpace and Landspace) are preparing rockets with a similar value proposition: notably the ZQ-2, 2A and 2B from Landspace (with 6 tons, 17t and 32t into orbit), and the iSpace Hyperbola-2 and Hyperbola-3, 3A and 3B (with 2, 9, 13, 32 tons into orbit).

What is Galactic Energy going to do with all this money? Naturally to fund the research and development of the Pallas-1 rocket, but it’s interesting to note that their press release seems to put emphasis on developing the launch infrastructure, a naturally an indispensable cornerstone for any launch service provider. And in this regard, it’s been fascinating to watch the different strategies of these handful of Chinese launch companies:

- Galactic Energy seems to be going down the sea launch route: it was known that they wanted to enable their solid-fueled Ceres-1 to launch from land but also from sea-based platforms. With this week’s announcement though, it seems that this may also be the case for their Pallas-1 liquid-fueled rocket, with notably a mysterious render of a sea platform included in the press release. This remains speculation but it would fit nicely with China’s main sea-based launch site in Haiyang mentioning that they are developing their launch activity to enable sea-based liquid-fueled launches (reference to DFH sea launch episode)

- Landspace, on the other hand, seems to be going down a more traditional route, as they are building a launch site in Jiuquan to enable the launch of their methalox-fueled ZQ-2 rocket, and many EO satellites have been taking snapshots of the construction making progress in Jiuquan.

iSpace is likely following a similar route, with increasing ties with the Wenchang Launch Center in Hainan to possibly launch their Hyperbola-2 from there.

While Galactic Energy stole the spotlight over the past week with their massive round of funding, a couple of other significant rounds took place:

Deep Blue Aerospace, another launch company (which we could probably put as 4th or 5th in the liquid-fueled rocket race), raised “nearly 200M RMB” in a A round of funding on January 18th, and this money will go to funding their Nebula-1 liquid-fueled rocket. I’d also add that it seems that their planned liquid-fueled rocket family is now resembling more and more that of Galactic Energy and iSpace, with the company having recently released renders of a Nebula-1 Heavy… with a thinly-veiled reference to Falcon Heavy.

Orienspace, a more recent commercial launch company, raised 300M RMB on January 26th; this new inflow of cash will be used to develop the Gravity-1 rocket, as well as heavier thrust liquid-fueled engines for Orienspace’s future rockets.

Finally, not exactly linked to fundraising but Orienspace and the Chinese methalox engine manufacturer Aerospace Propulsion signed a strategic cooperation agreement, meaning that Orienspace will could source their methalox engines from Aerospace Propulsion. This makes sense because Orienspace is a very new rocket company (founded in June 2020), and this all bears a strong resemblance with the move of another competitor, Rocket Pi, also a very new rocket company, officializing the purchase of off-the-shelf methalox engines from engine manufacturer Jiuzhou Yunjian.

Blaine’s Take

Incredible. A point to mention about Chinese commercial launch funding: we’ve seen a crazy amount of money raised for sure. According to my DB of Chinese commercial space funding that goes back to 2014, we have seen ~¥13-16B invested into commercial launch companies in China over the past 8 years. Or between US$2-2.5B. A huge amount of money, for sure, but if we compare it to, for example, SpaceX, the company raised US$1.5B…in 2021 alone. Rocket Lab raised US$777M in gross proceeds from their single SPAC, or around ⅓ of all the money raised by all Chinese commercial launch companies. This is not to make any specific comparisons about China and SpaceX beyond order of magnitude–we’ve seen a ton of money go into Chinese launch companies already, but if SpaceX, Rocket Lab, etc. are any indication, we could see a whole lot more money put into these companies.

So far in January, we have seen around ¥1B invested into Chinese commercial space companies, and this does not include the ¥1.2B that we heard about from Galactic Energy (this would have been 2021). The other impressive element of this funding is the diversity of company types.

The ~¥1B has been across 6 funding rounds, with this including one of China’s most established commercial space companies (Spacety), as well as several very new companies (oSpace, founded in 2021 and already raised US$100M, HiStarlink, founded in 2021). There is also impressive geographic diversity, with iStar Aerospace representing Tianjin, Jiuzhou Yunjian concentrating in Bengbu, and oSpace in Shandong, to go along with Spacety in Changsha, DBA in Nantong, and HiStarlink in Shenzhen.

2) Suborbital launch companies also gaining momentum

Blaine’s Take

Lots of funding is going to orbital launch development, suggesting that we are getting closer and closer to the maiden launch of one of the medium-lift liquid-fueled rockets you mentioned.

