by Blaine Curcio and Jean Deville

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 22-28 Feb 2021”.

Hello and welcome to another episode of the Dongfang Hour China Aero/Space News Roundup! A special shout-out to our friends at GoTaikonauts!, and at SpaceWatch.Global, both excellent sources of space industry news. In particular, we suggest checking out GoTaikonauts! long-form China reporting, as well as the Space Cafe series from SpaceWatch.Global. Without further ado, the news update from the week of 22 – 28 February.

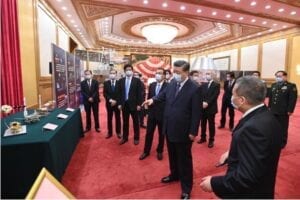

1) Xi Jinping and a very high-level delegation visits Chang’e 5 expo at the Great Hall of the People

Jean’s Take

On February 22nd, Xi Jinping visited an exhibition on the Chinese lunar mission Chang’e 5, which successfully completed its sample return mission earlier this year.

President Xi toured the exhibition, with the leadership of China’s space apparatus (CNSA, CASC, …) presenting various points of interest: the rocket engines, an exhibition of some moon samples, Chang’e 5 models, …; Xi also made a speech, and there was a group picture.

While this may seem like an ordinary event, there are several noteworthy points the unpack here:

- First and foremost, it’s been a while since Xi Jinping has held a public event in support of the space industry. The last one was 2 years ago for Chang’e 4, and I believe before that it was in 2016 when XJP met up with the crew of Shenzhou 11.

- The delegation that accompanied President Xi was also high profile: present were the entire standing committee of the Politburo, in other words, the 6 most powerful people in China after Xi Jinping. This included Premier Li Keqiang.

- Also present were, unsurprisingly, many big names of the space industry. Obviously the head of various space SoEs (such as CASC → Wu Yansheng), Yang Mengfei (chief designer of CE5), Wang Jue (commander-in-chief director of the LM5 project), as well as the head of CNSA Zhang Kejian. Lastly, there were also former leading chief designers and leaders that had played a key role in the space industry: Sun Jiadong and Luan Enjie. Put together, it was a big part of the space team and Chinese leadership put together in one room (as seen in the picture in video).

During the event, Xi Jinping concluded that China had successfully completed its initial 3-step Moon program (orbiter, lander/rover, and sample return), and pushed for phase 4 of lunar exploration (CE6, 7, 8, and ILRS). While it has been said before that Xi Jinping was necessarily a very “space” person, this shows renewed support from the highest level of leadership for Chinese exploration programs, which is a good sign for future missions, especially with the relative stability of China’s political system.

Blaine’s Take

Definitely a noteworthy development. I continue to stand by my assertion that President Xi is not a fan of space, however, it is also becoming increasingly clear that China can and does use space for soft power. A few noteworthy lines from President Xi during his speech:

- President Xi noted that “exploring the vast universe is humanity’s common dream, ad urged implementing the fourth phase of China’s Lunar Exploration Program

- Xi also called for giving full play to the advantages of the new system of pooling national resources and strengths, enhancing independent innovation, strengthening overall planning and working harder to promote the innovative development of China’s space science, space technologies, and space applications

- President Xi also stressed actively conducting international cooperation and making better contributions to humanity’s well-being

Overall, definitely a noteworthy development. President Xi has been active in space before when it has been useful for Chinese political or economic purposes–for example, he made a visit to Inmarsat in late 2015, during which time he discussed the potential for a “Belt and Road” proposition for one of the satellites in Inmarsat’s Global Xpress constellation. The satellite has not seen much progress since.

The main takeaway for me is the extent to which the Chinese leadership has clearly identified space as a means for international cooperation, economic development, and other goals of the party. The more the space industry can be aligned with these (and other) goals in China, likely the faster things will move, most support will be given to the sector, etc. Definitely, interesting times, made more interesting by arguably the most powerful leader in the world going and checking out Chang’e-5.

