By Nandini Sarma

In many parts of the world, space technology is being used to improve people’s lives. Apart from their uses for everyday services like weather forecasting, long-distance communications, and GPS systems, the manifold applications of space technology assist in many other ways. Space-borne platforms, for example, have demonstrated their capabilities in disaster management. Earth-observation satellites have provided basic support in pre-disaster preparedness programmes, disaster response monitoring, and post-disaster reconstruction. This report outlines the space programmes of the different countries of ASEAN (Association of Southeast Asian Nations); it traces their genesis, discusses their current state, and defines the challenges facing them.

The various applications of space technology are crucial to many Southeast Asian countries[i] in the areas of disaster management, agriculture, and tourism. By developing indigenous Earth observation satellites, these countries are also better able to monitor disputed border areas and handle conflicts by providing accurate mapping for use by the military. These space programmes also provide capacity development for the countries’ research institutes and innovation departments.

The space programmes of the different Southeast Asian countries covered in this report are motivated largely by socio-economic requirements and a desire to nurture self-reliance in the area of security. They are interested less in prestigious projects such as sending missions to outer space, and more in enhancing economic development using better technologies, as well as, for some of them, competing in commercial markets for providing space services. The latter is indeed a motivating factor, as the space industry—valued at U.S.$360 billion in 2018—is projected to grow at a CAGR of 5.6 percent, to reach a value of U.S.$558 billion by 2026.[ii] This huge market is ready to be tapped by countries that can develop and commercialise their space technologies.

Many of the Southeast Asian countries started investing in space technology some decades ago. Indonesia, for example, set up its space institute, Indonesian National Institute of Aeronautics and Space (LAPAN) in the 1960s. For its part, Thailand in 1971 established a ground-receiving station to utilise data from the Earth Resources Technology Satellite-1 of the U.S.’ NASA (National Aeronautics and Satellite Agency); the ground-receiving station was the first in Southeast Asia. In 1979, Vietnam sent its first citizen to space through the Soviet Union’s Interkosmos programme.[iii]

According to a report by Euroconsult as quoted in newspaper reports[iv], in 2012, Vietnam was the largest spender within the ASEAN group with U.S.$93 million, followed by Laos (U.S.$87 million), Indonesia (U.S.$38 million), Thailand (U.S.$20 million), and Malaysia (U.S.$18 million). These countries are spending huge sums of money to develop indigenous space programmes. Laos, one of the poorest ASEAN members, is now the second biggest spender on space programmes in the region. (See Table 1.)

Table 1: Space Expenditures of Key Southeast Asian Countries

| Country | Organisation and year of establishment | Expenditure on Space sector, 2012 (in U.S.$ million) | First Communication Satellite launched |

| Vietnam | Vietnam National Space Centre (VNSC), 2011 | 93 | Vinasat-1 launched in 2008 |

| Thailand | Geo-Informatics and Space Technology Development Agency (GISTDA), 2000 | 20 | Thaicom-1 launched in 1993 |

| Malaysia | ANGKASA, 2002 | 18 | MEASAT-1 launched in 1996 |

| Singapore | – | ST-1 launched in 1998 | |

| Indonesia | National Institute of Aeronautics and Space (LAPAN), 1962 | 38 | Palapa-1A launched in 1976 |

| Philippines | Philippines Space Agency (PhilSA) to be established | – | Agila-2 launched in 1997 |

| Laos | – | 87 | LaoSat-1 launched in 2015 |

Mapping the space programmes of Southeast Asian countries

Vietnam

In 2017, the Vietnam National Space Centre (VNSC) announced that by 2022, the country will produce its own satellite “and become one of the leading countries in the region in this field.”[v]Indeed, Vietnam has made large investments in space, viewing its importance not only for achieving the sustainable development goals but also for conducting its military and foreign affairs. Of all the ASEAN governments, Vietnam spent the most in 2012 in its civil space programme with U.S.$93 million.

