By Helen Jameson

The past few years have seen the satellite press column inches dominated by excited talk of new mega constellations. We have learned how thousands of small satellites are going to transform connectivity for billions around the world. I should know, I am one of the people that have been excitedly scribbling about it. But now that the dust has settled on the flurry of news of the constellations that are in the pipeline, where are we now?

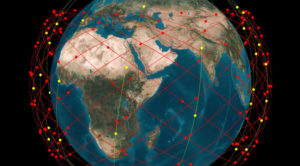

There’s no doubt that these constellations, and the vision of what they can do, is hugely appealing. With 49% of the planet still unable to access the internet, the idea of being able to connect and bring the socio-economic benefits of broadband is an incredible offering. Imagine what could be achieved if every school had access to reliable ICTs; if remote, small businesses could tap into the global marketplace, or critical services such as healthcare could be accessed by those who live far from major urban centres. It is utterly transformational. High profile investors have put their names to these projects and they have generated huge interest but the fact is that these companies have really got their work cut out for them and it was never going to be easy to be one of the first to deliver on what is effectively a new era in communications. They have huge hurdles to overcome and time is short. With promises that OneWeb will be rolling out services next year, SpaceX’s StarLink in 2020 and Telesat in 2021 for example, they will need to move quickly to hit these targets.

Northern Sky Research (NSR) brought out a new report in May 2018 called Satellite Constellations: A Critical Analysis and it would have made difficult reading for some non-Geostationary satellite orbit (NGSO) operators as the forecast was mixed. The report stated that: “two, out of the five Non-GEO HTS [High Throughput Satellite] constellations analysed, do not have a viable business case and will not be sustainable, if launched.” It also found that: “The remaining three will generate 12% of overall satcom market revenues over the next decade.” Principal challenges cited by NSR included the sheer cost of manufacturing the systems and replenishment cycles; funding challenges; demand; and technical and regulatory complexity.

Demand

Mega constellations are relying on the fact that there will be the demand for their services and that just under half the population have no broadband access makes for a huge addressable market. However, the price at which services are delivered and the business model that these satellite operators will adopt is going to be critical to their success. For so many people living below the poverty line, costs will need to be extremely low to make broadband services viable. Add the competition from fibre, which is gradually becoming more available, and prices will need to be attractive enough to drive users to satellite rather than terrestrial services. With pricing of LEO HTS services still very much a mystery, this is a pivotal question that needs to be answered and could make or break operator success.

Regulation

The question of regulation is a complex one and LEO operators have a challenging task ahead if their system architecture means that they need to secure landing rights and licensing in each country into which they will provide services. For constellations where satellites do not link together, the operator will also have to build gateways in order to receive services in any country. This is a laborious and expensive task.

Sovereign Satellites –Competition?

Another problem that could eventually hit LEO operators is that of countries taking advantage of the small satellite revolution. Today, any country could feasibly develop its own satellite due to the falling cost of manufacture. There are several emerging countries that are very eager to start their own indigenous space industry and the build and launch their own satellites. Yes, this takes time to achieve, but ultimately reduces reliance upon any other system and puts such a country in control of its communications destiny. China is just one illustration of a massive market and a country that is developing its own constellation and therefore will simply not require the services of another LEO HTS operator. Its Hongyan constellation of 300 satellites is in development and sources say that the first satellites will be trialled this year with eventual completion slated at sometime around 2021. These satellites will offer global communications and other services such as mobile broadcasting, ground data collection and exchange, and disaster prevention.

Manufacturing

Management of the supply chain for operators will also be a considerable task that will require a great deal of capital expenditure. Mega constellations are reliant upon economies of scale and it is very important that companies are able to keep up the pace of manufacture of satellites and the replenishment of their constellations. There is a large amount of cost involved and although in-house manufacturing makes sense, this is still a significant challenge to get right. As Shagun Sachdeva, the NSR analyst behind its report, states: “Supply chain management is a momentous challenge, even for industries that are conceived on a mass production model with years of experience, such as the automotive industry. Various other production and assembly processes need to be redesigned, and testing and safety standards need to be re-evaluated for the specific cases of mass producing satellites.”

Frequency of Launch

The shortage of rides into space is another question that has to be highlighted. Yes, you have a satellite but how do you find a vehicle to get it where it needs to go? The projected growth of the small satellite market illustrates perfectly the need for alternative launch options. Orbis Research forecasts that the global smallsat market will grow from U.S.$2.28 billion in 2016 to U.S.$7.66 billion in 2023. However, this growth could be stifled if the rides to space are not available.

There are many new and innovative small launch vehicles in development so this bottleneck promises to ease eventually. However, once a vehicle makes its maiden flight, it still must prove that it can launch reliably and on time so there is an inevitable wait for these vehicles to be validated and become commercially operational. There is insufficient capacity across the small satellite launch industry at present and it is more complex than it at first seems as it is spread across all types of launch vehicle and smallsat operators are reduced to simply taking what they can get, when they can get it. And with the promise of multiple mega constellations in the offing, it’s a problem that is not going away. If a smallsat operator wants to launch to a specific orbit at a specific time, they have quite a task on their hands. This will improve with new launchers gradually accelerating their development and preparing to come online such as Rocket Lab and Firefly, but there is still a way to go and access to space could be a problem in the near-term at least.

The rise of LEO HTS constellations is compelling and, since no constellation is operational at the moment and no one knows quite where this is going to go, speculation is inevitable. We have to ask these questions of the operators. It cannot be argued that humanity has a pressing problem. Why should one half of the world’s population be connected whilst the other is not? In an age that runs on broadband networks, is that really acceptable, especially given the inextricable link between broadband and development, enrichment, empowerment, and prosperity? However, the success and sustainability of mega constellations rests on whether they are affordable to the people that they are meant for and whether the hurdles that exist can be overcome. Developments in technology and the maturation of the market will ultimately result in costs being lowered but at such an early stage, as we wait for deployment, it is difficult to assess how things will go. There is a rush now for these operators to realise their vision; to be the first ones to get to orbit and start to deliver their services.

However, above and beyond all of that, it is going to be imperative that they get it right the first time.

Helen Jameson is the Editor-in-Chief of SpaceWatch.Global

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space