by Blaine Curcio

The first year of the 2020s has been nothing if not very memorable. A global pandemic, political turmoil, and rapid technological development coming from and also helping to propel these changes. Flying somewhat more under the radar, however, has been the year in Chinese launch. 2020 has seen billions of Yuan poured into companies, has seen a plethora of engine tests and other technological steps forward, and government support for the growing crop of launchers.

The Numbers: Impressive in both relative and absolute terms

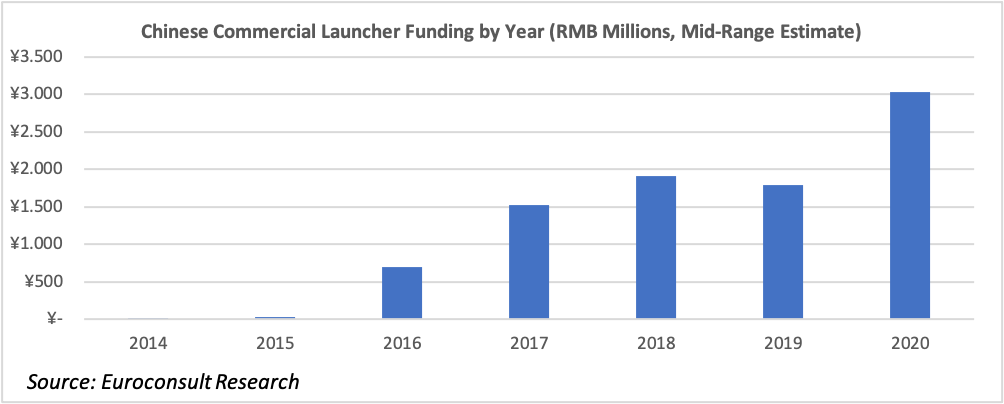

Consider the funding rounds that have taken place among Chinese commercial launch companies over the past year, covered in detail in Euroconsult’s China Space Industry 2020 Report. Landspace completed a RMB 500M round in November 2019. Tianbing Aerospace raised RMB ~100M in April, and another RMB ~100M in September. Deep Blue Aerospace raised RMB ~100M in June, OneSpace covertly raised RMB ~100M in September, and Galactic Energy raised RMB 200M in November. The total from these 6 rounds—RMB 1.1 billion (US$170M)—would be a good year for the commercial launch sectors of most countries. However, China’s 2020 has been truly massive, with iSpace and Landspace having completed rounds of roughly RMB 1.2 billion each in August and September, respectively, meaning that 2020 (and the last 2 months of 2019) have seen a total of RMB ~3.5B (US$530M) of funding for commercial launch companies, across 8 rounds of funding.

These numbers are impressive not just in absolute terms, but also when compared to launch startups elsewhere. For instance, one of the most well-funded European commercial launch startups is Isar Aerospace, which plans for a rocket capable of lifting ~1,000kg to LEO. The German company completed a Series A round in late 2019, bringing in a total of EUR 17 million, which represents the majority of Isar’s total funding raised thus far. This would mean that Isar Aerospace has raised less funding than Landspace, iSpace, OneSpace, Expace, Galactic Energy, Deep Blue Aerospace, and possibly Tianbing Aerospace, or that Isar has comparable funding to China’s 6th or 7th most well-funded commercial launch company. This is by no means a negative indicator of Isar, but rather is a comment on the amount of money being poured into the sector in China today.

Said funding is also noteworthy for its diversity. For instance, Landspace’s late 2019 round involved Country Garden, a major real estate developer that has been active in venture capital for some time. Both iSpace and Landspace’s mega-rounds involved a plethora of investors, including Chinese branches of American VCs (Sequoia China, Matrix Partners), returning investors (Country Garden participated in Landspace’s 2020 round, for instance), and local governments (Huzhou Government Fund). In the Chinese system, this is helpful insofar as it allows for diversification of risk, but also allows the government to maintain a large, often controlling stake. Such a system has also allowed for local and provincial governments, very large and powerful in their own right, to partner with space companies as a way of developing the local economy.