The Space Technology Institute (STI) and VNSC are the leading governmental organisations in Vietnam that work under the Vietnam Academy of Science and Technology (VAST) for the country’s space programme. The STI conducts research on space science and technology, and VNSC is responsible for developing projects that include technology applications and training of high-quality, skilled workers. It is also responsible for implementing international cooperation projects and for controlling, operating and managing Vietnam’s Earth observation satellites. The budget of VAST for 26 projects over 2012-2015 was U.S.$5 million and another U.S.$10 million for future 22 projects through 2016-2020.[vi] These projects will focus on fabrication of space technology equipment such as nano-satellites, GPS high resolution receivers, mobile receiving station, as well as developing launcher rocket techniques.

Vietnam engages in collaboration in developing its satellite programmes. For example, Vietnam’s initial space venture started with the Soviet Union’s Interkosmos programme—an initiative in 1979 by the Soviet Union for other socialist countries.[vii] Through the venture, Vietnam sent its first citizen, Phạm Tuân, to space, becoming the first Asian to do so. Vietnam introduced its first space strategy, “Strategy for Research and Application of Space Technology of Vietnam until 2020”, in 2006. It aims to develop a legal and regulatory framework for research and application of space technology, develop the infrastructure of space technology, and build indigenous capacity for satellite development. Following political and economic reforms in 1986, Vietnam began to explore more options for international collaborations. VINASAT-1 is the first Vietnamese communication satellite launched into space in 2008, which was built by the U.S. VINASAT-2 is the second communications satellite built by the U.S. that was put in orbit in 2012. Vietnam’s VNREDSAT-1, optical Earth observation satellite, was built in collaboration with France and Belgium and launched in 2013. Vietnam is also part of the space pillar of China’s Belt and Road Initiative (BRI).[viii]

In 2016, India and Vietnam signed the Inter-Governmental Framework Agreement for the Exploration of Outer Space for Peaceful Purposes. India has set up a satellite tracking and imaging centre in Ho Chi Minh that will give Vietnam access to pictures from India’s Earth observation satellites that cover the region, including China and the South China Sea.[ix] In 2018, India and Vietnam signed an MoU to enhance cooperation in information and broadcasting sector and space cooperation. The countries also agreed on the implementation arrangement between the Indian Space Research Organisation (ISRO) and Vietnam’s National Remote Sensing Department for the establishment of a tracking and data reception station and data processing facility. The Tracking and Telemetry station will be linked up with another station in Indonesia.[x] While it is mainly for civilian use, security experts say that improved imaging technology means that it would have military use as well. The tracking station will be the first such foreign facility in Vietnam and follows a series of other agreements that have been signed for enhancing security ties. It is also an important strategic asset for India in the South China Sea.

Vietnam will require more skilled workers and is relying on other countries to build a pool of such technicians. Japan, for one, will invest some U.S.$480 million in Vietnam’s space industry. The loans are to be spent on three projects: two observation satellites, an Earth-based space centre, and the training of engineers by the Japan Aerospace Exploration Agency.[xi] The Hoa Lac Space Centre project for space research and development opened in 2018. According to the National Space Strategy, Vietnam will focus on manufacture and launch of small Earth observation satellites. The aim is to master the technology to reduce dependence on foreign buyers.

VNSC has already developed a prototype of a Vietnamese-built satellite called PicoDragon that weighs about 1 kg, launched in collaboration with Japan in 2013. The next step is to implement bigger satellites such as the NanoDragon (4-5 kg) and MicroDragon (50 kg). MicroDragon is being developed as part of a joint Vietnam-Japan project on disaster and climate change prevention using earth observation satellites. It is to be launched in early 2019. Micro Dragon is designed to observe coastal waters to determine water quality and locate fisheries resources. Vietnam is also developing two types of radar-equipped satellites weighing 600 kg called LOTUSat-1 and LOTUSat-2, in collaboration with Japan.[xii] LOTUSat-1 will use a sensor to observe the Earth, and thus functions independently of a light source.[xiii]

Indonesia

Indonesia is home to thousands of volcanic islands and has an extensive latitudinal stretch. It holds a massive 17 percent of the world’s total coral reef area, of which 82 percent has been found to be at risk. Given its location and unique geographical conditions, Indonesia has long realised the importance of space technology for sustainable development. The Indonesian government established the national space agency called LAPAN in 1962 under the National Council for Aeronautics and Space of the Republic of Indonesia (DEPANRI).

