SpaceWatch Middle East Editor-in-Chief Helen Jameson took the chance to attend the World Space Risk Forum 2017 on June 15th in London, United Kingdom.

SpaceWatch Middle East Editor-in-Chief Helen Jameson took the chance to attend the World Space Risk Forum 2017 on June 15th in London, United Kingdom.

If a roomful of people could agree on something, it would definitely be the fact that the space industry is at a critical tipping point. It is evolving quickly, maturing – and it is reinventing itself in the process. This was definitely the general consensus of the delegates and speakers at the annual World Space Risk Forum, held in London last Thursday. The annual event brings together the people who are daring to chase their dreams in space to share their experiences of risk and the challenges that they face.

If a roomful of people could agree on something, it would definitely be the fact that the space industry is at a critical tipping point. It is evolving quickly, maturing – and it is reinventing itself in the process. This was definitely the general consensus of the delegates and speakers at the annual World Space Risk Forum, held in London last Thursday. The annual event brings together the people who are daring to chase their dreams in space to share their experiences of risk and the challenges that they face.

No longer is connectivity a luxury, it is now held up as a basic human right and this is being reflected in the space industry’s innovation and technology. The NewSpace phenomenon is truly shaking up the business with entrepreneurs and private investors staking their claim in the development of a new phase of the space sector. This brave new world of space also brings with it a brand new set of risks, and, as the sector even struggles to define what NewSpace truly means at this point, assessing risk becomes even trickier.

We have now entered an era that looks set to be dominated by the small satellite and the low cost launch vehicle. The role that brokers and underwriters play in this industry is crucial. Space, in itself, is a high risk business. We place satellites on top of highly explosive rockets to place them into orbit. We take risks with technology. But now, with a slew of new launch vehicles on the table and disruptive small satellite technology transforming the satellite landscape, it seems that everything we knew is going to change – and even the traditional operators, manufacturers and launch vehicle providers are going to need to re-think their business models – and this will all affect how risk is assessed.

Low Cost Launch

Increased manufacture of small satellites, especially cubesats is one thing, but catering for the projected burgeoning demand to orbit them is another. Although there is expected to be a significant launch bottleneck, new launchers are entering the market on a regular basis, in order to take a slice of the smallsat pie – and at the WSRF, we saw a mix of the re-usable and the expendable.

Blue Origin’s Ariane Cornell, Head of North American New Glenn Sales for Blue Origin began by putting across the company’s vision of ‘millions of people living and working in space’. She explained how Blue Origin’s New Shepherd rocket is being used to gain experience in re-usability that they will eventually apply to the New Glenn rocket which is slated to become operational by 2020. The sub-orbital New Shepherd system has successfully been reused four times and a manned mission is planned. The heavy lift New Glenn rocket will eventually be used for both human and commercial spaceflight, using a moving ship for landing to provide a more stable base. Blue Origin want to ensure that their rockets may be reused as much as possible with an emphasis on the lowering of cost. The team anticipates that the New Glenn will be able to achieve up to 100 reuses.

Blue Origin’s Ariane Cornell, Head of North American New Glenn Sales for Blue Origin began by putting across the company’s vision of ‘millions of people living and working in space’. She explained how Blue Origin’s New Shepherd rocket is being used to gain experience in re-usability that they will eventually apply to the New Glenn rocket which is slated to become operational by 2020. The sub-orbital New Shepherd system has successfully been reused four times and a manned mission is planned. The heavy lift New Glenn rocket will eventually be used for both human and commercial spaceflight, using a moving ship for landing to provide a more stable base. Blue Origin want to ensure that their rockets may be reused as much as possible with an emphasis on the lowering of cost. The team anticipates that the New Glenn will be able to achieve up to 100 reuses.

Obviously, we cannot talk about reusability without talking about SpaceX. Jonathan Hofeller, VP Commercial Sales, SpaceX recounted how the industry had laughed at Elon Musk’s vision. “When we were a new kid on the block, we got beat up quite a bit”, he said. Those critics are now well and truly eating their words. He talked about how they had seen their conceptual videos turn into reality. The team hopes to realise their dream of human spaceflight next year. But most importantly, from a satellite sector perspective, he talks about customer acceptance of the flight proven Falcon 9. The company has seen a ‘paradigm shift’ in terms of customers moving to the re-used vehicle. This is the new normal.

I certainly remember the skepticism when SpaceX proclaimed that they were going to deploy a satellite into orbit and then land the rocket back onto a droneship. But they did. And they have done it over and over again. They have effectively reduced the risk away of Falcon 9 reusability and customer confidence has soared. It hasn’t been without its problems but SpaceX have been very open about their successes and failures. They consider themselves to be a transparent company, which is what the insurers appreciate. With their reusable rockets thoroughly assessed after landing, and each part replaced if required, they follow the same acceptance level as new rockets.