China’s Interrelated System of Companies, Provinces, and SOEs

China’s impressive year in commercial launch has been enabled in part by a system that China has used to foster innovation in cutting-edge sectors. Most such sectors in China today are controlled by state-owned enterprises that enjoy monopolies or oligopolies. The government has seemingly accepted that such a model is not optimal for producing rapid innovation, and yet a fully free-market system that might produce such rapid innovation is not possible in a system with such large, monopolistic SOEs. As such, China has seemingly targeted a “third way”, whereby commercial companies, provincial governments, and established SOE incumbents have somewhat aligned incentives, and are able to collaborate in ways that maximize the competitive advantages of each distinct type of entity.

To take an example: Landspace is likely the most well-funded commercial launch company in China. Its most recent funding rounds have been for RMB 1.2 billion (September 2020) and RMB 500 million (December 2019). The two rounds were primarily led by Country Garden, the aforementioned private real estate developer and VC. Country Garden brings significant private capital to the picture. Landspace also had a previous agreement with the local government of Huzhou, a city near Shanghai, whereby Huzhou invested around RMB 200 million into the company, while also providing land for a manufacturing facility. Landspace, with private money and a leadership team that counts experience not only at China’s traditional space companies but also HSBC and PwC, has the ability to assemble nimble teams of the industry’s best and brightest, offering highly competitive salaries and more rapid job advancement opportunities than at the traditional space companies, in exchange for somewhat less certain job status and potentially, less prestige.

The end result may be a launch company that is commercial in its economic incentive structure, but still effectively part of the state-owned apparatus. This will be even more true if Landspace’s major customers are SOEs like CASC and CASIC, a likely outcome if Landspace, for instance, were to take the lead on development of liquid engine technology for their rockets. Privately run companies getting direct and indirect government support via contracts and free land, while attracting investment from private companies that just want a piece of the white-hot space industry pie. Indeed, while Musk fanboys may be loath to admit it, the industry in China is really not so different from the US in this way—looking at SpaceX’s list of customers, the top of the list is dominated by “internal demand” (Starlink), but right below that would surely be the US Government, with the latter entity having a vested interest in 1) getting lower-cost access to space, and 2) helping foster innovative American startups. Sounds an awful lot like the desired outcomes by the Chinese.

Benefits and Drawbacks

While these two sides may have broadly similar objectives of making their own country’s launch industries great (again), the two different systems have different benefits and drawbacks. The biggest difference between SpaceX and Landspace, beyond the fact that SpaceX is a much older company with much, much more advanced business model/technology, is the fact that SpaceX has, for better or worse, a wider berth in what they are allowed to do. CEO gets high on a live podcast? It’s fine. Commits securities fraud by publicly announcing false plans to take Tesla private at $420 per share? A relatively small fine from the SEC. Company makes a rocket that is objectively cheaper, and arguably better, than anything NASA has built in decades, making it improbable that NASA will ever be able to justify building its own rockets again? Also fine. Basically, SpaceX, as a commercial company in the United States, can do whatever it wants so long as it is considered beneficial for shareholders and not blatantly illegal.

On the other hand, it is unimaginable for all sorts of reasons that an executive from a Chinese rocket company would go get high on a live podcast. It is similarly unthinkable that Landspace would be touting their rocket as superior to the ones being produced by the state. While Landspace has some freedoms as a commercial company, freedoms that allow it to do some cool things, they have markedly less freedom than SpaceX. Even if Landspace could raise the money to do it, they would never build a competitor to the Long March-5. Even if Landspace wanted to build such a rocket, no sane Chinese investor would fund a competitor to the state. In short, you have a situation where Landspace operates with many more constraints than SpaceX. Probably, the biggest advantage of the US “system” over the Chinese “system” is the fact that the US system is more conducive to what we might call disruptive innovation. We have no idea whether LEO constellations will succeed, but we know that right now, by a good margin, the most advanced one is Starlink, and the reason is because in the US, moving fast and breaking things is quite okay, whereas in China, moving fast and breaking things can be a recipe for instability, and that is a clear no-go-zone.

