Sky and Space Global Ltd. is pleased to announce that it has received signed binding commitments to raise $12 million via a two-tranche share placement to sophisticated and professional investors (Placement) at $0.03 per share. Settlement of the signed binding commitments received is conditional on lodgement of a Prospectus.

The Company expects to resume trading on ASX post lodgement of the Prospectus and Settlement (estimated to be Friday 22 February 2019).

The Company also plans to conduct a fully Underwritten Priority Offer (PO) to raise a further $3 million, with the ability to accept up to $1 million of over-subscriptions on the same terms. The PO will be subject to shareholder approval under ASX Listing Rule 7.1.

Commenting on the successful Placement, Sky and Space Global Managing Director and CEO Meir Moalem said:

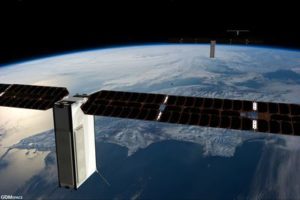

“We have undertaken this raise at a pivotal time for the Company, as we prepare to launch our first batch of Pearls nano-satellites into space, and following this, start generating revenue from our existing customers through the binding signed contracts that we already have in place.

“This Placement has been well supported by existing investors and several new high quality institutional and sophisticated investors that have joined our share register. The support we received is indicative of the confidence the market has in our ability to deliver on milestones and to achieve the objectives we have set out.

“Sky and Space Global Chairman Michael Malone, myself [as Managing Director & CEO], and other Directors will also invest a total of $710,000 in the Placement, subject to shareholder approval, highlighting our support and confidence in the Company. Existing Eligible Shareholders have the opportunity to subscribe for up to $15,000 of fully paid ordinary shares on the same terms as the Placement, ensuring that all our shareholders have an opportunity to participate in the exciting future of Sky and Space Global at this pivotal stage of its development.”

Placement proceeds will be used mainly for capex payments to suppliers, completion of first Pearl launch activities, for operational working capital and for general administration costs, thereby progressing Sky and Space Global’s Pearl nano-satellites to the next stage of the launch process and bringing the Company into revenue generation by late 2019iii.

$12 million Placement Details – Binding Commitments Received

Sky and Space Global has received signed binding commitments for a two-tranche Placement to institutional, sophisticated and professional investors, to raise $12 million (before costs). The Placement was strongly supported by existing investors as well several new high quality institutional and sophisticated investors.

The Placement will be undertaken in two tranches:

1) an offer of 260,422,667 fully paid ordinary shares (Shares) in Sky and Space Global at an issue price of $0.03 per share to raise $7,812,680. The Placement Shares will be issued pursuant to the Company’s available placement capacity under ASX Listing Rule 7.1 and the issue is expected to occur on Friday 22 February once all Placement funds are cleared in the Company’s bank account following lodgement of a Prospectus; and

2) an offer of 139,577,333 fully paid Shares in Sky and Space Global at an issue price of $0.03 per share to raise $4,187,320, to be issued subject to approval at a General Meeting of Shareholders to be held in April 2019 (Shareholder Meeting).

All allocations, outside of the investments to be made by Directors (subject to shareholder approval at the same General Meeting of Shareholders to approve the second tranche of the Placement) will be apportioned across the two tranches.

The issue price represents a discount of 44% to the 15-day VWAP of $0.054 prior to the trading halt on 4 February 2019.

Participants in the Placement will also receive one free attaching listed option for every Share issued, with an exercise price of $0.05 and a 3-year expiry date from the date of issue. The Company will apply for quotation of the free attaching options. Issue of the options is subject to receipt of shareholder approval at the Shareholder Meeting.

New shares issued under the Placement will rank equally with the Company’s existing ordinary shares on issue. Taylor Collison acted as Lead Manager and Lead Broker for the Placement.

$3 million Priority Offer (PO) details – Fully Underwritten

Sky and Space Global intends to offer the opportunity to each of its existing Eligible Shareholders as at the Record Date of on or around Wednesday 27 February 2019 to participate in the capital raising via a separate offer, on the same terms as the sophisticated investors under the Placement.

The Company intends to issue a Prospectus for an underwritten PO in the coming days to raise $3 million at an offer price of $0.03 per Share, with the ability to accept up to $1 million in oversubscriptions, the PO will be subject to shareholder approval. Consistent with the Placement, participants in the PO will also receive one free attaching listed option for every Share issued, with an exercise price of $0.05 and a 3-year expiry date from the date of issue. The Company will apply for quotation of the free attaching options. Issue of the options is also subject to receipt of shareholder approval.

The Company will offer all eligible shareholders as at the Record Date of on or around Wednesday 27 February 2019 the opportunity to participate. Each Eligible Shareholder will be able to apply for set allocations of $2,000, $5,000, $10,000 or $15,000 under the PO, and can also apply for oversubscription.

The PO will be fully underwritten by Taylor Collison and Chieftain Securities up to $3 million.

Applications under the Priority Offer will be allocated on a ‘first in first served basis’ and the final allocation decision will be allocated at the sole discretion of the Board. Shareholders who would like to receive email notification and download their entitlement form once available are encouraged to register their email address with Computershare https://www-au.computershare.com/Investor/

The Company may accept oversubscriptions for an additional $1 million under the PO. New shares issued under the PO will rank equally with the Company’s existing ordinary shares on issue. No brokerage or commissions are payable in respect of subscribing for shares under the PO.

Details of the PO will be set out in the PO Prospectus, which will be released to the market on or around Friday 22 February 2019. A detailed timetable will be provided in the PO Prospectus. Settlement of Tranche One of the Placement is subject to lodgement of the Prospectus. As such, the Company expects to resume trading on ASX post lodgement of the Prospectus and Settlement (estimated to be Friday 22 February 2019).