by Blaine Curcio and Jean Deville

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 1 – 7 March 2021”.

As part of the partnership between SpaceWatch.Global and Orbital Gateway Consulting we have been granted permission to publish selected articles and texts. We are pleased to present “Dongfang Hour China Aerospace News Roundup 1 – 7 March 2021”.

Hello and welcome to another episode of the Dongfang Hour China Aero/Space News Roundup! A special shout-out to our friends at GoTaikonauts!, and at SpaceWatch.Global, both excellent sources of space industry news. In particular, we suggest checking out GoTaikonauts! long-form China reporting, as well as the Space Cafe series from SpaceWatch.Global. Without further ado, the news update from the week of 1 – 7 March 2021.

1) Qiansheng Exploration (QS-T) Announces >RMB 100M Series A Round

Blaine’s Take

Chinese satellite manufacturer Qiansheng Exploration announced a Series A funding round of more than RMB 100 million on Friday 5 March, with the funding expected to go towards strengthening the company’s satellite manufacturing and geospatial information services capabilities. The round was led by the Fuzhou (Jiangxi) High-Tech Emerging Industry Development Fund, which is apparently a part of the Fuzhou National High-Tech Industrial Zone. The round of funding is noteworthy for several reasons:

Qiansheng Exploration had previously had pretty close relations with the Zhongguancun area of Beijing. While we do not necessarily have reason to believe this has changed, the funding round being led by Fuzhou likely implies that Qiansheng will relocate some activity to the city as a form of economic development.

Also noteworthy is the city of Fuzhou. To be honest, my original thought was “Ah, Fuzhou, the capital of Fujian Province”, which seemed like a slightly random city given the lack of space industry, and the fact that it’s a pretty average-sized city in China. Turns out, I was wrong, it was not Fuzhou, capital of Fujian, but rather Fuzhou, Jiangxi (抚州,as compared to 福州, Fujian).

Fuzhou, Jiangxi is a city that I have never heard of (and without wanting to brag, being a geography nut who has lived in Greater China for almost a decade, I have heard of a lot of Chinese cities), and a city which, according to Wikipedia, is home to such industries as food processing, textiles, food (implicitly agriculture given that it is mentioned separate from food processing), and light vehicles. In short, Fuzhou, Jiangxi, is probably not the first place one would think of when choosing a place to build satellites. That being said, my suspicion is that QS-T did not so much choose Fuzhou, as Fuzhou chose them. That is, I believe the “better” prospective cities/provinces for satellite manufacturing have partnered with commercial satellite manufacturers already, and ones that are more advanced than QS-T. For example, Nantong (Jiangsu) brought in Galaxy Space. Commsat went to Yibin (Sichuan) and Tangshan (Hebei). Beijing Smart Satellite went to Tongchuan (Shanxi, near to Xi’an). Basically, all of these satellite manufacturers that have advanced somewhat more quickly than QS-T have managed to pair up with cities that are rather wealthier, more developed, or both. This isn’t to say that the QS-T/Fuzhou tie-up is bound for failure, but it seems safe to say that the synergies are somewhat limited.

Jean’s Take

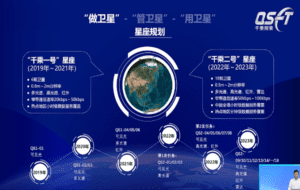

Qiansheng Exploration is a good example of a verticalized EO company. They are building their own constellation (Qiansheng-1, Qiansheng-2, and even Qiansheng-3 in some interviews), designing and manufacturing the satellites, building up their network of ground stations, while at the same time developing the cloud infrastructure, the analytics tools, and providing portable terminals to their customers.

According to the slides shown at CCAF2020, they have a pretty packed launch calendar in the coming years, which would definitely need strong financial backing. This A-round of funding makes sense, their previous rounds having all been quite a while ago (angel in January 2018, Pre-A in March 2018, Pre-A1 in in Sept 2018). Their first satellite, the Qiansheng-1, was launched on Jielong-1 in August 2019.

