by Blaine Curcio and Jean Deville

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 26 July – 1 August 2021”.

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 26 July – 1 August 2021”.

Hello and welcome to another episode of the Dongfang Hour China Aero/Space News Roundup! A special shout-out to our friends at GoTaikonauts!, and at SpaceWatch.Global, both excellent sources of space industry news. In particular, we suggest checking out GoTaikonauts! long-form China reporting, as well as the Space Cafe series from SpaceWatch.Global. Without further ado, the news update from the week of 26 July – 1 August 2021.

1) Remember the non-symmetrical Hyperbola 3A rocket proposal? iSpace provides a technical justification

Jean’s Take

A couple of weeks ago in June 2021, we had reported that iSpace had completed the definition phase of their medium-lift rocket, the Hyperbola-3, which was also an opportunity for them to reveal a few technical characteristics on the different versions.

Among the different versions was an especially eye-catching one, the Hyperbola-3A, for its non-symmetrical structure (with only a single side booster!).

iSpace provided some insights this week on their decision behind this unusual rocket layout, some interesting material for a Dongfang Hour weekly discussion:

- Firstly, iSpace mentions that while the architecture of this rocket seems bizarre, it is not the first such design. The American Space Shuttle was famously a great example of a non symmetrical design, with the orbital vehicle (spaceplane) hanging to one side. Similarly, the Soviet Union’s Buran spaceplane hung to the side of the Energia rocket, to a similar effect.

Another famous and perhaps less obvious non-symmetrical rocket is ULA’s Atlas V, which can accept 0, 1, 2, 3 and 5 side boosters. Every version except the one without side boosters is non-symmetrical, and this is obvious when looking at the rocket from above. And notably the version with a single side booster, called the 411 version of the Atlas V, looks similar to the Hyperbola 3A. - The major disadvantage of such a layout is that the offset of the booster from the center of gravity creates torque, which in turn needs to be compensated by some significant gimballing from the first stage engines. This means basically orienting the engine nozzles in a direction different from the main axis of the rocket to create torque in the opposite direction. Another solution proposed by iSpace would be to apply variable thrust to the many engines of the first stage, creating torque in the opposite direction.

- Another tricky part according to iSpace is that the flight dynamics laws are significantly more complex than for axisymmetric rockets. This is quite understandable, symmetry being a classical source of simplifications in equations.

Not impossible to do as the US and soviet programs have proven, but just an additional finicky balance to get right.

The question is, why do this at all?

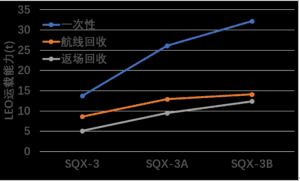

iSpace mentions that this is to have a more versatile Hyperbola 3 family. The Hyperbola 3 with no side boosters has a 13.7t payload capacity into LEO when expendable, and the Hyperbola 3B with 2 side boosters has this capacity increased to a whooping 32.2t. The Hyperbola 3A sits in-between them at 26.1t. Similarly in a reusable version, we get 8.6t, 12.9t, and 14.1t into LEO.

iSpace mentions that this is to have a more versatile Hyperbola 3 family. The Hyperbola 3 with no side boosters has a 13.7t payload capacity into LEO when expendable, and the Hyperbola 3B with 2 side boosters has this capacity increased to a whooping 32.2t. The Hyperbola 3A sits in-between them at 26.1t. Similarly in a reusable version, we get 8.6t, 12.9t, and 14.1t into LEO.

Definitely a more versatile payload capacity to offer to customers, and with minimal development time and costs due to the modular approach, according to iSpace.

If iSpace actually pursues this solution (remember, we are still at a very early stage) and is successful, it will be a clear demonstration that Chinese commercial launch companies are also able to innovate, rather than just “copy” SpaceX technical solutions.

Blaine’s Take

Just a couple of small points to add: the lengths that iSpace seems to be willing to go to improve versatility of the Hyperbola-3 is indicative of two things: 1) we still don’t really know how the broader space economy is going to develop at a much lower launch cost, and 2) there are a lot of launch companies in China, and I suspect, there is an advantage in doing something outside the box, if for no other reason than to stand out from a plethora of competitors.

