By Jules Varma, European Space Policy Institute

About Space Venture Europe

The ESPI Space Venture Europe is an annual publication that provides a complete overview of the European New Space sector with a focus on private investments in European space start-ups. For 2020, the report provides key information on the evolution of Europe’s entrepreneurship environment and start-up dynamics as well as the impact of COVID-19.

The ESPI Space Venture Europe is an annual publication that provides a complete overview of the European New Space sector with a focus on private investments in European space start-ups. For 2020, the report provides key information on the evolution of Europe’s entrepreneurship environment and start-up dynamics as well as the impact of COVID-19.

The Space Venture Europe report is broken down into 3 principal segments:

- New Space trends in 2020, where we cover important institutional developments in the European New Space sector

- Investment in European space start-ups, which analyzes the investment landscape in Europe in 2020

- The European space entrepreneurship survey, which offers an in-depth overview of the start-up ecosystem

Space Venture Europe scope and rationale

While there are many estimates for the size of the European New Space sector, the Space Venture Europe report aims to focus on start-ups and companies that are included within the space value chain. Furthermore, the perimeter of analysis excludes companies that we believe are not start-ups or not based in Europe. As such, while purposefully restricted, the Space Venture Europe report offers a concise and consistent view on European New Space, allowing both decision-makers and casual readers to make well-informed decisions on the sector.

A Historic Year for European New Space start-ups

ESPI Space Venture Europe 2020 statistics highlight an outstanding year for investment and entrepreneurship trends in the European space sector. The year was marked by multiple announcements and new initiatives from European public institutions to further support these trends, suggesting that 2020 will not be an extraordinary year but rather a new milestone for Europe.

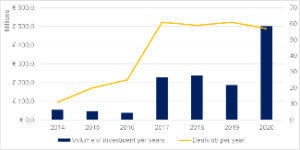

In 2020 ESPI recorded a new high of €502 million raised for European space start-ups over 57 deals (conservative estimate as 8 deals were undisclosed). Over the period of 2014-2020, over €1.249 million has been raised through almost 300 investment deals.

While the previous three years (2017-2019) had been marked by a plateauing of investments in European space start-ups at around €200 million per year, 2020 broke with this trend upholding a massive 168% increase compared to 2019. The considerable increase of the investment volume contrasts with the flat number of deals since 2017, underlining that investment rounds in European space start-ups are not more numerous but increasingly large.

While the previous three years (2017-2019) had been marked by a plateauing of investments in European space start-ups at around €200 million per year, 2020 broke with this trend upholding a massive 168% increase compared to 2019. The considerable increase of the investment volume contrasts with the flat number of deals since 2017, underlining that investment rounds in European space start-ups are not more numerous but increasingly large.

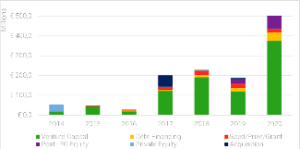

Venture Capital accounts for a vast majority of the investment in European space start-ups (71% between 2014-2020). In 2020 again, Venture Capital accounted for a total of 30 deals which represented €375 million or 75% of the total. The second type of investment in terms of volume was equity. This financing represented 2 large investments totalling €64 million.

The third form of investment in 2020 was the increasingly used structure of debt financing/venture debt. Out of the six debt-financing deals two were made by the European Investment Bank.

More marginal in 2020 were the Seed/Prize/Grant and acquisition financing structure which, while representing a third of the total deals, was only worth 4% of the total volume of investment.

More marginal in 2020 were the Seed/Prize/Grant and acquisition financing structure which, while representing a third of the total deals, was only worth 4% of the total volume of investment.

Growing support from European public institutions

In 2020, European and national public institutions continued to develop financial instruments to foster entrepreneurship and accelerate investment into space start-ups. Through these instruments and funds, public institutions play an increasingly prominent role in the development of the European New Space ecosystem and in the acceleration of investment trends in Europe.

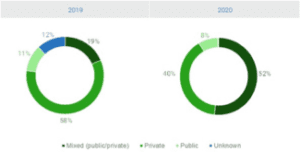

In 2020, 8% of the total investment originated purely from institutional investors such as public investment banks or regional development funds. This accounted for €40 million directly invested into European space start-ups. The real change in 2020 occurred on the front of mixed investments (public/private). An investment is considered mixed when the investment round counts with at least one public institution and one private company. The investment profile in 2020 changed consequently with an increasing volume of mixed investment through ambitious investment partnerships between public institutions and private companies. In 2020, the share of mixed investment reached 52% of the total volume. This means that out of the €502 million invested into the European space start-ups ecosystem in 2020, €260 million came from consortiums with at least one public backer

In 2020, 8% of the total investment originated purely from institutional investors such as public investment banks or regional development funds. This accounted for €40 million directly invested into European space start-ups. The real change in 2020 occurred on the front of mixed investments (public/private). An investment is considered mixed when the investment round counts with at least one public institution and one private company. The investment profile in 2020 changed consequently with an increasing volume of mixed investment through ambitious investment partnerships between public institutions and private companies. In 2020, the share of mixed investment reached 52% of the total volume. This means that out of the €502 million invested into the European space start-ups ecosystem in 2020, €260 million came from consortiums with at least one public backer

COVID-19 and the European investment landscape

While the COVID-19 outbreak was initially expected to have an unfavourable effect on the investments in the space sector, with €263 million extra funding compared to the previous record of 2018, European space start-ups continued to attract capital throughout the entire pandemic.

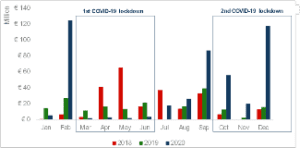

The year was still marked by the impacts of COVID-19 during the first global lockdown from March to June: the number of deals decreased two-fold compared to 2019 and 2018. With only 15 deals recorded and €11 million raised from March to June 2020, the investment pace decreased considerably during this period.

The year was still marked by the impacts of COVID-19 during the first global lockdown from March to June: the number of deals decreased two-fold compared to 2019 and 2018. With only 15 deals recorded and €11 million raised from March to June 2020, the investment pace decreased considerably during this period.

Interestingly, while investments were frozen throughout the first lockdown, the same situation did not occur during the second lockdown, which started around October in Europe. Quite the contrary as European space start-ups raised a total of €193 million (40% of total annual value) in October, November and December 2020.

The impact of the COVID-19 crisis on space investment mirrors the situation faced on other European financial markets over the year. Ultimately the economic impact of the COVID-19 crisis has been greatly mitigated by governmental measures including quantitative easing and economic stimulus. As a consequence, and although investments paused between March and June 2020, the impact of the COVID-19 crisis on investment in the European space sector was not noticeable at the end of the year.

And more…

Within the report you can find additional information on the European New Space investment landscape such as:

- Location of investments

- Location of investors

- Value chain of investments

- European investments in a global context

Furthermore, the report also includes a survey of the impacts of COVID-19 on European space start-ups and offers insights on various effects of the pandemic such as business continuity measures and the progress of public support in Europe.

We hope that you will enjoy going through this publication as much as we did in preparing it. Of course, we would be more than happy to receive feedback on ways ESPI Space Venture could still improve to better fulfil your needs in its future issues.

About the author

Jules Varma is a Resident Research Fellow at the European Space Policy Institute (ESPI) in Vienna, an independent and public think-tank providing decision-makers with an informed view on short to long-term issues relevant to European space policy. At ESPI his work focuses on the space economy and New Space related activities. Prior to joining ESPI, he worked at the United Nations Environment Programme in the economy division. He holds a MSc. in the department of Space and Climate Physics from University College London (UCL).