So, onto the expendable rockets. Virgin Orbit, the other new kid on the block, is preparing also to capitalise on the smallsat market with its vertically integrated, 2-stage expendable system that will be launched using a Boeing 747 known as ‘Cosmic Girl’. The aircraft is currently in the final stages of being modified and is expected to make its first test launch in Q1 2018. It’s highly mobile infrastructure will mean that Virgin Orbit will be able to launch from a range of sites and the company is currently looking at Florida, Puerto Rico and Hawaii as possibilities.

Considered to be the ‘traditional’ launch companies, ILS and Arianespace both offered their take on how they need to evolve to ensure that they can remain competitive. Jim Kramer, VP of Engineering and Mission Assurance, ILS, explained how the company is working hard to ‘respond to customer requirements and priorities’. He explained that the market for GTO is falling and that no longer are operators looking to buy excess performance, but are looking at each launch individually. In the midst of the increasing segmentation of the market, ILS is introducing Proton Medium to its portfolio. Proton Medium is a two-stage vehicle for LEO missions and will offer customers reduction in cost of launch and of performance.

Arianespace continues with its development of the Ariane 6 launch vehicle which will replace the current Ariane 5 and the Soyuz. Michel Doubovick, Senior VP and CFO of the launch service provider explained that there was a ‘need for the heritage launchers to become more cost-effective’ and that Arianespace is focusing now on its own next generation, market driven systems. The Ariane 6 is expected to be ready for test flight in 2020. The Vega C rocket is expected to make its qualification flight at the end of 2019.

Arianespace continues with its development of the Ariane 6 launch vehicle which will replace the current Ariane 5 and the Soyuz. Michel Doubovick, Senior VP and CFO of the launch service provider explained that there was a ‘need for the heritage launchers to become more cost-effective’ and that Arianespace is focusing now on its own next generation, market driven systems. The Ariane 6 is expected to be ready for test flight in 2020. The Vega C rocket is expected to make its qualification flight at the end of 2019.

Hispasat’s engaging CTO, Antonio Abad, gave an interesting keynote in which he stressed: “Like it or not, satellite needs to be competitive with terrestrial solutions. Today, we are not competing. Today we are the last resort.” He highlighted that the satellite industry, though adept at broadcasting, needs to be better at point-to-point services and that the industry needs to look again at the design of its satellites to remain relevant. He said: “We need to do things in different ways to obtain different results”. And part of that will involve taking more risks.

Satellite Manufacturing Boomtime

The other key element in the NewSpace phenomenon, satellite manufacturing, was a pivotal topic during the WSRF. Euroconsult’s Maxime Puteaux led the discussion and highlighted the massive increase in small satellite production that we have seen over the last 10 years – a growth of 12%, on average, with Earth observation and LEO communications as the two most popular applications. This new generation of satellites is bringing with it new risks, as business models adapt to this burgeoning demand.

Craig Clarke, CEO, Clyde Space highlighted just how far the small satellite capabiliites have come. He explained that, today, high resolution imaging, SAR, communications and Earth observation capabilities can all be offered on a small 400kg platform. The advancement in technology has been phenomenal. This has also enabled a lower cost in terms of download of data which has led to a change in the customer profile, and the risk profile. The cubesat sector, Clyde Space’s speciality, is very much driving the market and he stressed the fact that they need to produce en masse, but also must do this with the highest quality every time. With customers constantly stretching what is possible, Clyde Space has to assess risk at the beginning and throughout any project.

Craig Clarke, CEO, Clyde Space highlighted just how far the small satellite capabiliites have come. He explained that, today, high resolution imaging, SAR, communications and Earth observation capabilities can all be offered on a small 400kg platform. The advancement in technology has been phenomenal. This has also enabled a lower cost in terms of download of data which has led to a change in the customer profile, and the risk profile. The cubesat sector, Clyde Space’s speciality, is very much driving the market and he stressed the fact that they need to produce en masse, but also must do this with the highest quality every time. With customers constantly stretching what is possible, Clyde Space has to assess risk at the beginning and throughout any project.

Mike Lawton, Founder and CEO of Oxford Space Systems, also offered his perspective on NewSpace and ‘OldSpace’. He explained that NewSpace was, by its nature, very high risk with a team that gets involved in multiple roles. On a NewSpace team, the aim is to disrupt, not simply to innovate. In NewSpace, challenges are addressed proactively. This is very different to the ‘OldSpace’ set up which is risk averse, and slower to react and focused on incremental improvements, rather than disruption.