Indonesia is one of the first few countries that already have an established National Space Law—the Indonesian Space Act enacted in 2013 which focuses on space science, remote sensing, development of aerospace technology, and launching and commercialisation of space activities. Its stated policy goals are to attain self-sufficiency and competitiveness in the area of space activities. A fundamental element of the space development programme is cooperation with other countries.[xiv] Robertus Triharjanto, the head of LAPAN’s Satellite Bus Technology division stated in 2014 that Indonesia will become “Asia’s next big space player” in 10 years.[xv]

Much of Indonesia’s space programme is concentrated on applications of space communications, meteorological satellites, remote-sensing satellites and studies on socio-economic and legal aspects of space technology. Further, in line with its national policy, LAPAN is working to develop launch capabilities and other space technologies to attain self-sufficiency in space activities. It is also developing its own series of remote-sensing satellites. LAPAN-Tubsat, also known as LAPAN-A1, was built in Germany in an ambitious project that taught Indonesia the process of building satellites from scratch.[xvi] It was launched by India in 2007. LAPAN A2/Orari satellite was produced entirely in Indonesia by the National Institute of Aeronautics and Space (LAPAN) in 2012. It is a successor to LAPAN A1/Tubsat and is an Earth-observation satellite. Indonesia is aiming to launch its indigenous satellite by 2040.[xvii]

With respect to collaborations, Indonesia has cooperated with the U.S. and France to get Earth resources data for agricultural development, forestry monitoring and flood monitoring. Apart from helping launch the experimental LAPAN-Tubsat microsatellite in 2007, Indonesia has also signed a cooperative agreement with India’s ISRO to host a ground station for telemetry and tracking of Indian satellites. It is in discussions with China to collaborate in building a launch site in Biak and Morotai.

Indonesia’s Gross Expenditure on Research & Development (GERD) as a percentage of GDP, at 0.9 percent, is amongst the lowest among the ASEAN countries. Even its Space Law fails to address the issue of human resources and Indonesia continues to rely on outside help for training. Indonesia is also a signatory to a host of international treaties and is party to international agreements such as the Outer Space Treaty and the Agreement on the Rescue of Astronauts.

Malaysia

Malaysia has been utilising foreign remote-sensing data since the 1970s and established a remote sensing station in 1988. Although small, the country’s space programme is steadily growing under the leadership of its space agency, ANGKASA, established in 2002 under the Ministry of Science, Technology and Innovation (MOSTI). While Malaysia does not have a space law, according to the country’s National Telecommunication Policy (NTP), its space policy is driven by the need for self-reliance in national security. It also has had representation in international organisations: Dr. Mazlan Othman was the director of the UN Office for Outer Space Affairs (UNOOSA) between 1999 and 2013. Sheikh Muszaphar Shukor is the first Malaysian astronaut in space, selected as part of the Angkasawan spaceflight programme that was initiated as part of the agreement with Russia to transport a Malaysian to the International Space Station (ISS) in return for the purchase of 18 Russian fighter jets by Malaysia.

The MEASAT series are the geostationary communication satellites of Malaysia, developed jointly with the Boeing and Hughes of the U.S. that can perform data transfer and broadcasting. Malaysia is also developing its indigenous building capacity in cooperation with foreign partners: It jointly built microsat (TiungSat-1) with Britain in 2000, and it is building remote sensing satellites – RazakSat—with the help of South Korea, launched by SpaceX in 2009. The Malaysian government has recently approved the National Space Policy 2030.[xviii]

Thailand

Thailand has long been using space information for the management of its natural resources, development of science and technology, and nurturing national and domestic security strategies. Thailand’s efforts in this regard are part of its comprehensive development strategy. It had an early start in the use of data from space, establishing a ground receiving station to utilise data from NASA’s Earth Resources Technology Satellite-1 in 1971, the first of its kind in Southeast Asia.