2) CNSA officially validates the Long March 9 in the Chinese space program

Jean’s Take

Probably not unrelated to the previous piece of news, a few days later Wu Yanhua, the deputy director of CNSA, was interviewed by CCTV, China’s central television media, during which time he stated that the development of the Long March 9 had been officially confirmed, with its main objective being crewed missions to the Moon and to Mars.

This is important news in many regards, and let’s unpack some of the important points here:

Technical overview:

First of all, it’s a relief to finally hear a confirmed plan for Long March 9! LM9 is China’s hypothetical super-heavy rocket and had loosely been in the pipeline for many many years, the first hints going back all the way to 2010 (When China Goes to the Moon, p115). And what China has done mostly since then is to explore multiple configurations for the rocket. At first, China considered a configuration with a hydrolox first stage with 4 solid-fueled side boosters and a hydrolox second stage. But rapidly the Chinese design teams swapped the solid-fueled side boosters and the hydrolox first stage for kerolox engines.

The total weight and thrust of the rocket have also changed considerably over time, as well as the specs of the engines, and even the names given to the engine. And this is what is tricky with Chinese space: for many early-stage projects, it is hard to keep track of what is the latest version, what are the official names. Here’s my latest take on the matter:

- First of all, it’s payload capacity: it would put 140t into LEO, and 50t into LTO. I’ve seen also very recent presentations with a stretched version of LM9 (103m tall instead of 93m) which would put 180t into LEO and 65t into LTO, but I haven’t managed to find the original source, and if we base ourselves on what was shown to Xi Jinping a few days ago (see snapshot), it seems like 140t into LEO is the figure to stick to.

- It would be available in 3 configurations, one with 4 side-boosters, and by stripping them down two by two, you get LM-9A (100t LEO), and LM-9B (50t LEO).

- Its 1st stage and boosters would be based on the YF-130 kerolox engine (called YF-650 is some older presentations), which has a thrust of 480t. This engine is a dual combustion, dual nozzle oxygen-rich staged combustion engine, which resembles somewhat the Russian RD-180. This is a highly efficient architecture, with a specific impulse of 306s. This shows China’s growing experience with kerolox technology, having previously developed and currently operating the YF-100 on-board the Long March 5, 6, 7 rockets. The influence of Russian engine design is clearly present here. The core stage will have 4xYF130s, and the side-boosters 2xYF130 each.

- It’s second stage engine is a hydrolox engine called the YF-90, capable of 220t of thrust, and similar to the YF-130 for kerolox, here it shows China’s growing mastery of hydrolox engines. China had previously designed the YF-77 for the Long March 5, a “simple” gas generator cycle engine. Here the YF-90 uses a “single pre-chamber + parallel even double pumps” configuration. While I don’t exactly know what that means (happy to have a viewer explain this to me in the comments!), it is definitely a more complex but more fuel-efficient configuration, with the engine having a specific impulse of 453s, very close to some of the legendary hydrolox engines such as the RS25 of the Space Shuttle. The second stage of the LM-9 has two of these YF-90 engines.

While the Long March 9 is not expected until 2030, China has already been working on developing the engine technology for a while. We reported in Episode 16 (Jan 11-17) that CASC’s 6th academy, AALPT, was doing tests on the preburner of the upcoming YF-90 hydrolox engine. And according to SpaceNews, the first YF130 had been assembled and was to be tested in 2019.

Role of the LM-9:

It’s interesting that in the interview Wu Yanhua stresses the crewed lunar and martian missions (“载人登月” and “载人登火”). There was much discussion of what purpose serve in the past, with crewed missions indeed being mentioned, alongside mars sample return missions or massive payloads which would require such a rocket (see our DFH Episode 5 on the Funky solar harvesting projects in China). It’s also interesting because this again hints at China’s ambition towards crewed missions not only to the Moon but also to Mars.

The last point, this raises the question of the role of the so-called “921 rocket”, a rocket that was first discussed by Chinese officials in 2019, and seen in multiple presentations since. It would be able to put 25t into LTI, which puts it on par more or less with the FH, with a similar-looking configuration (hence the nickname “Chinese FH”). And the advantage of this rocket is that it is based on mature technology, notably the kerolox YF-100K engines. This could be the rocket available in the middle of the decade, as opposed to the LM-9. It’s main goal would probably be lunar missions and notably crewed missions. Noteworthily, “921 rocket” is a forum nickname, the official name so far being “next-generation crewed rocket” (新一代载人火箭).