Moving forward, damned if I know how well the Hyperbola-3 will work out commercially or technologically, but to iSpace’s credit, they’re clearly doing something different, and something that might give them a competitive edge in a crowded market.

2) First 5G network and LEO broadband satellite integration test performed in Jinan and Beijing

Blaine’s Take

China announced its first 5G network/LEO broadband satellite integration test this week, performed in Jinan and Beijing. The test apparently created a link between private networks in the two cities, and involved a simulation of a dangerous goods leak in a factory in Jinan, with staff in Beijing handling the accident simulation remotely via LEO satellite. According to Chen Tianheng, a satellite internet systems engineer involved with the test, the latency of the test was 20-30ms. Peng Mugen, Deputy Director of the State Key Laboratory of Network Technology at the Beijing University of Posts & Telecommunications noted that satellite-enabled 5G will provide backup for situations such as forest fires, emergency response, etc.

While it does not explicitly mention it, the test appears to have been done using the Galaxy-1 (Yinhe-1) satellite, launched by Galaxy Space in early 2020. The aforementioned Chen Tianheng noted during an interview that “we” have built a satellite superfactory in Nantong, and that after completion, it will reach an annual capacity of several hundred satellites. Again, nowhere does the article mention Galaxy Space, but given that Galaxy Space is building the very specifically-named “Satellite Superfactory” (卫星超级工厂) in Nantong, we can only assume that this is a Galaxy-1-enabled test. That being the case, it seems that this test was carried out as a collaborative effort between Beijing University of Posts & Telecommunications and Galaxy Space, possibly with some other partners.

Indeed, the lack of mention of Galaxy Space by name is in and of itself a somewhat interesting detail. Total speculation here, but it seems that individual companies are to some extent laying low in the context of these tests involving government-type participants (Beijing University of Posts & Telecommunications is a very prestigious and powerful university in Beijing, for example). Other noteworthy points about this press release include the obligatory mention to China’s addition of Satellite Internet to its New Infrastructures list in 2020, and the fact that SpaceX is launching Starlink very quickly, and that China needs to respond with a similarly fast rollout. The article also highlights the need for mass manufacturing of LEO satellites, pointing out that the visibility of each satellite is quite limited due to their proximity to the earth, and therefore one would need several hundred to several thousand satellites for full global coverage.

Final note is a lengthy and quite comprehensive interview with Wang Peng of Galaxy Space from February of this year. During the interview, he notes that Galaxy Space is capable of producing 30 payloads per year, and 30 satellites per year, at their facilities in Xi’an and Shanghai, respectively. Wang also notes that the company hopes to produce at a rate of 100 satellites per year by the end of 2021, though it is not clear if he is referring to their facility in Shanghai, or a sort of first phase of their factory in Nantong which aims for an eventual capacity of 500 satellites per year.

Bottom line, it seems that Galaxy Space is positioning itself as a sort of space technology company with activities in different areas related to satellite internet, namely satellites, applications, and possibly related equipment (not clear whether Galaxy Space manufactures their own equipment), and they are ramping up production capabilities for broadband satellites and payloads, while also conducting tests for different applications using their in-space infrastructure.

Jean’s Take

I think that with this test, we have a prime example of where 5G shines.

Many people have a tendency to think that 5G is simply 4G with higher bandwidth. But 5G goes beyond that, it is also a significant drop in latency. The test here talks about 20-30 ms of latency, which is significantly lower than the human reaction which is at 200-ish ms. The lower-than-human latency enables many industrial applications, from autonomous driving, remote industrial operations, etc. And I think the dangerous goods leak simulation in Jinan with operations from Beijing is a perfect illustration of what is possible with 5G but not 4G.