Thailand developed its space programme with the help of advanced space powers such as the U.S., China and Japan. It is one of the founding members of the China-led Asia-Pacific Space Cooperation Organization (APSCO). It also signed an MOU in 1998 on the Cooperation in Small Multi-Mission Satellite (SMMS) project with China, Iran, Republic of Korea, Mongolia, and Pakistan.

Thailand’s fourth communication satellite called iPStar (Thaicom-4), built by the U.S., offers a host of broadband services for the Asian-Pacific region. One of its principal markets is Australia. Thaicom Public Company Limited is the company that owns and operates the satellite fleet and other telecommunication businesses in Thailand and throughout the Asia-Pacific region. It reported a record net profit of 2.122 billion baht (approximately U.S.$67 million) in 2015.[xix] It is now expanding into newer markets in India, Myanmar, and Malaysia.

In 2000, the Thai space organisation, Geo-Informatics and Space Technology Development Agency (GISTDA), was established, tasked with remote sensing and developing satellite technology. Since 2004, Thailand has initiated efforts to develop its own satellites. GISTDA signed a bilateral agreement with France to co-develop the Thailand Earth Observation Satellite (Theos) for remote sensing which was launched in 2008 in the Sun-synchronous orbit.[xx] This was the country’s first Earth observation satellite. Data from Theos has been used to monitor agricultural crop area, to get updates on flood situations, and for various aspects of natural resources management. It has also been used in national security and military uses, by providing updated mapping of disputed areas between Cambodia and Thailand.[xxi]

Theos-2, which was approved in 2017 and will replace Theos, will be manufactured by Airbus. It will provide high-resolution imagery (0.5 metres). Thailand has also developed two cubesats – university research satellite KNACKSAT (launched in December 2018) and amateur radio JAISAT-1.[xxii]

Singapore

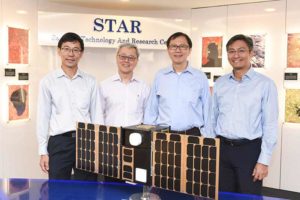

Singapore’s foray into space has been more recent than other ASEAN countries. However, given its financial viability and technological resources to develop its space technology, Singapore has made significant investments since it kickstarted its space programme. It is mainly focused on using space technology for communications, control of resources and educational aspects of space technologies. It is also building a talent pool with technical expertise in satellite technologies and various university programmes are providing the relevant courses. The Satellite Technology and Research Centre (STAR) at the National University Singapore conducts trainings of undergraduate and postgraduate students to support the manpower required for the country’s ambitions to build a new spacecraft industry.

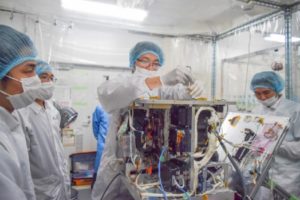

In 2011, Singapore launched its first communication and Earth observation satellites called X-sat. It was built by the Nanyang Technological University (NTU) in collaboration with Defence Science Organisation of Singapore. The 105-kg micro-satellite was successfully launched with the help of India’s Polar Satellite Launch Vehicle (PSLV-C16) at a cost of U.S.$29 million in 2011. Its purpose is to conduct observation of soil erosion around Singapore and to study and monitor environmental changes. It is designed for the purpose of building local capabilities in satellite engineering and has a mission life of three years.[xxiii] Its success led to the formation of a new satellite company ST Electronics (Satellite Systems) in 2011, which subsequently built and launched Singapore’s first made-in-Singapore commercial satellite TeLEOS-1 in December 2015. It is an Earth observation satellite and was also launched from India.