I’d like to expand launch to suborbital launches, which has seen a lot of activity recently. While most Chinese launch companies are focusing on liquid-fueled orbital rockets, a small number are developing their niche in suborbital launch vehicles, which can be useful for technology-verification purposes in many industries: space, military aviation, academic research, materials sciences, …

So far, at least 3 companies are known to develop this: OneSpace, SpaceTrek, and Space Transportation.

OneSpace and SpaceTrek have a similar profile: both have a solid-fueled single stage suborbital rocket (OS-X for OneSpace, Tansuo-1 for SpaceTrek), and both are developing orbital rockets (Linglong liquid-fueled rocket series for OneSpace, the Xingtu-1 solid-fueled rocket + 2 unnamed liquid-fueled rockets for SpaceTrek).

Space Transportation, on the other hand, seems to be going down a different road: they have the Tianxing-1 and -2 series of suborbital rockets, which are solid-fueled and have flown several times already, including most recently this past week. They likely serve similar markets as SpaceTrek and OneSpace’s suborbital rockets, although with some differences:

- first of all the Tianxing seems to make more of aerodynamic lift with delta wings clearly visible on the rocket;

- And more generally, it seems that Space Transportation is more successful at selling their rockets to customers: they have accomplished 10 suborbital launches of Tianxing, with some customers being:

- The Combustion and Propulsion Laboratory of Tsinghua University: which seems to have tested a scramjet prototype on a two-stage Tianxing rocket a couple of days ago,

- Xiamen University: which tested a waverider type hypersonic payload design in 2019

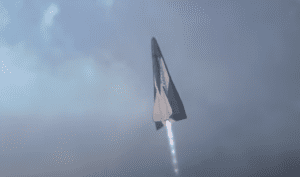

One last point that perhaps makes Space Transportation the odd man out of the Chinese commercial launch ecosystem: rather than pursuing orbital launch with liquid-fueled VTVL rockets, they prefer to go the spaceplane route, and targeting markets such as suborbital and orbital space tourism, as well as point-to-point intercontinental Earth transportation. They recently published a roadmap which puts dates on their plans:

- With 2019-2023 being dedicated to suborbital rockets for test flights

- 2023-2025 for a suborbital space tourism spaceplane, with a prototype launched in 2023 and a first human-carrying launch in 2025

- 2025-2030 for a hypersonic spaceplane which will enable intercontinental travel. From the renders shown by the company, this spacecraft should be a two-stage rocket, launching vertically, and with a lift generating second stage. Despite the spaceplane shape of the second stage, which would be carrying the passengers, it would perform vertical landing. A first flight is planned by 2028, with an entry-in-service of the rocket/spaceplane in 2030. A fascinating project, if they can pull it off.

Digressing, and going back to suborbital launch, it seems that there is a niche market for suborbital launches. While Space Transportation seems to have captured the bulk of these launches (10 vs ~3 and 1 for OneSpace and SpaceTrek), SpaceTrek has very recently just raised “tens of millions of RMB” in a new round of funding, so we shouldn’t write them off yet. Although I’d note that the money was reported to be to fund the company’s liquid-fueled rockets as well as their Chengfeng series of cruise missiles.

And this brings us to the last fun fact of the day to wrap up this episode. SpaceTrek openly advertises their Changfeng series of cruise missiles, being very transparent that they are working for both civil and military end-users. This is in stark contrast with many other commercial companies that tend to emphasize their purely civil and commercial nature.

This has been another episode of the Dongfang Hour China Space News Roundup. If you’ve made it this far, we thank you for your kind attention, and look forward to seeing you next time! Until then, don’t forget to follow us on YouTube, Twitter, or LinkedIn, or your local podcast source.

Blaine Curcio has spent the past 10 years at the intersection of China and the space sector. Blaine has spent most of the past decade in China, including Hong Kong, Shenzhen, and Beijing, working as a consultant and analyst covering the space/satcom sector for companies including Euroconsult and Orbital Gateway Consulting. When not talking about China space, Blaine can be found reading about economics/finance, exploring cities, and taking photos.

Jean Deville is a graduate from ISAE, where he studied aerospace engineering and specialized in fluid dynamics. A long-time aerospace enthusiast and China watcher, Jean was previously based in Toulouse and Shenzhen, and is currently working in the aviation industry between Paris and Shanghai. He also writes on a regular basis in the China Aerospace Blog. Hobbies include hiking, astrophotography, plane spotting, as well as a soft spot for Hakka food and (some) Ningxia wines.