And speaking of Jielong…

2) Jielong-3 to make its maiden launch in 2022

Jean’s Take

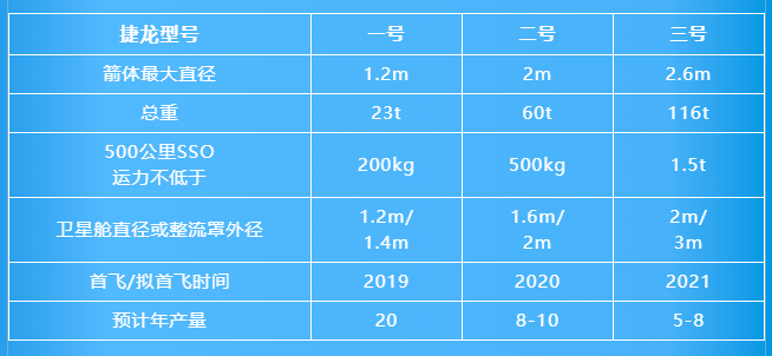

CALT’s commercial subsidiary China Rocket announced on March 3rd that the Jielong-3 small lift solid-fueled launch vehicle would make its maiden launch in 2022. Jielong-3 is the 3rd and heaviest rocket of the Jielong rocket series, putting 1.5 tons into LEO. The other two are two lighter lift launch vehicles capable of putting 200 kg and 500 kg into LEO, with Jielong-1 having succeeded its first orbital launch in August 2019.

(AFAIK) the Jielong 2, 3 rockets were announced at a China Rocket event in October 2019; back in the days the company had already set a foot in the realm of small lift commercial launch vehicles with the Jielong-1, and the follow-up Jielong series showed CALT/China Rocket’s ambition to consolidate its presence in launch and compete with the likes of Expace as well as other commercial launch companies. The payload capacities indeed compete directly with a lot of the commercial launch companies discussed in previous episodes (see table).

During the same event in 2019, the Tenglong medium lift liquid-fueled series were also announced by China Rocket, in a pattern that resembles a lot of the commercial launch companies (see our earlier DFH Episode on Chinese Commercial Launch).

An interesting point on the announcement today is that it concerns the Jielong-3, but nothing was mentioned for the Jielong-2. This may be contradicting China Rocket’s calendar, which planned on launching sequentially JD1, JD2 and JD3 (initially planned for 2019, 2020 and 2021). Has China Rocket considered that the JD2’s market was too limited and moved directly to JD3? Hard to say, but this could definitely be a possibility. This also fits with Landspace CMO Kevin Xu’s description of small lift solid-fueled rockets becoming exceedingly crowded (resulting in Landspace putting aside the ZQ1).

Blaine’s Take

Indeed, the announcement by China Rocket should be bad news for any commercial company hoping to address the small/medium lift solid-fuelled rocket market in China.

To give a bit of context: China Rocket is a commercial subsidiary of CALT, the main launch subsidiary of CASC. In this way, China Rocket is very similar to Expace, insofar as both companies are commercial subsidiaries of major SOEs (China Rocket of CASC, Expace of CASIC). Expace has seen considerable success over the past several years in the development of its KZ-1A fast-response rocket, and the company has shown an interesting blend of traditional space industry technology chops (largely inherited from CASIC) and commercial space flair. Case in point is the oft-mentioned live online auction of a KZ-1A rocket in early 2020.

By having a commercial launch subsidiary, CALT clearly has hoped to gain some greater flexibility (China Rocket is likely more nimble than CALT in certain ways), while also heading off a potential rival in Expace, with this now extending from the Jielong-1 (roughly similar to KZ-1A) to the Jielong-3, which has very similar specs to Expace’s Kuaizhou-11 small/medium-lift rocket, which suffered a launch failure in its inaugural launch in July 2020.

A question I think worth asking in regard to the expanded efforts of China Rocket and the Jielong-3 is–is this really worth it for CASC/CALT? Do they really need to develop multiple “commercial” solid-fueled rockets to compete with any and all potential CASIC/commercial rockets? It’s hard to say, but I think the emphasis on commercial rocketry by CASC is an example of a tendency of Chinese SOEs–the tendency to despite any and all competition of any kind, and try to stomp out any and all competitive threats, no matter how small.

Think about it–CASC has, over the past several years, built and launched a global satnav constellation (BeiDou-3), made advancements on High Throughput GEO satellites, launched multiple EO constellations, and ohbytheway, also had several Moon missions, Chinese space station, and so on. One might reasonably ask, therefore, is yet another small/medium solid-fueled rocket that has limited relevance to any of the above megaprojects really the best use of CASC’s limited resources? Would it really be the end of the world to let CASIC develop a small/medium solid rocket without a China Rocket competitor? Granted, what do I know, I’m not the one trying to compete with the massive financial heft of CASIC, but from my perspective this seems like an example of the Chinese system producing a suboptimal outcome. China does not need any more small/medium solid rockets, and CASC has a huge amount on their plate already.