Singapore is also conducting research on newer technologies in space satellites using small satellites. In 2015, VELOX-II (12 kg), built by NTU, was launched from India. It was the world’s first satellite-to-satellite communication technology which allows the VELOX-II to communicate with commercial geosynchronous satellites anytime and anywhere in space. AOBA VELOX-III (2 kg), a nano-satellite with a unique micro-thruster, was launched in 2017 from the International Space Station (ISS). A joint project between NTU and Japan’s Kyushu Institute of Technology,[xxiv] it is to test a new wireless communication system.

In 2015, NUS launched the Galassia, developed by the NUS Faculty of Engineering. The 2-kg nanosatellite carried the first quantum science payload that was designed by the Centre for Quantum Technologies at NUS.[xxv] The mission of this payload was to test a quantum-based communication. These experiments with small satellites has helped local university students to be directly involved in developing space technology. The Singapore government is also collaborating with the UK on a 10-million pound programme to develop new space quantum technologies.[xxvi]

The next step for Singapore would be to commercialise its expertise in space-related technologies with the help of local companies. After all, the market for small satellites is projected to grow to U.S.$7.5 billion by 2022. With Singapore’s strong R&D and high technical expertise and wealth, it has the potential to take a lead in space technologies, despite its late start. Many companies are already tapping this strength and establishing their base in Singapore, including satellite communications companies including SES and Thuraya, niche operators such as Kacific and 21AT and solutions providers like Addvalue and GomSpace.[xxvii]

Singapore is also attracting start-ups. These include Spire, an American company that uses nanosatellites to provide maritime data and Astroscale, and a Japanese company which works on developing technology to clear space debris.

The Philippines

The Philippines is a country comprising more than 7,000 islands. Its location in the Pacific Ring of Fire[1] makes it vulnerable to natural disasters such as earthquakes and tsunamis. It is also rich in biodiversity. Therefore, like Indonesia, the Philippines understands the benefits of developing its space technology. Its space activities started with the purchase in the 1990s of Agila-2, a telecommunication satellite meant to provide coverage in the Asia-Pacific.

The Philippines is yet to create a dedicated space agency, and as such its space activities are handled by different departments under the Department of Science and Technology (DOST)—among them, the Philippine Atmospheric, Geophysical and Astronomical Services Administration (PAGASA), the National Mapping and Resource Information Authority (NAMRIA), the National Disaster Risk Reduction and Management Council (NDRRMC), Mines and Geosciences Bureau, and the Philippine Institute of Volcanology and Seismology, as well as the Department of National Defense.

One of the major steps taken recently for the development of the space programme was a bill introduced in Congress in 2012—the Philippine Space Act of 2012—which aimed to create a national space agency. The bill failed to pass, however, and analysts say this is because public opinion was against developing expensive space technologies given the poverty that persists in many parts of the country.[xxviii] Opinions changed after in 2013, following the particularly massive Typhoon Haiyan, and awareness of the need for disaster preparedness increased. There have been other initiatives in the area of space activities—among them, the setting up of the Manila Observatory in 2012 for research, and the launch in 2014 of the Philippines Scientific Earth Observation Microsatellite programme.

The Diwata satellites (launched in 2016) were built by the DOST in collaborations with Japanese universities, Hokkaido and Tohuku. The data is mainly to be used for research at universities. The Diwata-2, an Earth-observation satellite, was launched in 2018.

The political push for the creation of a space agency is underway. The Philippine Space Development Act was passed on December 2018. This will create a central space agency called Philippine Space Agency (PhilSA) that will address all national issues and activities related to space science and technology applications. The bill also provides for a Philippine Space Development and Utilization Policy (PSDUP) that shall serve as the country’s primary strategic roadmap for space development. The Philippines is also part of all the major space treaties, including the 1979 Moon Treaty.

Laos

Laos, one of the poorest countries in Southeast Asia, does not have an agency dedicated to the development of space. It also does not have the required infrastructure. China has built and launched, as per a bilateral agreement, a communications satellite for Laos; it also built a satellite control centre. LaoSat-1 was placed into geostationary transfer orbit by a Chinese Long March 3B in 2015.