Now using a satellite component for the deployment of 5G network (the Galaxy-1 5G satellite as mentioned by Blaine) means that remote areas could potentially be more easily covered by this technology, which is very good news for remote industrial sites. And satellite tech is especially helpful to 5G due to the fact that 5G is composed of millimeter wavelengths (–>higher frequency than 4G), meaning that the coverage range of a 5G base station on the ground is much lower than a 4G station. Consequently, this means a bigger effort is needed to deploy a 5G network compared to 4G. And this also explains the massive number of ground stations involved in the 5G deployment efforts of Chinese cities, typically in Guangzhou the municipality had announced a few weeks ago the deployment of an additional 39k 5G stations before the end of 2022.

This is where 5G satellites can have a role to play: reducing the cost/impact of 5G base stations deployment by offering 5G satellite backhauling in areas that don’t make sense for a full ground deployment.

Another 5G satellite test that took place this week was between CAICT and China Satcom (Chinasat-16), to keep this episode reasonably short I’ll let the viewers that are interested check out our newsletter for more detail on this test.

3) Plethora of updates from the Chinese launch industry

Jean’s Take

An article published by China’s official space media China Aerospace News announced on July 28th that CASC’s 6th Academy (a.k.a AALPT) had completed the first engineering prototype of the YF-90 engine.

The YF-90 is a closed cycle fuel-rich hydrolox engine which produces 220t of thrust.

The article mentions that AALPT plans to perform the first “semi-system” tests this year, followed by a full system test. “Semi-system test” could refer to testing all the systems that come before the combustion chamber (LOX, LH2 pumps, preburner, …); while full system tests refer to the end-to-end system test including igniting the combustion chamber and generating the full amount of thrust of the rocket engine.

This piece of news confirms that AALPT has been making good progress on the YF-90. This comes in addition to the news we had reported as recently as January 2021 (see DFH episode 11-17 Jan) that the Academy had completed a number of key tests linked to the LH2 and LOX turbopumps and the associated cryogenic systems.

We also reported that in March 2021, AALPT had successfully completed a “semi-system” run on the massive YF-130 480t staged combustion kerolox engine, also destined for China’s lunar rockets.

Now the most interesting thing about this piece of news is actually the fact that this engine is mentioned at all in the context of the Long March 9. Up to very recently it was believed to power the second stage of the Long March 9 (2xYF-90); but in the most recent iteration of the LM9 shown by Long Lehao during a presentation at HKU (which I feel I mention every week now), it seemed that a new configuration of the Long March 9 was announced, with similar payload capacity but with no side boosters, with common bulkhead tanks, and … different engines.

Based on Long Lehao’s diagram, it would seem that 120t hydrolox engines are used for the second stage, not the YF-90.

So who is right about the engines on the Long March 9? Long Lehao or the publication of China Aerospace News (which are both official sources)?

A post by Chinese media Dianfeng Gaodi seems to suggest that both configurations could be maintained, with the older design Long March 9 being ready earlier for the first lunar missions in the early 2030s, and the newer, possibly reusable version of Long March 9 presented by Long Lehao coming to fruition after 2035.

A lot of stuff going on with China’s massive state-owned lunar rocket projects, and a healthy dose of mystery! @Blaine, anything going on with the private launch sector as well?

Blaine’s Take

Space Pioneer (aka Tianbing Aerospace) announced a “hundreds of millions of RMB” Pre-B round of funding earlier this week. The round of funding marks the 6th (!!) round of funding completed by Tianbing in the past 2 years, with the company claiming to have raised more than RMB 1B during those 6 rounds.

As we have noted before, Tianbing is one of multiple “second-generation” Chinese launch firms that was founded by a former leader of a “first-generation” one (former CTO of LandSpace Kang Yonglai is the Founder/CEO of Tianbing). The company appears to be building up quite an industrial base and network of contacts within the Yangtze River Delta (YRD). Previous funding rounds have featured the ZJU Innovation Fund, associated with Zhejiang University in Hangzhou, and more recently, the company announced plans for a smart rocket and engine industrial base in Suzhou, notably Zhangjiagang. Now, this most recent round of funding includes, as one of the three investors, the Zhangjiagang Ecological Technology Fund.