3) An interesting piece by the Beijing Daily on Beijing’s commercial space ecosystem

Jean’s Take

The Beijing Daily published an interesting article on March 1st on the capital’s commercial space ecosystem. While there were not actually announcements, it discussed a wide variety of topics, and this is a great excuse to talk a little bit about Beijing in space.

First point worth mentioning, Beijing has proven to be the undeniable capital of Chinese commercial space from all standpoints, ranging from the place of incorporation of startups all the way to space investments. This is to a large extent discussed in previous space reports (Future Space investment report, Euroconsult China Space report, STPI report, ESPI NewSpace report…)

Perhaps more interestingly, the article discussed how Beijing seems to have an interesting geographic divide between the North (attracting satellite manufacturing startups) and the South (focused on rockets). This has given the capital the nickname in Chinese of “南箭北星”, as we may have mentioned in previous episodes. And interestingly, according to the Beijing Daily article, this is actually due to the fact that CALT has a strong presence in the south and with who Chinese startups collaborate with; and similarly in the Northern suburbs is CAST facilities, of significant interest for satellite manufacturing companies.

Another noteworthy point of the article is the support that the Beijing municipal government provides its commercial space ecosystem, and this can be generalized to many other provincial capitals (–> see ESPI’s NewSpace in Asia report). This can be in terms of infrastructure/facilities, with science & tech parks putting preferential policies for tech heavy companies (a good example in Beijing is Zhongguancun). The article also mentions “building commercial aerospace industry bases” in Beijing’s most southern district Daxing.Last but not least, the support is also financial. The article mentions employing municipal level industry funds to support commercial space companies, and financial mechanisms to limit insurance premiums for launch.

Blaine’s Take

Beijing is indeed China’s biggest space city by far. The 南箭北星 is all too true–I recall my last time to Beijing (nearly 1.5 years ago…) visiting Landspace in the south of the city. Interestingly, Landscape was renting office space (possibly at subsidized pricing) from none other than AVIC, with Landspace having its own pretty big building in a massive “AVIC Plaza” real estate development. During the same trip, I went to visit Commsat in the north of the city, and found they were located in a sort of “CAS Military-Civil Fusion Industrial Park”, again possibly paying subsidized rent.

It’s certainly a commentary on the diversity and size of Beijing’s space ecosystem to have such a policy as “we build rockets in the south, we build satellites in the north”. For those who have not been, Beijing is mind-bogglingly huge, and so to a certain extent, it’s understandable that the city government would want to promote some degree of clustering of certain industries, so as to avoid several hour trips to visit related companies. This is something to which I can attest all too well–on a few trips to BJ with clients in 2018, we would be spending 2-3 hours per day in the car between meetings, and that was even with my having scheduled the meetings in a geographically convenient order! Overall, big space industry in Beijing, lot of stuff going on, and a lot of different moving pieces. Bloody hell do I miss the Northern Capital.

This has been another episode of the Dongfang Hour China Aero/Space News Roundup. If you’ve made it this far, we thank you for your kind attention, and look forward to seeing you next time! Until then, don’t forget to follow us on YouTube, Twitter, or LinkedIn, or your local podcast source.

Blaine Curcio has spent the past 10 years at the intersection of China and the space sector. Blaine has spent most of the past decade in China, including Hong Kong, Shenzhen, and Beijing, working as a consultant and analyst covering the space/satcom sector for companies including Euroconsult and Orbital Gateway Consulting. When not talking about China space, Blaine can be found reading about economics/finance, exploring cities, and taking photos.

Jean Deville is a graduate from ISAE, where he studied aerospace engineering and specialized in fluid dynamics. A long-time aerospace enthusiast and China watcher, Jean was previously based in Toulouse and Shenzhen, and is currently working in the aviation industry between Paris and Shanghai. He also writes on a regular basis in the China Aerospace Blog. Hobbies include hiking, astrophotography, plane spotting, as well as a soft spot for Hakka food and (some) Ningxia wines.

SpaceWatch.Global An independent perspective on space

SpaceWatch.Global An independent perspective on space