Laos is looking at assistance from other countries in developing its satellite programme. So far, it does not have the required resources, talent or political push to pursue an independent space programme. Even as Laos was the second largest spender in civil space programmes in 2012, it is having difficulties raising money for social expenditure and is relying on international donors.[xxix]

Myanmar

Remote sensing has been used in Myanmar since the 1990s. Much earlier, in 1973, the Department of Meteorology & Hydrology introduced satellite meteorology, eventually upgrading it in 1979. The introduction of space studies started in the country in 1997 with the upgrading of the Aerospace Engineering Department.

The country’s first satellite which is currently in use, MyanmarSat-1, is on a lease. Myanmar will be launching its own satellite system MyanmarSat-2 in 2019, which will be used on joint ownership system with an undisclosed partner. It is a step towards reducing dependency on foreign-owned systems. Owning a satellite also gives Myanmar leverage for providing security to its citizens. The MyanmarSat-2 project will cost some U.S.$156 million.

In terms of collaboration, the first Myanmar-India Friendship Centre for Remote Sensing and Data Processing (MIFCRSDP) was established in 2001, as a bilateral initiative between the Ministry of Science and Technology (MOST), Myanmar and India’s ISRO. China is also making inroads in Myanmar – China and Myanmar held their first science and technology cooperation meeting in Yangon in 2018, where they established a joint radar and satellite communications laboratory as part of the China-led BRI.

Cambodia

Cambodia has been slow in its development of space technology. It was only in 2018 that the country signed a framework agreement with China for a new communications satellite, Techo-1; it will be its first communications satellite,[xxx] and will be used for broadband, disaster management, national security and government services. The Cambodian government believes that satellites will aid in the economic development of the country. However, it can scarcely afford to meet the threshold for space activities and relies mostly on foreign sponsorship. For example, China will provide end-to-end satellite services including satellite development, launch, ground station systems, and training and technology transfer. The satellite, which will have a design life of 15 years, is expected to launch in 2021.

Brunei

Brunei does not have a dedicated government agency for space. It meets its space needs through Intelsat earth stations, providing meteorological information to its citizens through foreign contract via the Brunei Meteorological Service (BMS), Department of Civil Aviation (DCA), and Ministry of Communications. An MoU was signed between Brunei and India in 2018 covering space cooperation and the establishment of a telemetry, tracking, and command (TT&C) station in the country for orbiting satellites and launch vehicles.[xxxi]

Conclusion

The space programmes of the various Southeast Asian countries share common characteristics. For one, international cooperation plays a key role in the development of these space programmes. These countries recognise the importance of collaborating with nations that have logged in more years in space activities, have the financial resources and skills, and are willing to assist in nurturing the indigenous programmes of countries with less resources. As there are no established space powers in the Southeast Asian region, it is essential for these countries to look to space powers such as the U.S., Japan, India, and China for funds, technology, and training.

Yet, at the same time, the development of indigenous space technology can also lead to greater cooperation amongst the Southeast Asian countries themselves. For example, Vietnam and Myanmar have shown interest in using Thailand’s THEOS data for monitoring disaster areas. Further, it has also been used to jointly develop the tourism industry between neighbouring countries that is expected to lead to boost of revenues for the countries involved. This is being implemented, for instance, by the Thai and Laos governments through sharing of THEOS data. Further, there was also early cooperation through the use of PALAPA telecommunications satellite services of Indonesia by neighbouring states. The ASEAN Sub-Committee on Space Technology and Application (SCOSA) has been in existence since the early 2000s. It meets twice a year and is funded fully by contributions from the ASEAN countries. The SCOSA aims to facilitate and accelerate transfer of space technology as well as to promote collaborative activities within ASEAN. This has led to member nations working together on training workshops on satellite applications. However, SCOSA is constrained by lack of resources.

Another trend in the international cooperation is diversification. While initially, collaborations were more with developed nations such as the U.S. and France due to their lead in the international space market, Southeast Asian countries are now collaborating with newer space powers such as China and India. Indonesia and Singapore have utilised India’s facilities to launch their satellites.