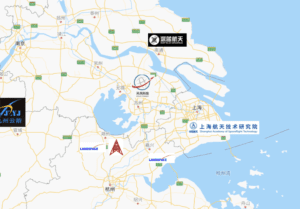

We have an interesting dynamic developing in the YRD. Lake Tai is a major lake in the center-ish of the YRD. At the southern shores of Lake Tai is Huzhou, and southeast is Jiaxing. The two cities have both seen a LandSpace factory built, and Huzhou is also home to Rocket Group. At the other side of the lake, we have Tianbing Aerospace in Suzhou, as well as Deep Blue Aerospace in Nantong (admittedly a bit further north). Finally, in the east, we have the behemoth of SAST and all of its launch capabilities, primarily clustered around Shanghai. In the very far west, arguably outside of the YRD, is Bengbu, Anhui Province, which is home to a JZYJ facility, and is noteworthily upriver (the Huai River, via the Yangtze) from the rest of the YRD. Moving forward, we are likely to see these various clusters compete and collaborate, and likewise see a very interesting supply chain develop. This is of course not limited to launch vehicles, with satellite manufacturers building their own clusters around the YRD, but that’s another story for another episode.

We have an interesting dynamic developing in the YRD. Lake Tai is a major lake in the center-ish of the YRD. At the southern shores of Lake Tai is Huzhou, and southeast is Jiaxing. The two cities have both seen a LandSpace factory built, and Huzhou is also home to Rocket Group. At the other side of the lake, we have Tianbing Aerospace in Suzhou, as well as Deep Blue Aerospace in Nantong (admittedly a bit further north). Finally, in the east, we have the behemoth of SAST and all of its launch capabilities, primarily clustered around Shanghai. In the very far west, arguably outside of the YRD, is Bengbu, Anhui Province, which is home to a JZYJ facility, and is noteworthily upriver (the Huai River, via the Yangtze) from the rest of the YRD. Moving forward, we are likely to see these various clusters compete and collaborate, and likewise see a very interesting supply chain develop. This is of course not limited to launch vehicles, with satellite manufacturers building their own clusters around the YRD, but that’s another story for another episode.

Jean’s Take

One last point that was a bit hidden in the press release: Space Pioneer claims that the funding will enable the company to continue to fund the development of medium and heavy lift launch vehicles, and… crewed spacecraft (空天往返载人飞船).

An interesting statement, considering that China’s crewed spaceflight program has basically been the exclusive prerogative of state-owned companies (notably CASC).

Is this a reference to the Request for Proposal for a light cargo spacecraft posted by China’s Manned Spaceflight Engineering Bureau (CMSEO) in January 2021?

We don’t know, but stay tuned to the Dongfang Hour, we will let you know as soon as we know more.

There were other launch updates this week, notably grid fin verification tests from iSpace, two variable thrust static fire tests for Deep Blue Aerospace, but for the sake of keeping these news episodes short, we’ll leave it to our newsletter to get into the details, so don’t forget to check that out!

This has been another episode of the Dongfang Hour China Aero/Space News Roundup. If you’ve made it this far, we thank you for your kind attention, and look forward to seeing you next time! Until then, don’t forget to follow us on YouTube, Twitter, or LinkedIn, or your local podcast source.

Blaine Curcio has spent the past 10 years at the intersection of China and the space sector. Blaine has spent most of the past decade in China, including Hong Kong, Shenzhen, and Beijing, working as a consultant and analyst covering the space/satcom sector for companies including Euroconsult and Orbital Gateway Consulting. When not talking about China space, Blaine can be found reading about economics/finance, exploring cities, and taking photos.

Jean Deville is a graduate from ISAE, where he studied aerospace engineering and specialized in fluid dynamics. A long-time aerospace enthusiast and China watcher, Jean was previously based in Toulouse and Shenzhen, and is currently working in the aviation industry between Paris and Shanghai. He also writes on a regular basis in the China Aerospace Blog. Hobbies include hiking, astrophotography, plane spotting, as well as a soft spot for Hakka food and (some) Ningxia wines.

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space