NewSpace is all about Risk

We have talked a lot about the technology and the innovation and disruptive forces that are defining the space industry at present, but the insurance community forms an absolute key part of the WSRF. The nature and magnitude of the innovation and the shift to privately funded companies, the radical evolution of existing systems such as reusable rockets signals that strategic risk is woven into NewSpace company psyches. It is a risk to be a start-up. It is a risk to be an entrepreneur. It goes with the territory and risk is built into the business model. Throughout the WSRF, it was stressed that the insurance sector would respond to the NewSpace market to help it to succeed. However, with so many unknowns, it is difficult to quantify the risk and models and the approach will need to evolve to accommodate this.

Peter Elson, Global Head of Space and COO, JLT Specialty, emphasised that what had previously worked for insurers and brokers in the past would no longer work due to the amount of innovation and disruption currently occurring within the industry. He said: “The stream of technology is about to be broken”, meaning that the predictable nature of satellite technology as it has been for decades, is about to encounter a paradigm shift. It is how the insurance market will respond to these changes that will be important. Development of new products to fit in with this new raft of companies will be necessary going forward – and this is a challenge to the insurers and brokers. The perennial issue of launch insurance was discussed at length with varying opinions on subjects such as the practical limit for a single launch.

In his keynote, Steve Lindsey, VP of Exploration at the Sierra Nevada Corporation, spoke about how his Dream Chaser project has meant that it is critical to understand your risks. In using a very diverse team of academia, start-ups, launch providers and people from different industries outside of space, he has been able to cover his ‘blind spots’ and to properly understand the risks of the Dream Chaser programme and the development of the crew and cargo version of the vehicle.

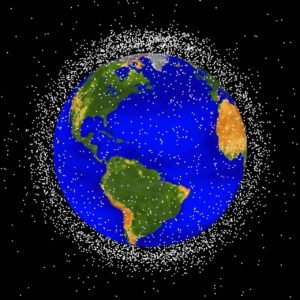

The Debris Challenge

Earlier in the day, Mark Dickinson of the Space Data Association had delivered a keynote on the valuable work that the organisation does to help to address the issue of identifying what is up there, who owns it and where it is. He put out a rallying call to operators and other interested parties to sign up and help to mitigate the chances of collisions in space. This is something that every operator should be thinking about.

Earlier in the day, Mark Dickinson of the Space Data Association had delivered a keynote on the valuable work that the organisation does to help to address the issue of identifying what is up there, who owns it and where it is. He put out a rallying call to operators and other interested parties to sign up and help to mitigate the chances of collisions in space. This is something that every operator should be thinking about.

This was followed at the end of the day by a stirring keynote by Dr. Moriba K. Jah, Director ASTRIA Assoc. Professor Aerospace Engineering and Engineering Mechanics Dept. University of Texas at Austin. Dr. Jah told it as it was. He talked about the huge concentration of debris in LEO – nuts, bolts, satellite remnants, launcher bodies – you name it. The average of 2-3 items that burn up in the atmosphere every day will not clean up the space debris mess that currently exists and with the planned constellations, we are simply adding to this junkyard. He went on to discuss the fact that we need to know what is up there and where and how it might affect assets in space. Dr. Jah is pushing for a scientifically and empirically informed taxonomy for man-made space objects that will allow classification of their relative risks according to their orbits, size and ability to manoeuvre. As Air Traffic Control has ‘custody’ over aircraft movements, a form of space traffic control should have ‘custody’ over spacecraft. However, in order to achieve this, there must be investment in the underlying science that will be required to understand it. He urged the space industry to think about the fact that any debris removal method must be sustainable – otherwise there is little point.

The panel that ended the day on the issue of space debris and satellite servicing discussed responsibility. Every operator has a responsibility to tackle to issue of debris. Every company putting anything into space must be responsible for what goes up and how it is managed. This will call for a cooperative and transparent approach – on an international scale. Over the last 60 years, man has launched a huge amount of objects into space without regard for the space environment. It is time to address this. The panel considered satellite servicing and life extension programmes as possible long-term solutions to this enormous problem, which will no doubt hold huge implications for our long-term future in space.

WSRF was a hugely successful and well-attended event crammed with interesting speakers at the very heart of the changes that are occurring in our industry today. Thanks to the organisers for such an engaging event and promoting dialogue on what really matters. One thing is evident…space and risk go hand-in-hand, but that’s what makes all of our hearts beat faster!

Original published at: https://spacewatch.global/2017/06/spacewatchme-review-worldspaceriskforum-2017-london-space-risky-business/

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space