Many challenges are facing the ASEAN countries in their pursuit of a space programme. For example, due to the dual nature of space technology, transfer of technology has been restricted to the development of satellites. Also, none of the Southeast Asian countries are part of the Missile Technology Control Regime (MTCR), the informal partnership of 35 nations that aims to prevent the proliferation of missiles that can carry a 500 kg payload up to 300 kilometers. The launch vehicles that are used to launch satellites can also launch missiles. Thus, partnership in space technology that can launch satellites or missiles is prohibited by other member states. Currently, Indonesia is the only country that is actively pursuing the development of independent launching capabilities and making it a non-negotiable part of technology transfers while collaborating with other countries.

Indeed, investments in space policy requires considerable expenditure. Thus, domestic politics and perception of space advancement amongst the larger population plays an important role. For example, the Philippines unsuccessfully tried to pass a law establishing a national space programme in 2012. Only in December 2018 was it passed, as public opinion became more favourable. Another point that is highlighted is the debate between expenditure on advanced technologies versus expenditure on social sectors. This is especially true given the fact that Vietnam and Laos top the list of highest spenders in the region, even as they count amongst the poorest.

Just as Southeast Asian countries are looking to global space powers for collaboration to develop their space programmes, established Asian space powers namely Japan, China and India are also competing with each other to play a larger role in the region. For example, India’s Act East policy—originally conceived as an economic initiative—has gained political, strategic and cultural dimensions. Japan also follows a policy of “Free and Open Indo-Pacific Strategy” that aims to enhance regional connectivity through high-quality infrastructure development and maritime law enforcement. This is part of its soft foreign policy. China’s BRI also has a space policy that is lesser known, namely the Space Information Corridor, which offers space information services to BRI states that includes position, navigation, broadcasting and other types of satellite-related development. This indicates that collaborations in space with Southeast Asian countries will also reflect strategic choices of these space powers.

Japan and China currently have two regional organisations, namely the Asia-Pacific Regional Space Agency Forum (APRSAF) established by Japan in 1993, and the Asia-Pacific Space Cooperation Organization (APSCO) established by China. APSCO Convention was signed in 2005 by eight countries. These two organisations do not have an institutional mechanism to coordinate with each other.[xxxii] This points to the competition in the region where the varying membership in the region points to a larger strategic alignment. While India does not have a regional space organisation, its existing space collaborations provide an important tool for it to enhance its soft power[xxxiii] in Southeast Asia. It is also the host to the Centre for Space Science and Technology Education in Asia and the Pacific (CSSTEAP) which offers postgraduate courses in various Asia Pacific countries.

This survey of space programmes in Southeast Asia has found that the large-scale deployment of space assets by these countries will continue in the future. Furthermore, the region could become a field for the three global space powers—Japan, India and China—to compete with one another in collaborative engagements with the Southeast Asian nations. For the ASEAN countries, this would likely mean more opportunities for enhancing their respective space programmes. The challenge for them is in balancing the Asian space powers in their own strategic goals.

Endnotes

[1] Ring of fire is a string of volcanoes and sites of seismic activity, or earthquakes, around the edges of the Pacific Ocean.

[i] ‘Southeast Asia’ refers to a subregion of Asia, consisting of the countries that are geographically south of Japan, Korea and China, east of India, west of Papua New Guinea, and north of Australia. Ten of the eleven states of Southeast Asia are members of the Association of Southeast Asian Nations (ASEAN), where East Timor is an observer state.

[ii] Global Space Industry Market and Technology Forecast to 2026.