Despite the clear drawbacks, China’s system also has some benefits. The most apparent is that the system allows for rapid technological catch-up. By having long-term plans and significant coordination between the SOEs, government, and private companies, China has been able to make a variety of advancements in launch, satellite manufacturing, and the application layer of commercial space. China’s system also allows for companies to adapt. It is a common saying in China that it can be very hard to start a company, but once a company is started, it is even harder for it to die. That is, given the relatively low labor costs, relatively flexible overhead costs (with space startups sometimes using office space from Chinese Academy of Sciences or others, for instance), and the amount of small-scale government support available, countless Chinese commercial space companies have puttered along for several years doing seemingly nothing, only to then announce a new round of funding and a slight tweak to the business model due to some change in regulations.

The Path Forward

China’s launch sector has seen a truly explosive last 12 months. Depending on one’s definition, on the global table of most well-funded commercial launch startups, China would now occupy roughly 5 of the top 10 spots (assuming Blue Origin, SpaceX, Rocket Lab, Relativity Space, and ISAR Aerospace would be in the top 10 along with Landspace, Expace, iSpace, OneSpace, and Galactic Energy). If we took top 20, China might account for more than half.

This begs the question—are we witnessing the rise of a leading rocket industry? Or are we witnessing a real-time exhibit of massively inefficient resource allocation? The truth is probably somewhere in-between, but a few things are near-certain in the coming few years for the Chinese launch sector:

- The plethora of commercial startups, funded by a plethora of VCs and provincial governments, will give rise to at least one, and probably several, globally-competitive medium-sized launch companies.

- The state, via its SOEs, will do an increasing amount of business with commercial companies, either publicly or, more likely, discreetly. As noted, we see commercial companies as being nimbler, and in certain niche areas, commercial companies are taking the technological lead in China. Within 5 years, a CALT or SAST-built rocket may use a liquid-powered engine built by Landspace, for instance.

- The industry will see a shakeout. There cannot be 20 launch companies in China, even if there are nearly 20 cities ready to support a local launch sector. If other Chinese industries are any indication, the brutal competition is likely to lead to a couple of world-class winners as mentioned in point 1 above.

- There will emerge a significant opportunity for integration of systems. One of the advantages of the US system is the vertical integration made possible by less powerful incumbents. If Starlink wants to be an ISP from space, more power to them, and incumbent space companies and ISPs be damned. In China, if they want a constellation to be an ISP, there are major SOEs with an oligopoly in the ISP part of the market. The lack of vertical integration will mean a market for sewing together a bunch of moving parts. This will also likely increase the strategic importance to China of technical standards.

Overall, it’s been a wild 2020 in Chinese launch thus far, and incredibly the year is not yet over. Despite a pandemic, we’ve seen a record ~US$500M poured into these companies, and have continued to see the government make decisions to slowly open the industry. Moving forward, the publication of the 14th Five Year Plan later this year will give important guidance for what we should expect for the medium-term from the launch sector. Until then, do not be surprised if another Chinese commercial company you’ve never heard of completes a 9-figure round of funding sometime between now and next week.

Euroconsult’s China Space Industry 2020 is a deep-dive report into all major verticals of the Chinese space sector. With dedicated chapters on satellite communications, earth observation, launch, satellite manufacturing, TT&C, and more, the report provides deep-dive analyses on a vertical level, complemented by a macro-level summary of the Chinese space sector, governmental policies, and profiles of key players. For more information, please visit Euroconsult.com

Blaine Curcio has spent the past 10 years at the intersection of China and the space sector. Blaine has spent most of the past decade in China, including Hong Kong, Shenzhen, and Beijing, working as a consultant and analyst covering the space/satcom sector for companies including Euroconsult and Orbital Gateway Consulting. When not talking about China space, Blaine can be found reading about economics/finance, exploring cities, and taking photos.

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space