Blaine’s Take

Definitely a major update from China. The LM-9 would put China head and shoulders ahead of most space programs in terms of super heavy-lift capabilities. As well, if we consider which other nations/space programs plan to have people on the Moon or Mars by 2030, it’s really only just the US/SpaceX.

As such, China’s confirmation of the LM-9 is another indication of the highly advanced, and also very broad/comprehensive nature of China’s space capabilities.

3) Takeaways from Future Space’s 2020 Investment Report

Blaine’s Take

A comprehensive report published by the Chinese space industry think-tank and event planner FutureSpace. A few main takeaways:

- Similar to data published by Euroconsult, we saw 2020 actually surpass 2019 in Chinese space sector funding, despite a significant drop in the number of funding rounds. In short: fewer, bigger rounds, and consequently, some degree of concentration of funds among the top several startups in their respective verticals.

- We also saw a change in the type of funding. In 2020, we only saw RMB 350 million going into seed rounds, angel rounds, or Pre-A rounds. This 350 million was out of a total space industry funding of RMB 9 billion in 2020, according to the report. So, very early-stage rounds represented ~4% of the total funding for Chinese space companies in 2020.

- We also saw “strategic investment” rounds occupy a large share of total funding, at more than half. This is not particularly surprising given that “strategic investment” rounds often involve large investors and more mature companies. That said, these types of rounds tend not to be as specific about the amount of funding raised, which probably means 1) there is some degree of estimation in FA’s figures for strategic investment rounds, and that 2) this may be a big piece of the delta between FA and EC’s figures.

- Beijing remains the undisputed king of space industry funding in China, with companies based in the capital collecting >RMB 5 billion of the RMB 9 billion total. That said, a couple of other cities saw jumps, notably Changchun (RMB 2.6 billion, almost entirely from CGSTL’s massive pre-IPO round), and Xi’an (RMB 537M across 2 rounds).

The final point from my side–it seems that CGSTLs’ “pre-IPO” round was considered “strategic investment” in the FA report. Whether or not the distinction is hugely important is secondary, the main takeaway here in my opinion is the subjectivity of the Chinese space sector, and the extent to which we sometimes really do not know what is going on for sure.

Jean’s Take

I think a noteworthy point here also is to put the 2020 investment in the Chinese commercial space industry in perspective compared to the overall VC investment in China. Overall the VC investment has cooled down in 2019 and 2020, with lower sums of money (and also few rounds) after crazy years in 2016, 17, 18 (although China remains the second country worldwide in terms of global VC investment behind the US). It’s interesting to see that commercial space has been following opposite trends and has continued to increase over the last two years, showing the confidence investors have in commercial space (and in deep tech more generally).

This has been another episode of the Dongfang Hour China Aero/Space News Roundup. If you’ve made it this far, we thank you for your kind attention, and look forward to seeing you next time! Until then, don’t forget to follow us on YouTube, Twitter, or LinkedIn, or your local podcast source.

Blaine Curcio has spent the past 10 years at the intersection of China and the space sector. Blaine has spent most of the past decade in China, including Hong Kong, Shenzhen, and Beijing, working as a consultant and analyst covering the space/satcom sector for companies including Euroconsult and Orbital Gateway Consulting. When not talking about China space, Blaine can be found reading about economics/finance, exploring cities, and taking photos.

Jean Deville is a graduate from ISAE, where he studied aerospace engineering and specialized in fluid dynamics. A long-time aerospace enthusiast and China watcher, Jean was previously based in Toulouse and Shenzhen, and is currently working in the aviation industry between Paris and Shanghai. He also writes on a regular basis in the China Aerospace Blog. Hobbies include hiking, astrophotography, plane spotting, as well as a soft spot for Hakka food and (some) Ningxia wines.

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space