[iii]Travis S. Cotton, “An examination of Vietnam and space,” ScienceDirect, accessed 25 October 2018

[iv] Talent Ng’andwe, “Is Asian space science drive harming development?” SciDevNet, 16 May 2013

[v]Vietnam National Space Centre (Event), “Recent development and implementation plan 2017-2022 of Vietnam Space Centre Project”

[vi] Presentation by Dr.Pham Minh Tuan on “Space Technology Development in Vietnam 2015-16” at AFRSAF-23

[vii] Travis S. Cotton, “An examination of Vietnam and space,” ScienceDirect, accessed 25 October 2018

[viii] Nicholas Chapman, “Vietnam’s Foreign Policy Balancing Act” The Diplomat, 19 January 2017

[ix] Sanjeev Miglani, Greg Torode “India to build satellite tracking station in Vietnam that offers eye on China”, The Reuters, 25 January 2016

[x] Dipanjan Roy Chaudhury, “New base: Satellite monitoring station in Vietnam to give India room in South China Sea region”, Economic Times, 12 May 2018

[xi] JenaraNerenberg, “Japan give Vietnam a Major Space Exploration Boost,” FastCompany, 01 September 2011

[xii] Adelaida Salikha, “Vietnam To Launch Its First Satellites in 2019-2022” Seasia, 07 September 2017

[xiii] BichNgoc,“Vietnam, Japan building satellite for natural disaster prevention” VNExpress, 19 October 2018

[xiv] H. Wiryosumarto (former Chairman, LAPAN), “Indonesia’s Space activities”, Science Direct, accessed 25 October 2018

[xv] Erwida Maulia, “Indonesia’s First Satellite Ready for Take Off”, wordpress, 17 January 2014

[xvi] “Indonesia’s first satellite ready for takeoff”, Jakarta Globe, 07 January 2014

[xvii] Deyana Goh, “Indonesia aims to launch an indigenous orbital rocket by 2040” Spacetech Asia, 30 August 2018

[xviii] Sholehah Ismail, Dr Noordin Ahman, “National Space policy 2010: Driving the space sector in Malaysia”, Coordinates, April 2017

[xix] Peter B. de Selding, “Thaicom reports record profit on television growth, plans successor to IPStar broadband satellite”, SpaceNews, 29 February 2016

[xx] Orbital Debris – EoPortal Directory – Satellite Missions

[xxi] Deyana Goh, “THEOS creates new roles for Thailand” Spacetech Asia, 19 June 2018

[xxii] Deyana Goh, “Thailand selects Airbus for Theos-2 satellite” Spacetech Asia, 19 June 2018,

[xxiii] Low Soon, “How Singapore can be a space power, with small satellites”, Channel NewsAsia, 08 October 2017

[xxiv] “NTU successfully launches its 7th satellite into space” NTU Media release, 17 January 2017

[xxv] Low Soon, “How Singapore can be a space power, with small satellites”, Channel NewsAsia, 08 October 2017

[xxvi] Ktn. “UK and Singapore Collaborate on £10m Satellite Project to Develop next Generation Communications Networks.” KTN, 5 October 2018

[xxvii] Lynette Tan, “Singapore’s case for space” Channel NewsAsia, 30 September 2017

[xxviii] Q. Verspieren et al., “An early history of the Philippine space development program”, Acta Astronautica, accessed 10 October 2018

[xxix] Talent Ng’andwe, “Is Asian space science drive harming development?” SciDevNet, 16 May 2013

[xxx] Deyana Goh,“China to build and launch Cambodia’s first satellite”, SpaceTechAsia, 12 January 2018

[xxxi] Sheldon, John. “Sultanate Of Brunei To Host Indian Satellite Tracking And Telemetry Station.” SpaceWatch.Global, 14 September 2018.

[xxxii] Rajeswari Pillai Rajagopalan, “Asia in space: cooperation or conflict?” Policy Forum, 10 October 2018

[xxxiii] ‘Soft power’ is the ability to shape the preferences of others through appeal and attraction. It is a persuasive approach to international relations, typically involving the use of economic or cultural influence.

Nandini Sarma is a Research Assistant with the Observer Research Foundation’s Nuclear and Space Policy Initiative. Her current research focuses on space programmes in Southeast Asia.

This report is republished here with the kind permission of the Observer Research Foundation, and was originally published here.